The S.E.C. has always thought that if you make a token for any reason, it is a security until the S.E.C. says otherwise. A protocol is also a security if you make it. You could also be breaking the law if you promise to make something bigger in the future. Everyone has asked for clear rules for the crypto business, but the SEC has chosen to focus more on penalizing firms and people who break the securities laws than on making sure these same companies and people know what the rules are.

Since January 2025, the S.E.C. has changed a lot. Gary Gensler is no longer there, and Paul Atkins is now the S.E.C. Commissioner. The S.E.C. began talking about "Project Crypto" and the token taxonomies that were being made shortly after this change. They also spoke about what could be a good way to go about it.

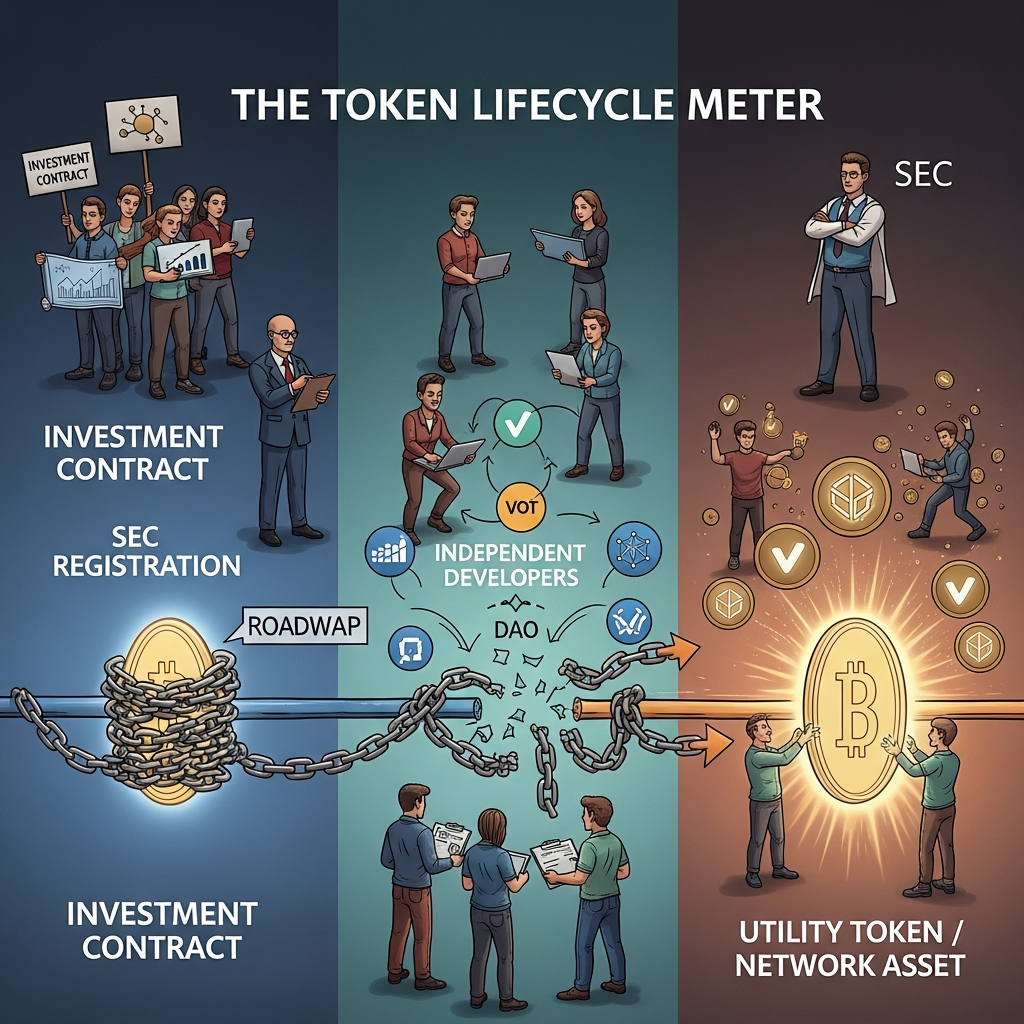

There is still a lot to figure out, and the new change might not last. The S.E.C. is now saying that not every token is a security, which is something it hasn't said since blockchain technology first came to the market. The S.E.C. also says that tokens can start out as securities and then stop being securities as the projects grow.

This difference is very important because it will change how projects are built, where and how tokens are exchanged, and whether or not U.S. crypto innovation will happen in the U.S. or another country.

The New Framework: Tokens Can Get Bigger

Chairman Atkins talked about the idea of token lifecycle contracts in November 2025. Even though buying a token may end up being a contract to sell an investment, there may still be another investment contract until the token's function changes. For example: When Howey (the person who came up with the Howey Test) sold his citrus groves to management companies, the land stopped being an investment and turned into a golf course. The soil itself didn't change, but the way investors made money from it did.

Tokens fit into this idea since they are meant to help developers and users interact and build a community. They also give community members a way to buy and store tokens in case they need them in the future. Tokens are like regular investment contracts in many ways.

For two years after the source was released, neither of the original developers worked on the code base. Also, the more than 100 current developers who are adding code don't talk to or collaborate with either of the original creators. So, the original creators no longer have any say in how this project is being built or how the protocol is being used on the blockchain. So, no buyer now needs the competent management of a single developer to make their investment in the blockchain more valuable.

The investment contract that a buyer signed with the development team is now complete once the buyer buys a token that the development team has issued. The Token itself will no longer be seen as a security. Instead, it was thought of as part of an investment contract for a short time when the token was being sold. After a buyer gets tokens from the development team, they won't be able to trade them for securities.

This new point of view didn't just arise out of nowhere. The SEC has backed this stance for a while now, and the SEC Chairman has been publicly pushing for it for a while now. The SEC has made it clear that this is now the official agency position and that both the SEC Chairman and the SEC agree with Commissioner Hester Peirce's point of view.

What The SEC New Crypto Framework Means for Projects

In the actual world, the effects are tremendous. Companies can get money by selling digital tokens, which give the company money. However, they must be completely honest about what will happen during the investment contract phase and follow all federal securities laws and rules at the start of the project. Once the projects are fully decentralized, they will no longer be considered securities.

There are four key causes for this change: clear promises made by the investors about how the company's managers will keep those promises, either delivering the promised products or failing to do so, the network becoming more mature with more people having control over it, and the founding team becoming less important for providing value to the network.

So, the basic steps in this Plan are as follows: in the first stage, register or otherwise qualify for an exemption from the SEC; keep your promise to provide technical support by building working code and moving toward a decentralized governance and development model; and keep track of when the network has changed from an investment contract to an independent network.

There isn't a clear definition of what "sufficient decentralization" means. It is impossible to measure how decentralized ownership must be to reach "sufficient decentralization." We still don't know how many independent developers it would take to attain this aim or what kind of governance structure shows that a project is no longer reliant on a central authority. There are still concerns regarding what "sufficient decentralization" really means and what level of momentum is needed to achieve decentralization.

The SEC has thrown out a number of lawsuits against different projects, and as of 2025, it looks like a number of them have shown that they are no longer securities. But since the SEC hasn't given any clear instructions on how long it should take for a project to change from being a security to a non-security, it's hard for any project to know for sure when it was a security and when it became a non-security.

The Exceptions That Make Everything More Difficult

No matter how decentralized they are, all tokens will always be seen as securities. Tokens that give you ownership in traditional (stock and bond) securities are called "tokenized securities." Because of this, they will always be seen as securities.

The GENIUS Act was passed in July 2025. It made it plain that payment stablecoins like USDC and USDT are not securities, which was intended for the initiatives described above. This doesn't make things clearer for different kinds of tokens.

The SEC has also ruled that meme coins (tokens that don't have a set development roadmap and don't promise anything from the developers) are not securities. This is because people don't expect to make money by buying meme coins. They are not putting money into something; they are buying a cultural meme. This designation of meme currencies as "too foolish to regulate" gave the whole category of tokens a legal foundation.

People are currently looking very closely at and investigating DeFi technologies. Governance tokens are not securities, yet the same protocols may nonetheless be running unregistered investment companies or exchanges from a legal point of view. Even if something is decentralized, you still have to obey all the rules and laws that apply to it.

What Crypto Projects Should Really Do

Before you launch a token in today's market, you should know that you will probably have to follow securities laws. The easiest approach to do this is to treat your token offering like a securities offering and either register the token with the right authorities or use an exemption like Regulation D or Regulation A+.

Be honest about what you're offering. The new company model needs clear and direct explanations of how managers will run things. Vague roadmaps won't work. You need to be extremely clear about what you're promising to do to make your token system better. You shouldn't guarantee anything if you can't make specific promises to finish specified development activities.

As your project moves forward, it's crucial to keep track of how you're getting closer to becoming a decentralized organization. This documentation will show how governance is becoming less centralized, how community-driven development is being used, and how the original team's role will continue to shrink. The most important thing is to show that these changes are really happening and not just something you want to happen.

You should hire a lawyer who knows a lot about cryptocurrency and securities legislation. When these two domains meet, things get quite difficult, and mistakes can have big financial effects. The SEC has said that it is willing to engage with projects that are really trying to follow the rules, but only if the project actually uses the current rules to its advantage.

Looking Ahead of the U.S. Crypto Regulation

The SEC's new stance is a big shift from the prior view that "everything is a security" to the new view that "it depends on the project's lifecycle." This update makes the rules clearer, which could provide U.S. crypto developers more chances to innovate instead of needing to do it outside of the U.S.

This new job does NOT offer projects free reign. When a project is launched, it must still respect the SEC's securities rules, the SEC's definition of decentralization, and the fact that the SEC may or may not clearly say when a security becomes a non-security. The "investment contract" is still a type of financial instrument.

Investors are starting to understand that investment contracts might "expire" and that tokens can stay classified as securities for years until a project effectively decentralizes.

There are still uncertainties about how long this framework will endure under the present administration, if Congress will make it clear that it is statutory law, and whether a project can really decentralize to the point where it is no longer considered a security.

The message right now is that if you launch honestly and decentralize in a true way, there is a good probability that the SEC will not classify your token as a security. This is better than the old way of looking at current regulations, but the sector still needs more clear direction.