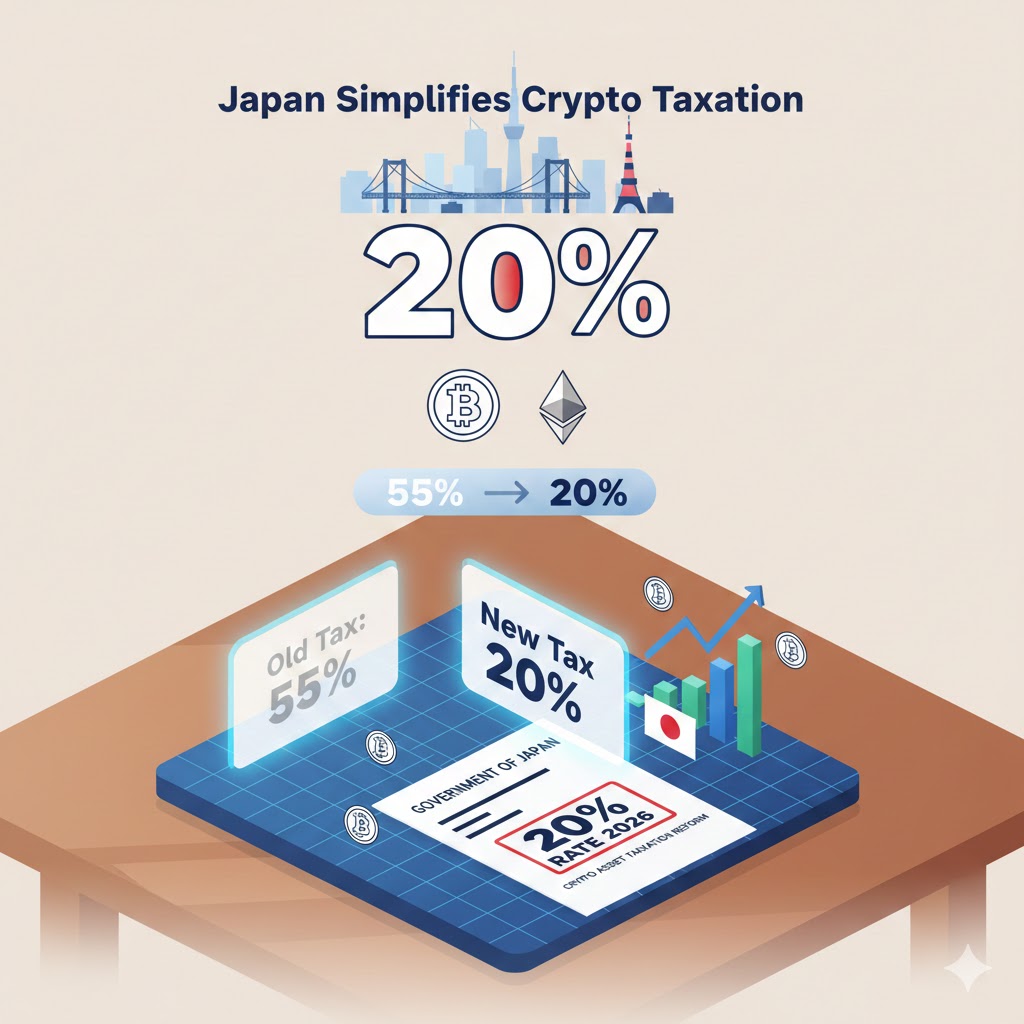

The tax overhaul rally in Japan is building behind the scheduled 2026 implementation of a flat 20% tax on cryptocurrency gains, which represents a major change in how the government will regulate digital assets. To appreciate the significance of this event, one must first examine how traders have been impacted under the existing tax system.

The Old System Was Brutal

In Japan, people who earn money through trading Bitcoin or Ethereum are taxed at the same rate as their salary tax. Since crypto is considered "miscellaneous income," you are required to pay income tax and local taxes on the same money twice, effectively increasing your taxation rate to 55%.

Think about that for a second. If you earn $10,000 in profits from trading Bitcoin or Ethereum, you could lose as much as half of that to taxes. Also, because crypto losses cannot be used to offset other income, it becomes very painful.

The law has become a barrier to entry for many traders, and those who cannot afford to relocate have had to find other opportunities in countries with more favorable tax laws. Thus, the Japanese law has not only reduced trading activity in Japan, but also forced some Japanese crypto traders to either move their operations abroad or simply sit on the sidelines as the rest of the world has continued to grow in a direction without them.

What's Actually Changing

Beginning in 2026, a proposed plan to tax all crypto earnings at 20% is funded by a proposal of $20 (20% will pay $20 regardless of whether you have a total earning of ¥100,000 or ¥10,000,000 worth of crypto income). Predictability is a big part of any taxation system. Most people would prefer not to spend time doing the Division of Division to determine where their earnings fall on the tax rate (in other words, no additional work is needed to determine what tax rate applies to them).

Secondly, this proposal would treat Crypto Currency the same way every other Security/Aggregate financial instrument would be treated under the taxation laws. While it may seem fairly inconsequential, it shows a major shift in thinking for the Japanese government. Additionally, it demonstrates that Crypto Currency has come to be viewed as an actual currency, rather than just an alternative to cash used to evade taxes.

Lastly, the introduction of a transparent framework around the taxation of crypto assets signals that businesses and individuals who invest in Crypto Currency will be able to make more informed decisions. Investors want this kind of clarity, so when a country as large as Japan establishes a fair and consistent, rule-based tax system, it eliminates uncertainty, thereby increasing investor confidence.

Why This Sparked a Rally

There is a simple truth; markets, including cryptocurrencies, are driven by certainty.

The Japanese exchanges reported an immediate increase in trading activity following the disclosure of regulatory reforms. This led to a surge in Bitcoin and Ethereum prices, with a corresponding increase in demand from U.S. based traders. Traders and businesses alike have had their fears alleviated and are now able to take action without the worry of having to deal with unpredictable regulations.

The newly established environment makes it easier for traders to cash out, as they will pay less tax. The way that traders view this new environment will encourage traders to take action.

For the institutional participants in the market, it gives them much clearer guidance regarding taxes; therefore, companies that were not willing to invest in crypto, because of the uncertainty created by the complex tax systems, may start to consider entering the market. The ecosystem will benefit from a greater variety of participants and increased activity.

What It Means for Japan's Crypto Scene

Japan has been a leading player in the world of crypto for many years. It was one of the first countries to recognize Bitcoin as a legitimate method of payment in 2017, and has a vibrant crypto economy not only with major exchanges, but also a great deal of interest in digital innovation.

The problem for Japan has been an overly-regulated and restrictive environment. The previous taxation structure was only part of the problem, as there are also very strict licensing requirements, intensive oversight of operations, and continual pressure from regulators to comply with all requirements.

The new tax framework demonstrates that Japan is ready for expansion. The tech talent found in Japan is extremely strong and has created a solid foundation for growth and success in areas such as gaming, digital infrastructure, and financial technology. If the regulatory environment can become more conducive to development, Japan has a tremendous opportunity to become one of the major cryptocurrency hubs in Asia, not only in terms of trading, but also in development, innovation, and institutional adoption.

In many ways, the 20% flat rate tax on profits received from crypto-assets is not particularly low. Many jurisdictions impose little or no taxes on profits derived from digital currencies. Japan does not want to be perceived as a tax haven; rather, it wants to establish itself as a mature and trustworthy market, with clearly defined laws and regulations, which is a better alternative than having the lowest taxation rates in unstable environments.

The Bigger Picture

How do these developments affect other countries?

When large nations recognize Crypto as a valid type of asset and create logical Tax legislation to regulate it, the overall conversation about Crypto on an international level will be altered. Countries that are still developing their cryptocurrency laws will likely be tracking this closely. If Japan's initiative is successful, and leads to an increase in Revenue, more Trading Activity, along with Crypto being better incorporated into the Global Financial System, then it follows that other Nations will now be inclined to replicate what Japan did.

The changing of Laws and Regulations in the past few years has created a Double-Edged Sword. When Regulations make the cultivation of money within the Crypto Space difficult at best for Investors, then Capital and Talent will leave. Nations that create Combination Laws and Opportunities are likely to thrive, as is evidenced by the things that Japan has put into play.

Additionally, there are competitive factors involved. Countries such as South Korea, Singapore, and Hong Kong are all waiting to see who will rise to be the Cryptocurrency Capital of the Asia-Pacific region. In recent years, Japan has lagged behind a bit due in part to its higher taxes, and Japan's recent efforts to change its tax rates allows Japan to once again be in contention.

What Happens Next

The 20% rate starts in 2026, which provides plenty of time to develop the necessary legislation, implementation rules, and updates to reporting for exchange operations. However, it is clear that a clear pathway is forming. As lessening taxes become a reality, it is likely that more and more crypto projects will not only consider Japan as an option, but probably eventually relocate there.

In addition, because of the 20% tax rate, Japanese crypto users are expected to have easier access to projects that will potentially generate revenues without experiencing the weight of tax consequences that is so often associated with these endeavors. Overall, this will create a safer environment for many crypto investors.

Final Thoughts

Tax reform does not usually garner excitement among the general public; however, when it comes to cryptocurrency, regulatory changes can have an immense impact. Japan's recent legislation establishing a flat 20 percent income tax on cryptocurrencies represents more than just a set of numbers; it conveys a clear message of welcome, equity, and a supportive environment for digital currencies.

This rise in the price of many altcoins is being driven not only by reduced taxation but also by the belief that Japan is taking steps to include cryptocurrencies within its broader economic landscape with transparency and safety.

Will 2026 see the beginning of a renaissance for cryptocurrency in Japan? Only time will reveal the answer, but it has become increasingly apparent that Japan was held back by its former approach to cryptocurrency regulation and has now made a tremendous leap toward enabling cryptocurrency growth and acceptance. Those with an interest in cryptocurrency should take note of the increased opportunities arising out of this development in Japan.