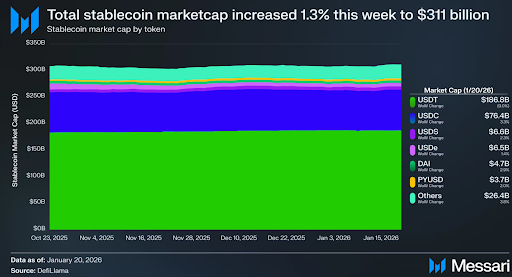

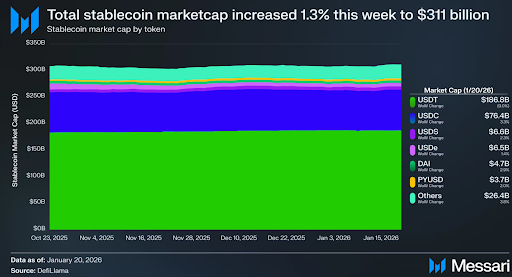

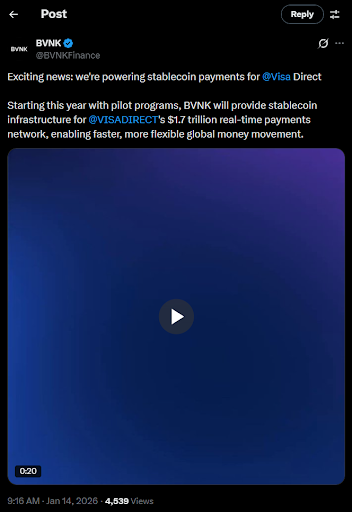

The stablecoin market hit $311 billion in January, showing steady growth despite ongoing debates about how these digital dollars should be regulated.

Image via Messari

While major payment companies are adding stablecoin features and more money is flowing into the sector, banks and lawmakers are fighting over rules that could change how these tokens work.

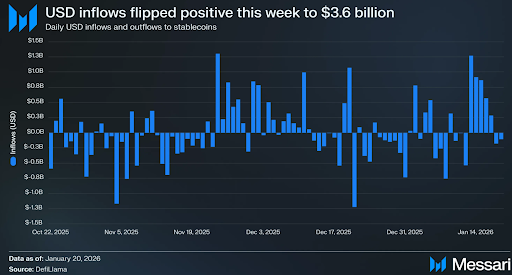

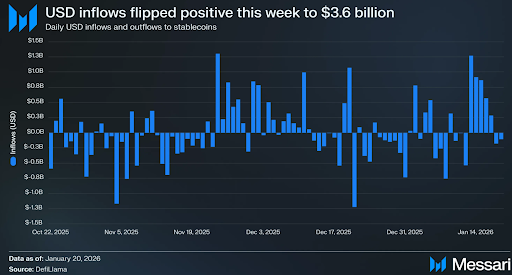

According to a recent Messari report, total stablecoin supply increased by 1.25% this week, with money flowing back into the market after several weeks of withdrawals.

Around $3.6 billion entered the stablecoin ecosystem, suggesting that traders and institutions are repositioning their funds rather than making long-term bets.

Image via Messari

USDT remains the biggest player with $186.8 billion in circulation, though its market dominance slipped from 60.8% to 60.1%. USDC is gaining ground, growing 3.3% in one week to reach $76.4 billion and capturing nearly a quarter of the total market.

Smaller stablecoins also saw notable gains. USDS, USDe, and DAI each grew around 2-3% this week. The combined category of other stablecoins jumped 3.8% to $26.4 billion, indicating that newer issuers are finding their footing in an increasingly competitive market.

Traditional Finance Moves Stablecoins Into Real Payments

Major financial institutions are moving beyond pilot programs into real-world stablecoin applications. Notable examples include:

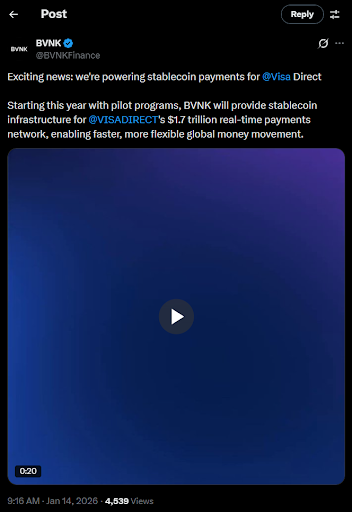

- Visa partnered with BVNK to allow businesses to pre-fund cross-border payments using stablecoins, then send money directly to recipients through Visa Direct.

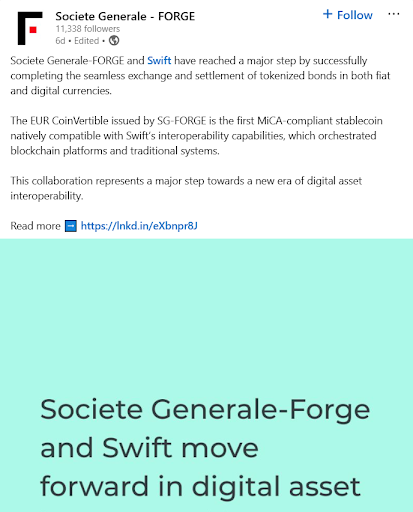

Image via X

This setup enables faster settlements that work around the clock, including weekends and holidays when banks are closed.

- SWIFT tested euro-denominated stablecoins for settling tokenized bonds, working with Societe Generale-Forge on a system that handles payments and redemptions across both blockchain and traditional banking networks.

Image via LinkedIn

The test used EURCV, described as the first stablecoin compliant with Europe's MiCA regulations that works natively with SWIFT's messaging standards.

Pakistan's Ministry of Finance signed an agreement to explore using USD1 stablecoins for remittances and trade payments.

Image via X

With over $36 billion in annual remittance flows, the country sees stablecoins as a way to modernize its payment infrastructure alongside a planned central bank digital currency.

Banks Are Pushing Back on Yield-Bearing Stablecoins

Bank of America's CEO warned that stablecoins offering interest could pull up to $6 trillion away from traditional bank deposits.

The concern centers on how yield-bearing stablecoins work. These instruments hold reserves in short-term government securities rather than loaning money out, which could reduce credit availability for small and medium-sized businesses.

This tension is holding up the CLARITY Act, a proposed law that would establish federal rules for stablecoins. Coinbase withdrew support for the bill over language that would ban platforms from sharing interest or rewards with stablecoin holders.

The company argues this restriction is anti-competitive and benefits bank lobbying efforts, while banking groups say the measure protects the financial system from deposit flight.

What This Means for Users and Traders

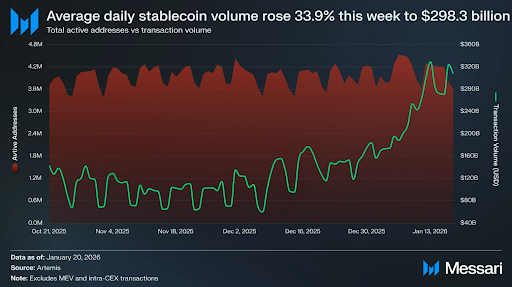

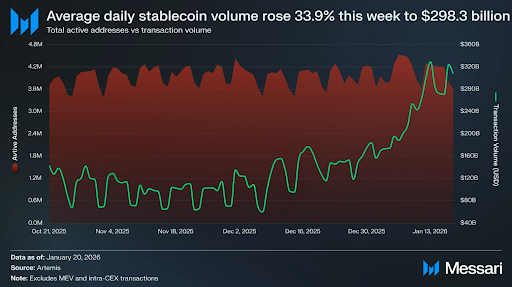

Transaction volumes jumped 33.9% in one week to $298.3 billion daily, though the number of active users fell slightly to 4.08 million.

Image via Messari

This pattern suggests large players are moving significant amounts while retail participation remains steady but not growing quickly.

For traders, the expansion of payment integrations could increase stablecoin utility beyond crypto exchanges. More real-world use cases typically support price stability and liquidity.

However, regulatory uncertainty around yield features and compliance requirements could limit which stablecoins gain mainstream adoption.

Stablecoin Statistics Data

- Current Stablecoin Market Cap: $316.55 Billion

- 24-Hour Trading Volume: $145.02 Billion

Top 10 Stablecoins

- Tether (USDT)

- USD Coin (USDC)

- Ethena USDe (USDe)

- Dai (DAI)

- PayPal USD (PYUSD)

- World Liberty Financial USD (USD1)

- Global Dollar (USDG)

- Ripple USD (RLUSD)

- USDD (USDD)

- United Stables (U)