Tron wrapped up 2025 by cementing its status as the go-to blockchain for everyday stablecoin transactions. The network saw major growth in user activity and institutional partnerships during the final quarter, even as crypto markets faced headwinds.

According to the recently released Coindesk report, daily active users on Tron climbed to 2.8 million between October and December, up from 2.6 million in Q3. That puts Tron second only to Solana among major layer-1 networks for user engagement.

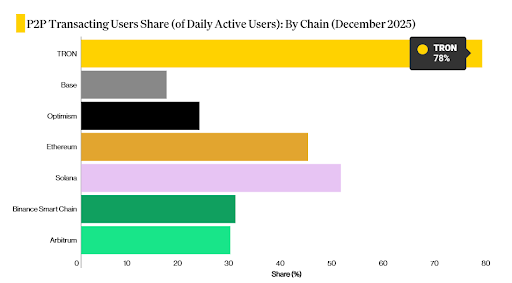

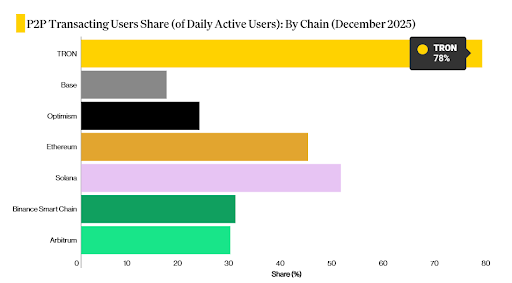

What's more interesting is how people actually use the network. About 78% of Tron's daily users send payments directly to each other, wallet-to-wallet. No other major blockchain comes close to this percentage.

Image via CoinDesk

It's clear evidence that regular people rely on Tron for peer-to-peer transfers rather than complex DeFi protocols.

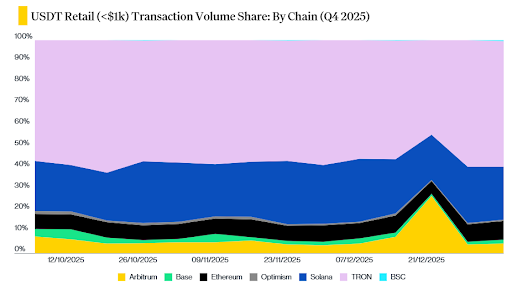

Tron Dominates Global Retail USDT Transfers

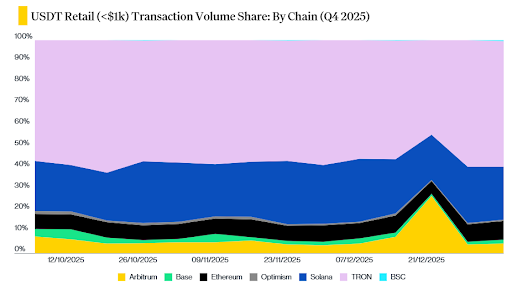

Tron handled roughly 56% of all small USDT transfers under $1,000 globally during Q4. While this number dipped slightly from Q3's peak of 65%, Tron still processes more retail-sized stablecoin payments than any competitor.

Image via CoinDesk

The network's overall stablecoin market share also grew from 25.7% in early October to 26.7% by year-end.

This happened while other stablecoin-focused chains like Plasma actually lost ground, dropping from $3.07 billion to $2.95 billion in total value locked during the same period.

Intent-Based Trading Explodes on Tron in Q4

One of Q4's biggest surprises was the explosion in intent-based transactions on Tron. This trading method lets users simply state what they want—like swapping one token for another—while automated systems handle the technical details behind the scenes.

Intent-based volume on Tron jumped 899% quarter-over-quarter to reach $449 million. That makes Tron the third-largest network for this type of activity, trailing only Ethereum at $3.5 billion and Solana at $634 million.

Revolut Integration Pushes Tron Toward Mainstream Adoption

December brought Tron's most significant integration to date: a partnership with Revolut.

The fintech giant now lets its 65 million users in European Economic Area countries stake TRX directly through the app with zero fees. It also allows them to make instant 1:1 fiat-to-stablecoin conversions and send quick stablecoin remittances.

This deal represents a huge step toward mainstream adoption. Revolut users can now access Tron's network without needing separate crypto wallets or dealing with complicated blockchain interfaces.

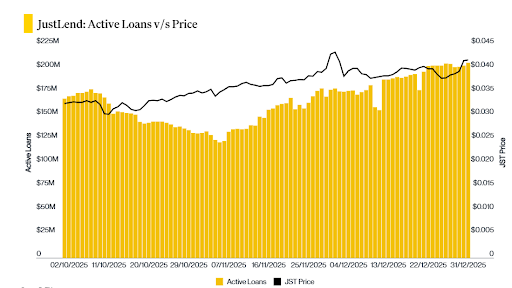

Tron DeFi Shows Resilience Despite TVL Decline

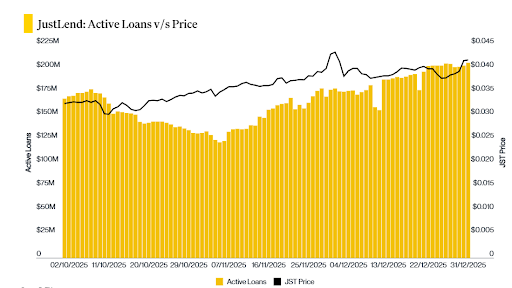

While total value locked on Tron fell from $6 billion to $4.5 billion during Q4, lending remained strong. JustLend, the network's biggest lending protocol, held $3.9 billion in TVL and saw active loans rise from $168 million to $206 million.

Image via CoinDesk

SunPerp, Tron's main perpetual DEX, bucked broader market trends by growing volumes 34% from $72 million to $96 million. The platform rebranded to SunX in November and even hit two consecutive days over $1 billion in trading volume during December.

Why Tron Is Positioned to Lead Retail Crypto Payments in 2026

Tron enters 2026 with solid momentum. The network's focus on simple, affordable stablecoin transfers continues attracting users who need practical crypto payment solutions rather than speculative trading platforms.

With institutional partnerships expanding and technical upgrades rolling out, Tron looks well-positioned to maintain its retail payments leadership.

TRX Statistics Data

- TRX Price: $0.297

- TRX Market Cap: $28.16B

- TRX Circulating Supply: 94.7B

- TRX Total Supply: ∞

- TRX Market Ranking: #8