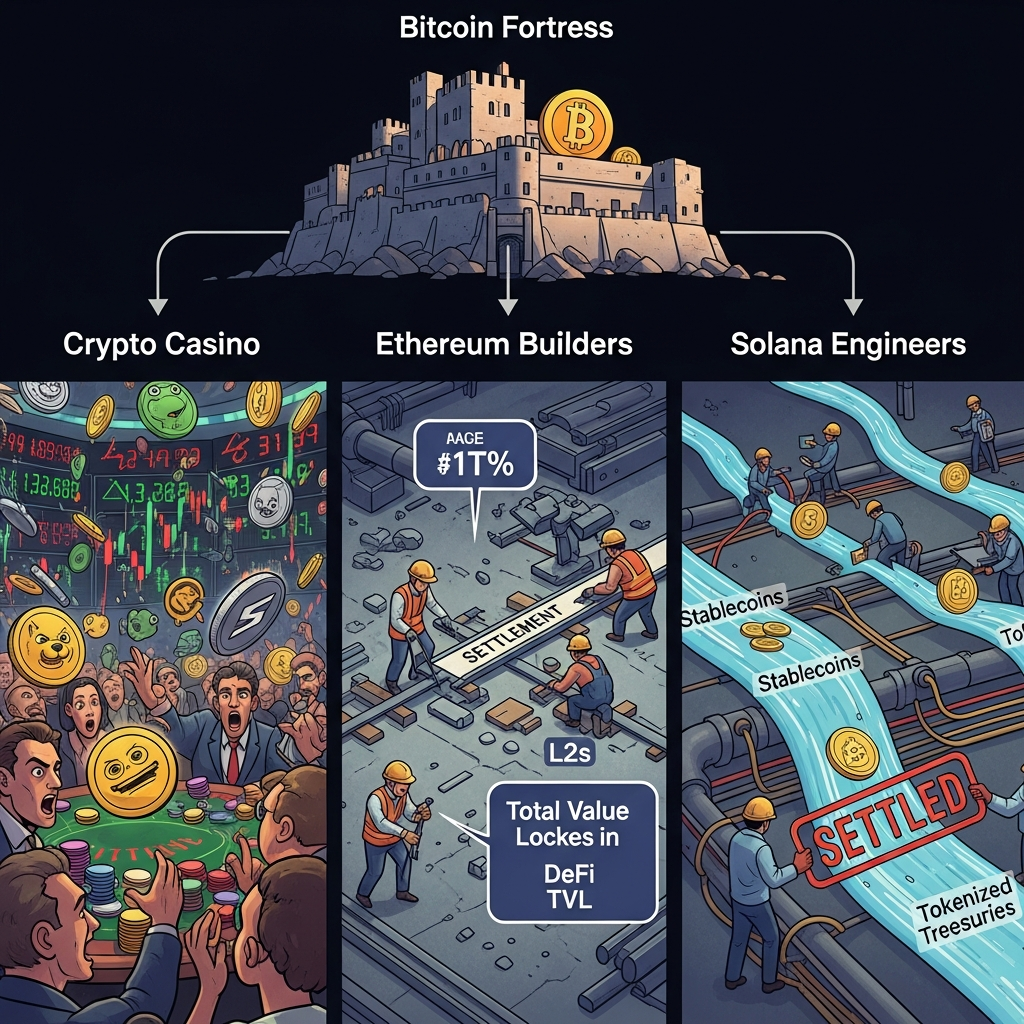

These numbers may not be as they appear, but they are not telling the whole story. Bitcoin has suffered from a decline in its Hashrate for two months in a row. Meanwhile, the number of active addresses was at all-time highs for Ethereum earlier this month. In addition, Solana has quietly grown its Total Value Locked (TVL) to over $9 billion. Overall the cryptocurrency market has been changing, each cryptocurrency is operating at its own market speed.

Therefore, tracking hashrates, active addresses, and total amount locked not only gives technical information, but also gives insight into where "real" people and their "real" money are placing their "real" bets.

Bitcoin: Network Security Holds as On-Chain Activity Slows

The stress being felt by miners will not only be caused by the price of Bitcoin but also by everything that is in place to mine Bitcoin. Due to the difficulty between block halving events that caused some miners to lose their subsidies due to the difficulty in mining, a number of mining companies have closed.

Although Bitcoin has record low profits from mining, Bitcoin has a high level of security because of its hash power. The recent drop in the hashing power of Bitcoin should rebound relatively quickly because of the power of Bitcoin's hash rate network.

In December, corporate treasury buying resulted in the largest monthly purchase of Bitcoin since the middle of 2025, when 42,000 BTC was bought by corporations from digital asset providers. Transaction volume on the base layer of the Bitcoin network is down, and the total active addresses on the Bitcoin network have dropped by 16% year-over-year. This indicates that more users of the Bitcoin network are treating Bitcoin as collateral used by institutions rather than using it to make transactions involving significant amounts of Bitcoin daily.

Ethereum: User Growth Without the Price Follow-Through

Ethereum has had a great start in 2023, despite ETH price currently being lower than the previous year. As of January 15th, 2023 there were over 1.075 million daily unique active wallet addresses on the Ethereum blockchain. This is over two times greater than the number of daily active wallets that existed on the same day in 2022. The daily transaction count for the Ethereum blockchain is another metric to determine how often the Ethereum blockchain is used.

There were 2.8 million transactions on the Ethereum blockchain on January 15th, 2023; this was the highest daily transaction count recorded on the Ethereum blockchain to date. Compared to December 2022, there were almost 8 million more new users of Ethereum's wallets to start the new year, with nearly 4 million users having created an Ethereum wallet in December 2022.

Most of these new users are still using their newly created wallets; therefore, Ethereum is still growing in terms of how fast its user base is expanding. Based on these metrics, there appears to be legitimate growth in Ethereum adoption as opposed to artificial growth resulting from bot traffic or wash trading.

Ethereum holds the majority of DeFi TVL, at 70%, while Solana, Tron, and Arbitrum comprise less than 70% of DeFi TVL across their ecosystems. The largest amount of TVL locked in DeFi on any single blockchain platform is approximately $149 billion, with Ethereum leading the pack.

Over 90% of Ethereum's computation transactions are being processed on layer-2 scalability solutions, resulting in low main net transaction fees, despite the volume of increased transactions on the Ethereum mainnet.

Lastly, while the Ethereum platform's infrastructure and network performance have been improved, the price of the Ethereum asset has not responded in kind. Prior to mid-January 2023, the price of ETH was approximately $3,300, which might seem attractive given the amount of network activity occurring on the Ethereum platform; however, current ETH prices do not accurately reflect what is happening in the Ethereum blockchain ecosystem at this moment in time.

Solana: From Meme-Driven Growth to Institutional Infrastructure

In January 2026, Solana's TVL within the DeFi ecosystem increased from $8 billion to $9 billion and total active daily users rose from 3.38 million to 3.78 million users in total. In 2025, Solana had 40 million users actively using the network who created $1.4 billion dollars of transaction fees. The revenue generated by the Solana businesses comes from all signed contracts or activities and not through speculation.

One of the most significant areas of growth for Solana is the growth of stable coin adoption. The total stable coin volume was $14.8 billion dollars in 2025 and the total volume of transactions was $11.7 trillion. As of January 2026, Solana had a TVL of $1.1 billion in real-world asset collateral, representing a 25% increase in the preceding 30 days, making Solana the third largest in this area. Institutional investors are currently tokenising their treasury assets on Solana, as they are able to settle them in subsecond times and for fractional transaction costs.

Solana's DEX volume was also a strong area of growth in 2025, with $1.5 trillion in total DEX volume. It has generated an average of over $100 million in income in 2025, with the majority of that revenue being generated from increased volume on the Solana Layer 1 protocol, with only the incentive program generating "low volume" by customers using unused protocols.

Aside from DEXs, the Solana infrastructure continues to grow and develop as meme coins have benefitted from Solana's Layer 1 protocol with "meme coins". At the end of January 2025, the weekly DEX volume of meme coins was $56 billion dollars but has significantly declined since then.

What Hashrate, Activity, and TVL Actually Reveal

The combined usage of Microsoft's hash rate to measure overall network security commitment, user participation and capital confidence, respectively, enables an understanding of the networks that have produced franchise businesses and generated "waves of narrative". Solana is working on a scalable execution layer to allow for the continued growth of the crypto economy.

Considering how these three categories work under different ecosystem constraints, we are more interested in how they can be leveraged to identify "actual winners" within the ecosystem than identifying one particular winner.

Bitcoin's hash rate is declining, indicating miners may not be able to operate on the price trends of the last several years, but it currently provides higher security than any other ecosystem due to its extensive adoption.

Ethereum has seen a large increase in users without corresponding increases in price; this suggests that the market is slow to recognize what a powerful ecosystem it has, but the marketplace now desires to leverage for practical applications, so it will likely transition into becoming an institutional "settlement layer" rather than just a speculative trading platform once there is sufficient performance and use case connection to the real world.

Overall, these three data points provide more insight into an ecosystem's strengths/limitations than daily charts, but there is no correlation between the data provided and the short-term price fluctuations of the ecosystem.