Privacy assets outperformed most of the crypto market in the final quarter of 2025, offering a bright spot during an otherwise difficult period for digital currencies.

While most sectors posted negative returns, tokens offering enhanced privacy features showed resilience, signaling a potential shift in investor priorities.

Market Performance Shows Clear Preference

Zcash (ZEC) led the charge among privacy tokens during Q4, delivering strong risk-adjusted returns even as the broader market pulled back.

The currency, which functions similarly to Bitcoin but includes optional privacy features through "shielded" transactions, saw real usage increase throughout the quarter.

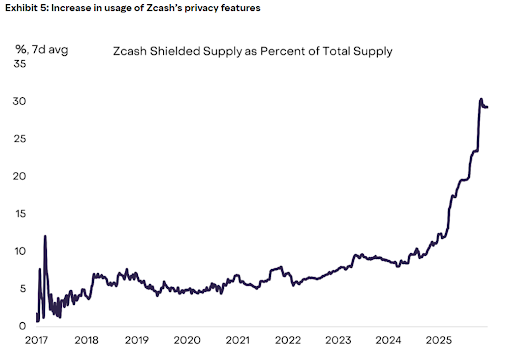

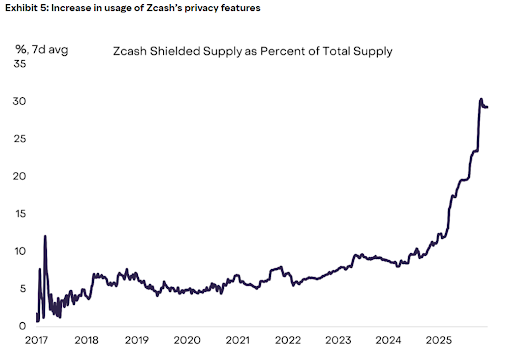

Grayscale data shows shielded balances as a percentage of total supply reached their highest levels since 2017, climbing to around 30% by late December.

Image via Grayscale

Other privacy coins also held up better than most alternatives. Monero (XMR), which uses stealth addresses to hide transaction details, maintained its position as one of the largest privacy assets by market value.

Dash (DASH) more than doubled its daily transaction count during the quarter, while Basic Attention Token (BAT), the native currency of privacy-focused Brave Browser, benefited as the browser crossed 100 million monthly users.

Why Privacy Assets Matter for Institutional Adoption

The growing interest in these assets isn't random. As blockchain technology moves closer to mainstream financial adoption, a fundamental problem becomes clear: most blockchains operate transparently by default.

Every transaction, balance, and wallet activity sits on public ledgers for anyone to view. This works fine for experimental projects, but it creates serious issues for real-world finance.

Companies don't want competitors tracking their payments. Individuals expect their salary, net worth, and spending habits to remain private. Traditional banking provides these privacy protections as standard features.

If blockchains want to serve institutional clients or everyday users, they need similar capabilities. That's where privacy-enhancing protocols come in.

They offer ways to conduct blockchain transactions without broadcasting sensitive financial information to the entire world.

Regulatory Clarity Drives Adoption

The timing of this privacy focus makes sense. U.S. lawmakers are expected to pass comprehensive market structure legislation for crypto in 2026.

This framework would bring traditional finance rules to digital asset markets, including registration requirements and disclosure standards.

For regulated institutions, this clarity creates opportunities to finally engage with blockchain technology in meaningful ways.

Banks, investment firms, and corporations could start holding digital assets on their balance sheets and conducting transactions on-chain. But they'll only do so if adequate privacy tools exist.

Looking at Real Usage

The price performance of privacy assets in Q4 wasn't just speculative hype. Several networks showed genuine increases in activity:

Zcash's rising shielded supply indicates people are actually using the privacy features, not just holding the token

Dash's transaction growth suggests real payment activity rather than just speculation

Decred (DCR), which offers privacy through its CoinShuffle++ feature alongside governance capabilities, also appeared among top performers

Beldex (BDX), providing a full suite of privacy tools including encrypted messaging, gained attention after integrating cross-chain functionality through LayerZero

What This Means for Investors

The Q4 performance suggests privacy isn't just a niche concern anymore. As institutional adoption accelerates, demand for privacy-preserving infrastructure will likely grow.

Traders and investors might want to understand which projects offer genuine privacy solutions versus marketing buzzwords.

However, the broader market context matters too. Privacy assets performed relatively well in Q4, but "relative" is key—they still faced headwinds along with everything else in crypto.

The question for 2026 is whether this theme has staying power or if market leadership will shift again.

For now, privacy looks like more than just another passing trend. It addresses a real need that becomes more urgent as blockchain integration with traditional finance deepens.

Whether current privacy tokens capture that value remains to be seen, but the underlying demand seems genuine and growing.

Privacy Tokens Statistics Data

Current Market Cap: $66.79 Billion

24-Hour Trading Volume: $5.37 Billion

Top 10 Privacy Tokens:

- ZCash (ZEC)

- Monero (XMR)

- Litecoin (LTC)

- Canton (CC)

- Midnight (NIGHT)

- Tezos (XTZ)

- Dash (DASH)

- Humanity Protocol (H)

- Starknet (STRK)

- Decred (DCR)