Listing a new cryptocurrency may seem easy, but ensuring it remains tradable is much more difficult. Once an exchange lists a new coin, it tries to ensure that the coin gets a lot of attention. However, if someone tries to purchase $50,000 worth of tokens at the same time, then the order book could potentially crash.

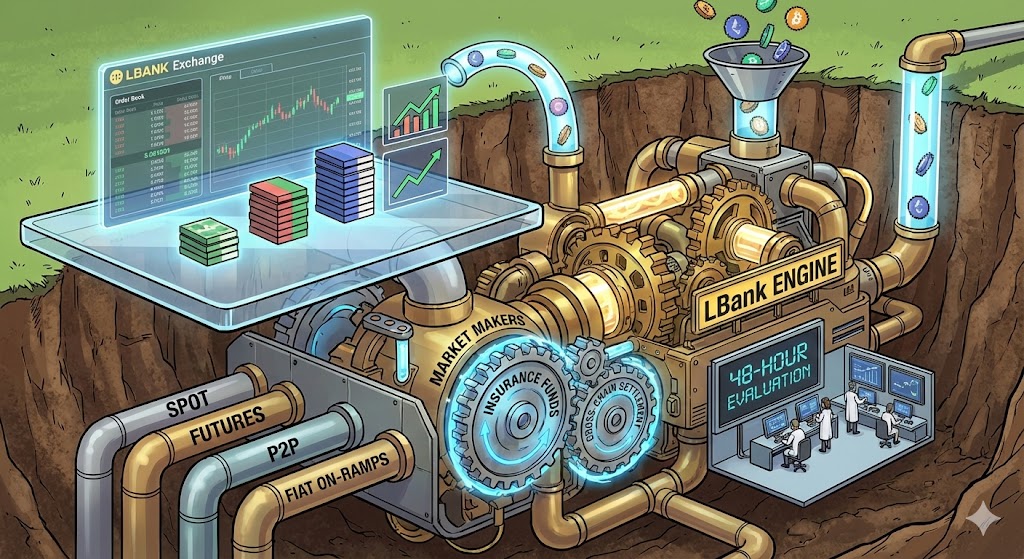

LBank has over 800 coins listed on its exchange along with more than 1,000 trading pairs. It did not grow to this size by simply expecting liquidity to appear. The exchange has created a multi-tiered infrastructure where liquidity is built directly into the exchange rather than added later. This is important for new tokens, particularly when no liquidity has yet been available for these tokens.

The 48-Hour Evaluation: Where Liquidity Planning Starts

Rather than merely verifying security audits and team credentials, LBank evaluates Token Applications (TAs) from their marketplace for 48 hours before they consider adding a new coin. They also evaluate the demand for the coin in the current market, DEX activity, and its compatibility with other blockchains as part of the listing process.

The evaluation process does not focus solely on whether or not there is some kind of application or use case for the token (and a team behind it), but also includes understanding how to use it. Additionally, the platform needs to have an understanding of which blockchain the tokens are on, how they can connect with bridges, and where their current liquidity pools. Only after this point can the coin potentially be listed by LBank.

The examination of the coin before it is listed is important because it determines what LBank's initial liquidity strategy will be for the token. If there is a lot of demand for a coin before it is launched, then it will likely have a different initial liquidity strategy than a coin that has just been launched and is not yet being traded anywhere.

LBank is not willing to take chances based solely on feelings or "vibes." They instead make sure to identify the entire liquidity ecosystem for a token, including where capital has been flowing into it. Then, based on that information, LBank will integrate into that ecosystem and capture that demand rather than using up resources to build an entire new liquidity ecosystem.

Cross-Chain Integration Making Multi-Network Assets Tradable

LBank is a centralized crypto exchange operating since 2015 and has served over 12 million clients across 210+ countries. With multiple licenses from the National Futures Association (NFA) and other related authorities in various jurisdictions, LBank has built a true global structure to support tokens from the most widely used blockchain networks within the United States, such as Ethereum, Binance Chain, and Solana, without the need for complex bridging procedures.

The LBank Multi-Chain Wallet Architecture (MCWA) and Multi-Chain Settlement Mechanism (MCSM) allow all of this functionality to occur seamlessly. The MCWA allows each user to safely store and transfer their assets across their corresponding home network, while MCSM gives each user the ability to deposit or withdraw money from any of the supported networks, quick and easy.

LBank's liquidity architecture allows users to access a massive pool of liquidity as needed and to facilitate smooth interactions across multiple network chains. Internal cross-chain settlements within the LBank platform provide similar functions to those offered by decentralised cross-chain decentralised exchanges (DEXs), by aggregating liquidity from multiple networks.

When a trader sends USDC to the Ethereum blockchain, they can then exchange that asset for USDT on the Solana blockchain. LBank's back-end system manages both on-chain and off-chain transactions associated with that trade and gives traders access to a single order book, regardless of where they are in the world. This gives LBank users a unified approach to trading, removing the need for solutions from completely decentralised competitors and significantly increasing the speed of transaction execution.

The EDGE Zone: Fast Listings With Guaranteed Liquidity

Lbank has launched LBANK EDGE: a new trading zone powered by both DEX data from the blockchain and AI-generated trade signals, to help identify promising early stage ventures. Not only does the EDGE zone allow for speedy token listings but it also ensures that listed tokens can actually be traded.

In addition to that, Lbank is supporting the EDGE zone with a total of $5 million in ecosystem funding and trading guarantees (meaning they provide USDT refunds for any net losses incurred while trading during the campaign periods.) This helps to mitigate the risk of getting in early on an unproven asset.

The model of the EDGE zone flips conventional thinking about liquidity at a standard exchange upside down. Instead of waiting for natural market makers to come in to provide liquidity, Lbank puts itself on the line and immediately implements algorithmic market making in order to ensure that liquidity exists within the order book right at the start. Because of this proactive approach, EDGE Zone token listings have the ability to go live within an hour in both spot and futures markets since liquidity already exists.

Maker-Taker Fee Structure and Market Maker Incentives

When trading on LBank, a trader pays a flat 0.10% (0.10% for maker and 0.10% for taker) for spot trades. For futures trades, the fees are as follows: a maker fee of 0.02% and a taker fee of 0.04%. Because of the consistency in this cost structure, it's simple for retail traders to calculate the cost of their trades, however, what most people do not realize is that behind the scenes has developed a professional liquidity provider model for retail traders that rewards volume and provides volume based discounts.

Additionally, unlike other exchanges which have VIP tiered systems, LBank provides a liquidity provider model that is not well known by the majority of retail traders but is essential to maintaining narrow spreads on new trading pairs.

LBank's order book depth is the result of building relationships with algorithmic trading firms to put capital into maintaining healthy order books for new trading pairs. As a result of using a reputable trading engine and many active retail traders support

By providing various volume incentives, co-locating order matching with algorithmic traders, and providing trader education and tools to aid in trading, the exchange enhances the user experience for both retail and institutional traders wanting to trade new tokens, mention "meme tokens", or participate in other forms of retail trading.

Leveraged Products and Liquidity Recycling on LBank

LBank offers its platform as a trading engine that offers leverage in the form of 3X long and short leveraged ETFs and 125X leverage for futures contracts, which allows traders to speculate on many different derivatives while at the same time, increasing liquidity.

As part of its business model, when a trader opens a leveraged position, the LBank matching engine will internally offset the exposure created from the opening of that position against all the other trades that were executed that day, before the rest of the trades are sent outside of the platform for hedging purposes. This creates a recycling of liquidity between the spot and derivatives markets.

The insurance fund model further stabilizes this system as LBank has separate insurance funds for each type of contract based on the leverage used. These funds are created from fees charged to profitable traders and are used to cover underwater accounts, thus preventing the chain of liquidations that would cause the order book to crash. This enables the exchange to continue to offer high levels of leverage for new tokens as well as maintaining the stability of the liquidity pool that has been created by adding new liquidity pools for new tokens.

P2P Markets and Fiat On-Ramps as Liquidity Sources

LBank's easy-to-use payment processing, with its support for more than 100 payment methods and the ability to make transactions in fiat currencies from around the globe, enables both users to convert their fiat to USDT and helps LBank manage its liquidity needs through its payment partners. The liquid assets that are deposited by users into the platform from their payment partners are then used to create liquidity pools for LBank's users to trade against.

LBank has created a P2P market whereby crypto assets are held on the platform and the users send fiat currency to each other off-line. By holding the crypto assets in escrow, LBank can establish liquidity pools and therefore collect capital from around the world, without needing to establish banking relationships with each of the countries where they operate.

Why the LBank Liquidity Architecture Works in Practice

The liquidity system of LBank operates through the view that tokens are an operational issue rather than just a marketing tool. The purpose of the 48-hour due diligence is to identify where liquidity will originate prior to the launch of the token. The multi-chain infrastructure eliminates many common issues with bridging.

The EDGE Zone provides liquidity for unproven projects. The market-making programs provide a capital commitment by professionals. Additionally, LBank uses derivatives to provide tradeable liquidity. Lastly, LBank's direct fiat-to-crypto on-ramps create new liquidity from fiat sources.

LBank states that they have the most meme liquidity and the fastest altcoin listing and trading guarantees. This statement is backed up by their historical performance such as the tokens $B (5,686% increase), $LAUNCHCOIN (15,194% increase), $DUPE (13,367% increase). These returns have generated a lot of excitement, but many people never see the underlying infrastructure that enables these returns to happen.

The reason LBank is able to have the above examples of successful token trades is not because they selected the best tokens to trade. The primary reason is that LBank has established a process which allows new tokens to be traded in large volumes right from the beginning. That process is what makes it different from other exchanges that simply list tokens and hope they create liquidity.

Disclaimer: The content created by LBank Creators represents their personal perspectives. LBank does not endorse any content on this page. Readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.