One of the most fundamental yet often overlooked concepts in successful trading is the risk-reward ratio. This simple mathematical principle can be the difference between long-term profitability and slowly bleeding your trading account dry.

Understanding how to calculate and apply risk-reward ratios transforms trading from gambling into a calculated, systematic approach to building wealth. This comprehensive guide will teach you everything you need to know about risk-reward ratios and how to use them effectively on LBank's trading platform.

What Is the Risk-Reward Ratio in Trading?

The risk-reward ratio is a measurement that compares the potential profit of a trade to its potential loss. It answers a critical question: "For every dollar I'm willing to lose on this trade, how many dollars am I potentially making?"

The ratio is expressed as a comparison, such as 1:2, 1:3, or 1:5. A 1:3 risk-reward ratio means that for every $1 you risk losing, you stand to gain $3 if the trade succeeds. In simple terms, you're risking $100 to potentially make $300.

This concept is fundamental because it allows you to be profitable even when you're wrong more often than you're right. With a 1:3 risk-reward ratio, you only need to be correct 25% of the time to break even, and anything above that creates profit. This mathematical reality is what separates professional traders from gamblers.

Why Risk-Reward Ratio Matters?

Many beginning traders focus exclusively on win rate—the percentage of profitable trades. While win rate is important, it's only half of the equation. You can have a 70% win rate and still lose money if your losses are much larger than your wins.

Consider two traders over ten trades. Trader A has a 70% win rate but doesn't use risk-reward ratios. They make $50 on seven winning trades ($350 total) but lose $100 on three losing trades ($300 total). Their net profit is only $50 despite winning 70% of the time.

Trader B has a 40% win rate but consistently uses a 1:3 risk-reward ratio. They risk $100 to make $300 on each trade. With four wins, they make $1,200. With six losses, they lose $600. Their net profit is $600 despite being wrong 60% of the time.

This example illustrates why professional traders obsess over risk-reward ratios. The math doesn't lie—favourable risk-reward ratios allow you to be profitable with mediocre win rates, while unfavourable ratios require unrealistically high win rates to succeed.

How to Calculate Risk-Reward Step by Step?

Calculating your risk-reward ratio before entering any trade is essential. The formula is straightforward but requires you to define three specific price points.

First, identify your entry price—the price at which you plan to enter the trade. Second, determine your stop loss price—the price at which you'll exit if the trade moves against you to prevent larger losses. Third, establish your take profit price—the price at which you'll exit to lock in profits if the trade moves in your favour.

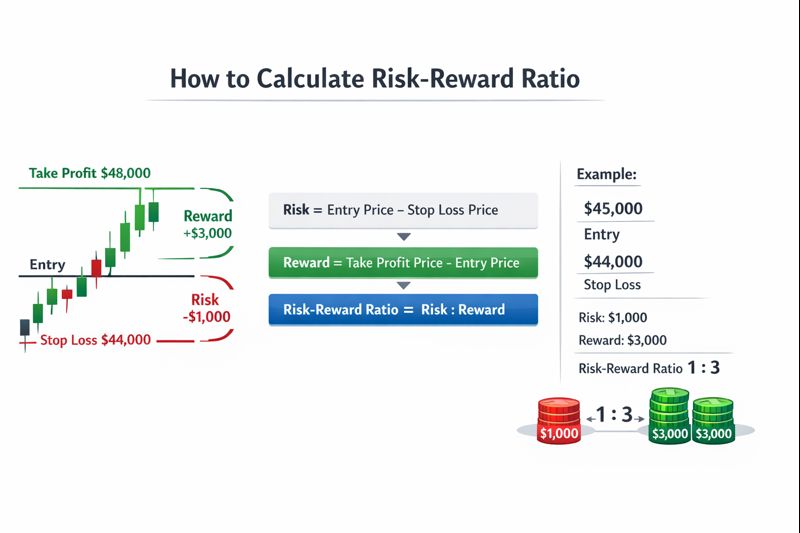

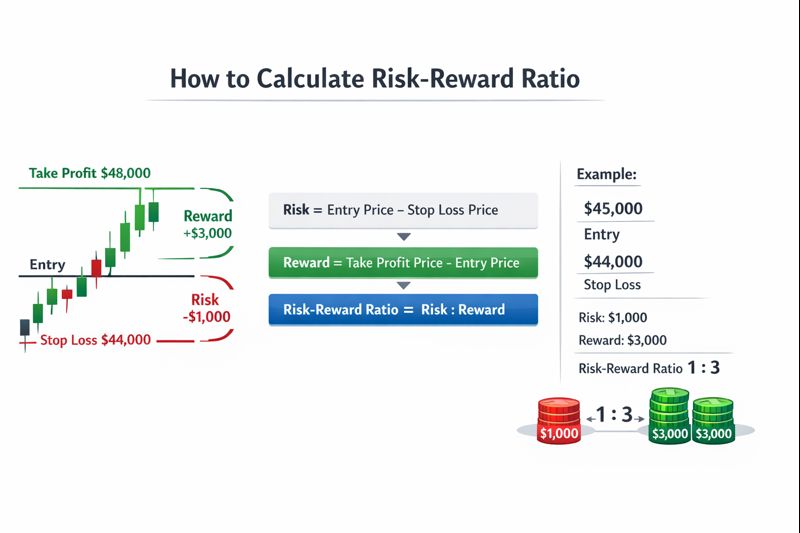

The calculation follows this formula:

Risk = Entry Price - Stop Loss Price (for long positions)

Reward = Take Profit Price - Entry Price (for long positions)

Risk-Reward Ratio = Risk: Reward

For example, suppose you're buying Bitcoin at $45,000. You set your stop loss at $44,000 (risking $1,000 per BTC) and your take profit at $48,000 (potential gain of $3,000 per BTC). Your risk is $1,000, your reward is $3,000, and your risk-reward ratio is 1:3.

For short positions, the calculation is reversed. Risk equals the stop loss price minus the entry price, and reward equals the entry price minus the take profit price.

Image source: by Author

How to Set Realistic Take Profit Targets

The most common mistake traders make with risk-reward ratios is setting unrealistic profit targets just to achieve a favourable ratio. Your take-profit level must be based on sound technical analysis, not arbitrary numbers.

Support and resistance levels are the foundation for setting profit targets. These are price levels where the market has historically reversed or paused. Your take profit should be placed just before significant resistance levels in long positions or just above significant support levels in short positions.

Fibonacci retracement and extension levels provide mathematically derived price targets that many traders watch. Common profit targets include the 1.618 Fibonacci extension level or previous swing highs and lows.

Chart patterns also offer guidance for profit targets. A breakout from a triangle pattern, for instance, typically moves a distance equal to the height of the triangle. A head-and-shoulders pattern suggests a price target equal to the distance from the head to the neckline.

Always ask yourself: "Can price realistically reach this level based on current market structure?" If your answer involves phrases like "if everything goes perfectly" or "it's possible but unlikely," you're probably being too optimistic.

How to Place Smart Stop Losses Without Over-Risking

Your stop loss placement is equally important and should never be arbitrary. Placing stops too tight leads to getting stopped out by normal market volatility, while placing them too wide risks excessive capital on single trades.

Effective stop loss placement considers volatility through measures like Average True Range (ATR). In highly volatile markets, stops need to be wider to avoid premature exits. Use ATR indicators to gauge appropriate stop distances based on recent price movement.

Stop losses should be placed beyond invalidation points—price levels that, if reached, invalidate your trading thesis. For a long position based on support holding, your stop should go slightly below that support level. If support breaks, your reason for the trade no longer exists.

Consider market structure when setting stops. For bullish trades, place stops below recent swing lows. For bearish trades, place stops above recent swing highs. This ensures that if your stop is hit, the market structure has genuinely turned against you.

Time stops are also valuable. If your trade hasn't moved toward your target within a reasonable timeframe, consider exiting even if your stop hasn't been hit. Opportunity cost matters—capital stuck in stagnant trades can't be deployed in better opportunities.

What Is the Minimum Acceptable Risk-Reward Ratio?

Professional traders typically won't enter a trade unless the risk-reward ratio meets a minimum threshold. While this threshold varies by trading style and market conditions, general guidelines exist.

For day trading and scalping, a minimum 1:2 risk-reward ratio is common. The higher frequency of trades and shorter holding periods make this necessary for profitability, given transaction costs.

For swing trading, a minimum 1:3 risk-reward ratio is standard. Swing trades involve holding positions for days or weeks, and the additional time exposure justifies requiring higher potential rewards.

For position trading and long-term holds, ratios of 1:5 or higher are often targeted. The extended timeframe and larger capital commitment demand proportionally larger potential returns.

However, these are guidelines, not rigid rules. Sometimes a 1:1.5 ratio makes sense for a very high probability setup, while other times you might want 1:10 for a speculative position. The key is being conscious and intentional about your ratio rather than accidentally taking unfavourable trades.

Image source: by Author

Win Rate vs Risk-Reward: The Math Most Traders Ignore

Understanding the mathematical relationship between win rate and risk-reward ratio reveals what's required for profitability.

Your breakeven win rate can be calculated with this formula:

Breakeven Win Rate = Risk / (Risk + Reward)

For a 1:2 risk-reward ratio, you need to win 33.3% of trades to break even (1 / (1+2) = 0.333). For a 1:3 ratio, you need only 25% (1 / (1+3) = 0.25). For a 1:1 ratio, you need 50%.

This mathematical reality explains why professional traders can be profitable with seemingly low win rates. A trader with a consistent 1:4 risk-reward ratio only needs to win 20% of trades to break even and 30% to be very profitable.

Conversely, traders using poor risk-reward ratios face an uphill battle. A 2:1 ratio (risking $2 to make $1) requires a 67% win rate just to break even. Achieving and maintaining such high win rates is extremely difficult, especially after accounting for transaction costs and slippage.

How Risk-Reward Changes by Trading Style

Different trading approaches require different applications of risk-reward principles.

Scalping

Involves many small trades throughout the day. Scalpers often accept lower risk-reward ratios (1:1 to 1:2) because they're seeking high-probability setups with smaller price movements. Their edge comes from frequency and win rate rather than large individual gains.

Day Trading

Typically targets 1:2 to 1:3 ratios. Day traders seek clear intraday setups with defined entry and exit points. They close all positions before the market closes, so their risk-reward calculations focus on likely price movements within a single trading session.

Swing Trading

Aims for 1:3 to 1:5 ratios or higher. Swing traders hold positions for several days or weeks, allowing more time for larger price moves. Their analysis focuses on intermediate-term technical levels and fundamental catalysts that support bigger price swings.

Position Trading

Often targets 1:5 to 1:10 or even higher ratios. These traders hold for months or years, seeking major trend changes and fundamental shifts. They accept lower win rates in exchange for potentially massive gains on successful trades.

Your trading style should align with your personality, available time, and risk tolerance. Trying to swing trade with a scalper's timeframe or vice versa leads to poor results.

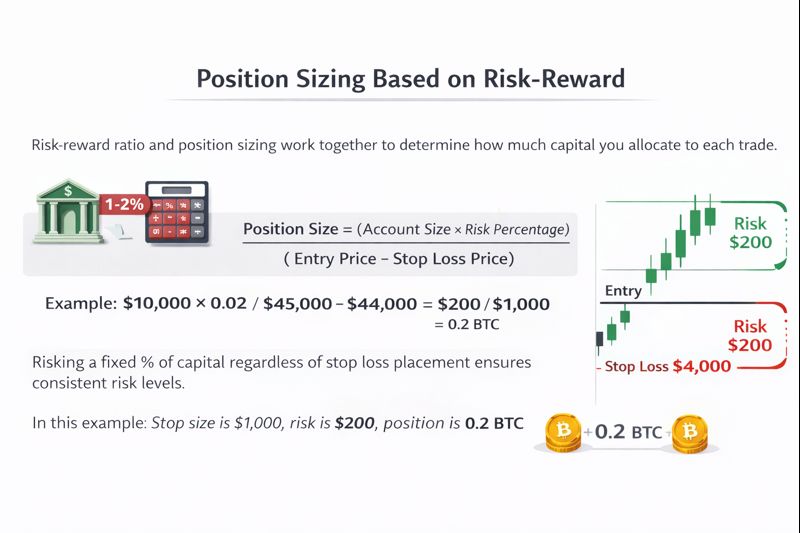

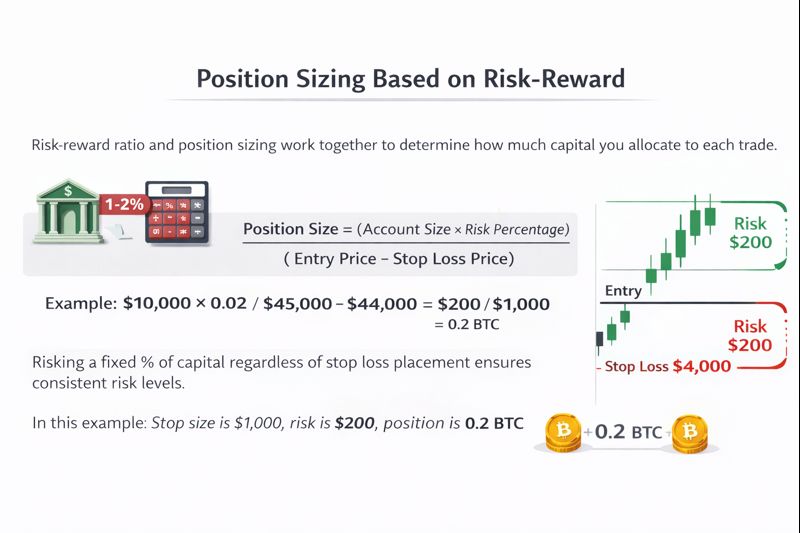

Position Sizing Based on Risk-Reward

Risk-reward ratio and position sizing work together to determine how much capital you allocate to each trade. Many traders calculate their position size to risk a fixed percentage of their capital (typically 1-2%) on each trade.

Here's the position sizing formula:

Position Size = (Account Size × Risk Percentage) / (Entry Price - Stop Loss Price)

For example, with a $10,000 account risking 2% per trade ($200), entering Bitcoin at $45,000 with a stop loss at $44,000:

Position Size = ($10,000 × 0.02) / ($45,000 - $44,000) = $200 / $1,000 = 0.2 BTC

This approach ensures that regardless of where your stop loss is placed, you're always risking the same dollar amount. A wider stop loss means a smaller position size, and a tighter stop means a larger position size.

This mathematical discipline prevents the common mistake of risking too much on any single trade. Even with a series of losses, you preserve enough capital to continue trading and eventually recover.

Image source: by Author

Common Risk-Reward Mistakes to Avoid

Understanding what not to do is as important as knowing what to do.

Moving your stop loss to avoid taking a loss is perhaps the most destructive habit. Once you've calculated your risk-reward ratio and entered a trade, your stop loss represents the point where your analysis was wrong. Moving it invalidates your entire risk management framework and often turns small losses into large ones.

Arbitrary profit targets chosen to create a favourable ratio without supporting analysis rarely work. Price doesn't care about your desired ratio—it follows market dynamics. Set targets based on actual market levels, then calculate your ratio. If the ratio is unfavourable, skip the trade rather than forcing unrealistic targets.

Exiting winners too early destroys your risk-reward ratio in practice. If you calculated a 1:3 ratio but consistently exit at 1:1 when the trade goes in your favour, you're not actually trading with a 1:3 ratio. Discipline in holding for your target is essential.

Taking trades with poor ratios because you're bored or feel you should be trading is a path to losses. Sometimes the best trade is no trade. If market conditions don't offer favourable risk-reward setups, preserve your capital and wait for better opportunities.

How Market Conditions Affect Risk-Reward

Market conditions affect what risk-reward ratios are realistically achievable.

In trending markets, price tends to move in one direction with minimal pullbacks. These conditions often support higher risk-reward ratios (1:4 or better) because trends can extend far beyond initial targets. Place stops at recent swing points and targets at Fibonacci extensions or previous major levels.

In ranging or sideways markets, the price oscillates between defined support and resistance levels. Risk-reward ratios tend to be lower (1:1.5 to 1:2) because price movements are constrained. Trade from support to resistance and vice versa, with stops just outside the range boundaries.

In volatile markets, larger price swings allow for potentially higher risk-reward ratios, but also require wider stops to avoid getting shaken out. Your position size should be smaller to account for the increased volatility, ensuring your dollar risk remains consistent.

In low volatility markets, price moves slowly with small ranges. This often makes finding favourable risk-reward setups difficult. You might need to trade on lower timeframes or simply wait for volatility to return before actively trading.

Advanced Risk-Reward Strategies for Experienced Traders

Once you've mastered basic risk-reward calculations, these advanced concepts can further improve your trading.

Scaling out of positions involves taking partial profits at different levels. You might exit 33% of your position at a 1:2 ratio, another 33% at 1:4, and let the final 33% run for 1:6 or higher. This approach locks in some profit while allowing for larger gains if the trade really performs.

Risk-free trades are achieved by moving your stop loss to breakeven after the trade has moved in your favour. Once the price has moved halfway to your target, you might move your stop to your entry price. This creates a "free trade" where you can no longer lose, only break even or profit.

Asymmetric risk-reward refers to setups where the potential upside is dramatically larger than the downside. Options trading, breakout trades, and early-stage investments in quality projects can offer 1:10 or even 1:100 ratios in favourable circumstances. These require smaller position sizes due to lower probability, but the rare success can be account-changing.

How to Track and Improve Your Risk-Reward Performance

Calculating risk-reward ratios before trades is important, but tracking your actual results is equally crucial.

Keep a detailed trading journal documenting your planned risk-reward ratio for each trade, your actual risk-reward ratio based on where you actually exited, your win rate over time, and your overall profitability.

Calculate your average risk-reward ratio across all trades. If you find that you consistently achieve lower ratios than planned, you're likely exiting winners too early or letting losers run. This awareness allows you to adjust your behaviour.

Review your losing trades to ensure you're actually honouring your stop losses. If your average loss is larger than your planned risk, you're moving stops or not using them at all—a critical problem to address immediately.

Many successful traders maintain a minimum of 1:2 actual risk-reward ratio while achieving a 50-60% win rate. This combination leads to consistent profitability over time. Set similar targets for yourself based on your trading style and gradually work toward achieving them consistently.

Tools That Help You Calculate Risk-Reward Faster

Several tools can help you calculate and visualise risk-reward ratios more easily.

Trading platforms, including LBank, often have built-in risk-reward calculators. When placing orders, you can input your entry, stop loss, and take profit levels, and the platform calculates your ratio automatically.

TradingView offers charting tools with risk-reward indicators that visually display your ratio on the chart. This helps you see immediately whether a trade offers favourable risk-reward before entering.

Position size calculators are available as mobile apps and web tools that quickly compute how much to trade based on your risk tolerance and stop loss distance. These remove the mental math and reduce errors.

For more detailed information on risk management and position sizing, resources like Investopedia's guide on risk-reward ratios provide additional perspectives and examples.

Psychological Aspects of Risk-Reward Trading

Following risk-reward discipline requires mastering psychological challenges.

The fear of missing out can pressure you into taking trades with poor risk-reward ratios. When everyone is talking about a cryptocurrency pump, the temptation to jump in regardless of whether you can set a reasonable stop and target is strong. Resist this urge—there will always be another opportunity.

Taking losses is emotionally difficult, but it's essential to honour your risk-reward framework. When price hits your stop loss, accept it as the cost of doing business. Your stop loss protected you from a potentially much larger loss.

Letting winners run feels unnatural because taking profit feels good. However, exiting at 1:1 when you planned 1:3 means you need a much higher win rate to maintain profitability. Trust your analysis and let profitable trades reach your target unless your thesis is invalidated.

Why Risk-Reward Is the Foundation of Profitable Trading

The risk-reward ratio is perhaps the most important mathematical concept in trading. It's the foundation of sustainable profitability and the difference between systematic trading and gambling. By calculating your risk-reward ratio before every trade, setting realistic targets based on market structure, placing strategic stop losses, and maintaining discipline in execution, you create a framework for long-term success.

Remember that you don't need to win most of your trades to be profitable—you just need your winners to be significantly larger than your losers. A trader with a 1:3 risk-reward ratio and 40% win rate dramatically outperforms a trader with a 1:1 ratio and 60% win rate over the long term.

Start implementing risk-reward analysis on LBank today. Before your next trade, identify your entry, stop loss, and take profit levels. Calculate your ratio. If it's below your minimum threshold, skip the trade no matter how compelling it seems. If it meets your criteria, execute with confidence knowing that the mathematics are on your side.

Over time, this disciplined approach to risk-reward will compound your results, protect your capital during inevitable losing streaks, and position you among the small percentage of traders who achieve consistent profitability in the cryptocurrency markets.