Crypto in the Arab World: From Speculation to Financial Infrastructure

Across the Arab world, cryptocurrency is no longer a fringe experiment or purely speculative trend. It is increasingly being evaluated as financial infrastructure. What began as curiosity has evolved into a serious discussion shaped by inflation, remittance inefficiencies, youth demographics, and long-standing gaps in banking access.

Yet adoption across the region is neither uniform nor frictionless. Crypto’s trajectory in the Arab world is defined by tension: opportunity versus regulation, innovation versus cultural alignment, and financial inclusion versus systemic risk. Understanding this balance is essential to assessing where the region is headed next.

This article examines the structural drivers behind crypto adoption in the Middle East and North Africa (MENA), the policy frameworks shaping its growth, the role of Sharia-aligned innovation, and the challenges that will determine whether crypto becomes a durable financial layer or remains a parallel system.

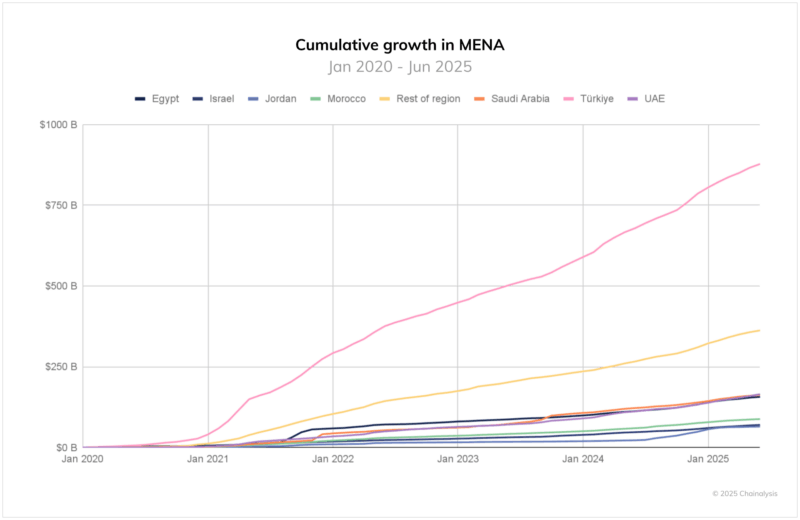

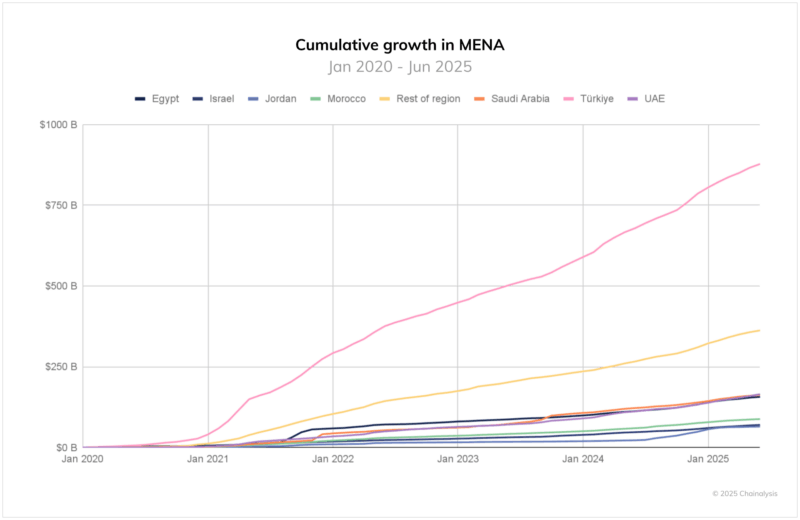

The Rise of Crypto Adoption Across the MENA Region

The MENA region is undergoing a quiet financial transition. In several economies, inflationary pressure, currency instability, and high remittance costs have exposed the limitations of traditional financial systems. In others, large segments of the population remain underbanked or excluded entirely from global capital markets. Within this environment, crypto is increasingly used not as a speculative vehicle but as a functional tool. Stablecoins enable value preservation and cross-border transfers. Spot trading provides exposure to global markets. Blockchain rails reduce friction for freelancers, SMEs, and migrant workers navigating fragmented banking systems.

Demographics amplify this shift. MENA has one of the world’s youngest populations, with high smartphone penetration and strong digital fluency. This combination has created fertile ground for crypto-native adoption, particularly among individuals already comfortable operating outside legacy financial institutions. On-chain data supports this narrative. Despite geopolitical volatility, crypto activity across MENA continues to grow, driven by both grassroots usage and institutional experimentation. The region is no longer just a consumer of crypto infrastructure; it is becoming a testing ground for new financial models.

Country-Level Signals of Momentum

- United Arab Emirates

- The UAE has positioned itself as the region’s most mature crypto hub. Dedicated regulators, financial free zones, and progressive licensing frameworks have attracted global exchanges, custodians, and Web3 startups. The approval of a dirham-backed stablecoin and progress toward a digital dirham reflect a state-led approach to integrating digital assets into the formal economy.

- Saudi Arabia

- Saudi Arabia has adopted a more cautious posture, shaped by regulatory conservatism and Sharia considerations. However, initiatives such as Project Aber (a joint CBDC experiment with the UAE) and growing retail interest indicate gradual engagement rather than outright resistance.

- Bahrain and Oman

- Bahrain has emerged as an early regulatory mover, licensing international exchanges and experimenting with stablecoin frameworks. Oman’s decision to license crypto mining operations and related infrastructure suggests openness to blockchain as an industrial and economic input, not just a financial asset.

Together, these developments position MENA as a region where crypto adoption is increasingly shaped by policy intent rather than regulatory ambiguity alone.

Source : chainalaysis.com

How Sharia Compliance is Shaping Crypto Innovation in MENA

One of the most misunderstood aspects of crypto adoption in the Arab world is the role of Sharia compliance. Often framed as a barrier, Islamic finance principles are increasingly becoming a design constraint that encourages more transparent, asset-backed, and risk-aware crypto products. Islamic finance emphasizes the avoidance of riba (interest), excessive uncertainty, and gambling. This creates tension with leverage-heavy derivatives, perpetual futures, and yield products that rely on lending mechanics.

However, it also aligns naturally with spot trading, asset-backed tokens, and on-chain participation models.

In response, platforms are beginning to adapt.

Sharia-aligned offerings now include:

- Spot-only trading environments

- Wakala-based staking structures

- Asset-backed and proof-of-reserve models

- Automated tools designed to avoid interest-bearing mechanics

This shift is not merely ethical positioning. Platforms that proactively address Sharia considerations are building long-term trust and liquidity in a market where values materially influence financial behavior.

Why the UAE Has Become a Global Magnet for Crypto Projects

The UAE’s emergence as a global crypto magnet is the result of deliberate policy design rather than coincidence.

From a financial perspective, the absence of personal income tax and capital gains tax creates a uniquely attractive environment for crypto investors and founders. The exemption of crypto transactions from VAT further lowers operational friction. Regulatory clarity is equally important. Dubai’s VARA and Abu Dhabi’s FSRA provide distinct but complementary frameworks, serving retail-focused platforms and institutional-grade operators respectively. This dual-track approach allows experimentation without sacrificing compliance.

Beyond policy, infrastructure matters. Free zones such as DMCC, ADGM, and DIFC offer ready-made ecosystems combining licensing, banking access, legal clarity, and global connectivity. Add to this high-speed digital infrastructure, cloud services, and a deep talent pool, and the UAE becomes a plug-and-play jurisdiction for Web3 companies. Finally, lifestyle and residency incentives play a non-trivial role. Golden Visas, safety, education, healthcare, and global travel connectivity make the UAE not just a business destination, but a long-term base for founders and investors.

The Biggest Barriers Still Slowing Crypto Adoption in MENA

Despite momentum, significant challenges remain.

Regulatory fragmentation across the Arab world complicates cross-border operations and raises compliance costs. What is permissible in one jurisdiction may be restricted in another, pushing activity into informal channels.

Sharia interpretation remains non-uniform. Even spot trading and token volatility are subjects of ongoing debate, creating uncertainty for both users and platforms.

Education and trust deficits persist. Limited technical understanding increases exposure to fraud, misinformation, and unrealistic expectations. Without sustained education, adoption risks being cyclical rather than structural.

Infrastructure constraints also matter. Fiat on-ramps, banking partnerships, and digital access remain uneven, particularly outside major urban centers.

What Will Drive the Next Phase of Crypto Growth in the Arab World

The next phase of crypto adoption in the Arab world is unlikely to be driven by speculation alone. Instead, it will hinge on utility, alignment, and institutional cooperation.

Stablecoins are central to this evolution. By combining price stability with blockchain efficiency, they offer practical solutions for payments, remittances, and treasury management in volatile currency environments. Sharia-compliant frameworks provide a pathway for ethical, transparent financial products that resonate with local values while remaining globally interoperable.

Real-world use cases are expanding beyond trading into payroll, cross-border commerce, freelance income, and SME finance. These applications anchor crypto in everyday economic activity rather than market cycles. At the same time, regulatory sandboxes and pilot programs are allowing governments and institutions to experiment without overcommitting. Successful models may eventually inform regional standards.

What Crypto’s Rise Means for the Future of Arab Finance

Crypto’s rise in the Arab world reflects deeper structural shifts in how value is stored, transferred, and accessed. While challenges around regulation, education, and cultural alignment remain, the trajectory is increasingly pragmatic rather than ideological. The region’s success will depend on collaboration between regulators, platforms, educators, and communities. When designed around real economic needs and local values, crypto can evolve from a parallel system into a meaningful component of the Arab world’s financial architecture.

Not revolutionary for its own sake, but functional, inclusive, and aligned.

Disclaimer: This content is for informational purposes only and does not constitute financial, legal, or religious advice. Cryptocurrency investments involve significant risk. Always conduct your own thorough research (DYOR) and consult with certified professionals before committing capital.