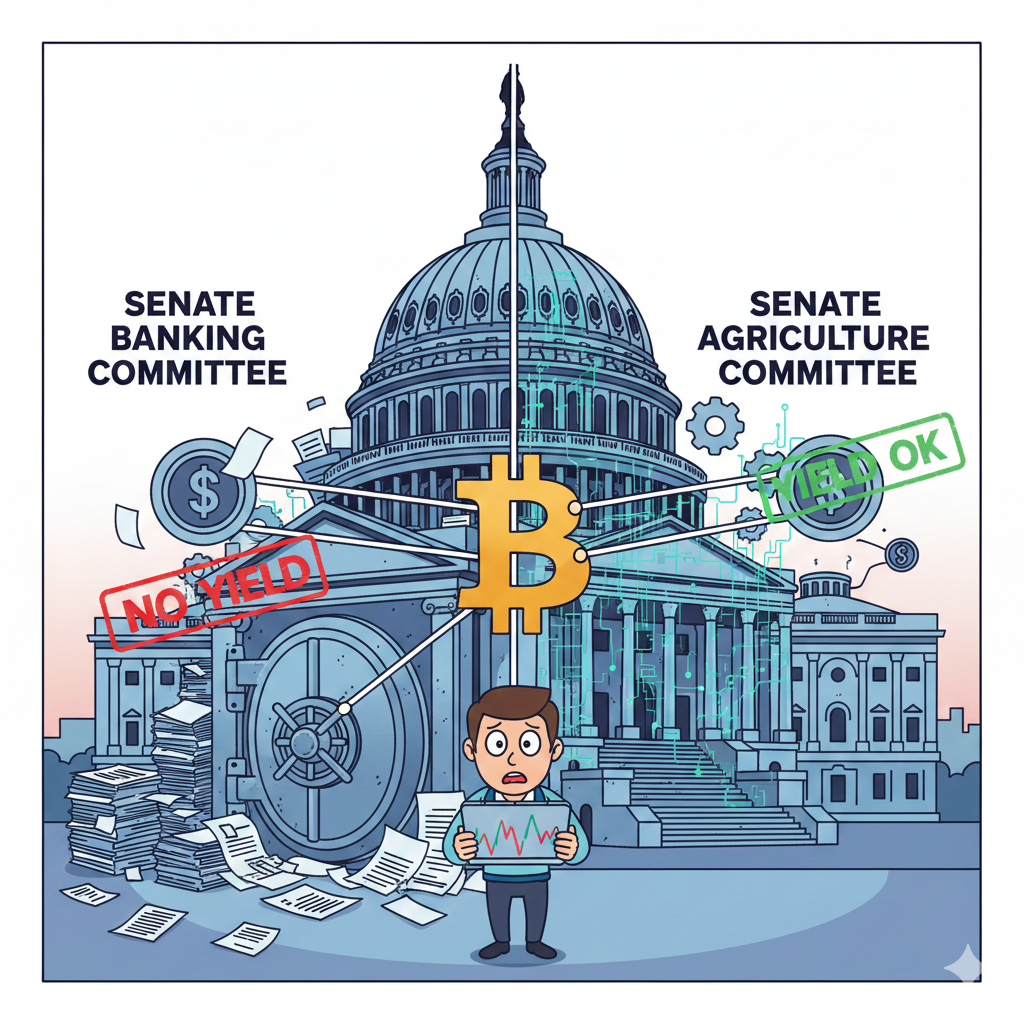

The CLARITY Act is still a split between Agriculture and Banking committees so it isn't dead. The Senate Agriculture Committee's version could preserve or destroy DeFi yields. Justin Dunn, Coinbase's CEO, rescinded his support for the Senate Banking Committee's crypto bill on January 14 so that he could repurpose his support in other areas. Dunn condemned the "kill rewards for stablecoins" and "problematic DeFi regulations." As a result, the Senate Banking Committee has indefinitely tabled the proposed legislation and is trying to reconcile both sides through Chairman Tim Scott. At the same time, Scott has failed to have any bipartisan backing for his proposal. The Agriculture Committee's version is quite different from the Banking Committee's, with respect to monitoring through the CFTC, protections for developers from liability, and most importantly the absence of any restrictions on yields for stablecoins. The future of innovation in the crypto markets will be determined by which Senate committee wins the jurisdictional battle, not by when regulations will come into place.

The Split That Changes Everything: Banking vs. Agriculture

The Senate Agricultural and Banking committees have expressed their own authority over the regulation of cryptocurrencies by the SEC and CFTC together. They will take different approaches to their regulation; The Banking draft regulating cryptocurrencies is based on traditional finance methods and regulates crypto exchanges in a similar way as shadow banks, with strict capital requirements, KYC/AML, and no offering of stablecoins with interest rates competing with Bank deposits. Ethereum co-founder, Charles Armstrong, called it, "Materially worse than the current status quo."

The Agriculture draft takes the opposite approach regarding cryptocurrency regulation. In the Agriculture draft, the CFTC is designated as the primary regulator of the Spot Market for cryptocurrencies, developers are protected from liability for not exercising control over their customers' assets, and stablecoin yield restrictions are removed. Chair Boozman pointed out the "fundamental policy differences" between himself and the Senate Democrats, but he promised to move forward with the markup on January 27th, 2020. Senator Kirsten Gillibrand has expressed "very high" expectations for the Agriculture Committee to pass a bill because, "They're pushing to get this done right now."

The regulatory process that promotes the cryptocurrency-friendliness of the Agriculture bill is also true of both committees. However, the process of comprehensive regulation will require the passing of both a Banking and Agriculture Committee bill to occur. If the Banking Committee is unable to advance a stable coin framework while the Agriculture Committee advances one, the Agriculture Committees will be able to take advantage of conference reconciliation.

Key Differences That Determine Your Crypto Portfolio's Future

The major change in the Agriculture bill is that it creates developer protections; The bill does not regulate software developers "unless the developer controls customer assets." This is a clear separation for DeFi enthusiasts, one that provides the distinction between decentralized protocol designers and centralized intermediaries. Amanda Tuminelli of the DeFi Education Fund is "optimistic" that Agriculture will create developer protections that provide a clear delineation between centralized intermediaries and software developers.

Expanding CFTC jurisdiction moves regulatory authority over cryptocurrencies from SEC enforcement to collaborative oversight and regulation of cryptocurrencies. As with the CFTC, the SEC typically has been stricter in its regulatory enforcement. Smaller DeFi protocols and platforms may be able to survive through CFTC inspection while most will be shut down by the SEC.

The lack of restrictions on stablecoin yields provided in the Agriculture bill is probably the best feature of the bill. Banking has prohibited crypto platforms from offering a return to idle assets, which was expected to correlate with 20% of Coinbase's revenue (approximately $355 million in Q3 2025). The major proponent of this prohibition is the lobbying of the banking industry, which has asserted that the lack of yield restrictions permits easily accessible competition among deposits. When it comes to commodities trading, the jurisdiction of Agriculture gives Senator Boozman political cover for permitting stablecoin yields as it does in a substantive manner for stablecoin yields. If the banking industry prevails, the only yield for stablecoins will disappear.

January 27 Senate Markup: The Defining Moment for Crypto Policy

Following years of Movement in the House only, the first substantive opportunity for crypto in the Senate is the January 27 Agriculture markup scheduled for a 3 p.m. EST/2 p.m. CST start time. The Agriculture markup will allow Democrats to submit amendments prior to the voting deadline for either a return to bi-partisan support or the unveiling of the political divide between the parties. Concerns over CFTC Commissioners appointments and an Ethics Rule that would stop any Trump officials from being able to issue digital commodities as well as a developer safe harbour as money laundering risks have all contributed to Senator Cory Booker's concerns.

A successful Agriculture markup allows a party line win for the Agriculture committee but leaves the Banking Committee with no other choice than to pass the Banking counter to Agriculture or allow the Agriculture framework to become the standard going forward.

Agricultural Chairman Scott indicated that negotiations are still ongoing for the Banking Committee's legislation, but is not willing to announce any date for a markup.

According to several sources that have been in touch with CoinDesk, the White House has instructed both crypto and banking interest groups to come to a resolution on the stablecoin yield issues before any further action is taken by the Banking Committee, which in effect, is outsourcing all legislative negotiating to private interests.

The end result of this legislation will depend on how the final versions of both Banking and Agriculture legislation are reconciled during the Conference. House Republicans have also indicated they would not accept any replacement for the July CLARITY Act.

To prevent a filibuster, the Banking bill will need 60 votes to pass in the Senate, including 7 Democrats. The closer we get to the 2026 mid-term elections, the more urgency will increase for consensus, but resolving the gap between Banking and Agriculture is fundamentally challenging.

January 27 Could Decide DeFi, Stablecoin Yields, and Innovation in 2026

Crypto gets CFTC-led regulation with developer safeguards and yield-friendly stablecoin measures if Agriculture passes its bill on January 27. If bank-versus-crypto lobbying paralyzes banking, Agriculture's framework becomes Senate negotiations' baseline. If neither committee passes legislation, comprehensive regulation waits until the November midterms, perpetuating the enforcement-by-litigation regime that has stifled innovation. The Agriculture Committee's markup isn't just procedural theater—crypto learned whether 2026 will bring regulatory clarity or battle. The CLARITY Act survived Armstrong's Coinbase withdrawal. It put crypto's destiny in the hands of a committee that wants to pass anything.