In the cryptocurrency markets, not all price movements are organic. Behind many dramatic price swings and confusing market behaviours are the actions of "whales"—individuals or entities holding massive amounts of cryptocurrency who can single-handedly influence market prices.

Understanding how these whales operate and learning to spot their manipulation tactics is crucial for protecting your capital and potentially profiting from their moves. This comprehensive guide will expose the most common manipulation strategies and teach you how to recognise them in real-time.

Who Are Crypto Whales and Why They Matter?

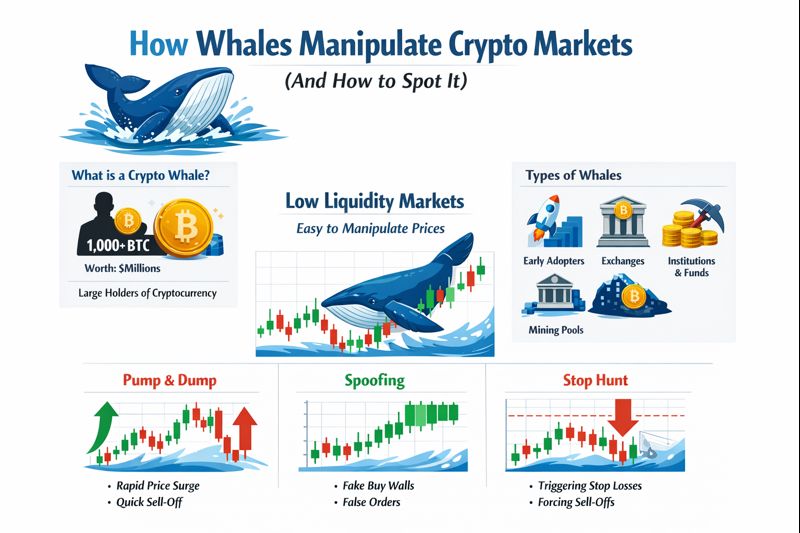

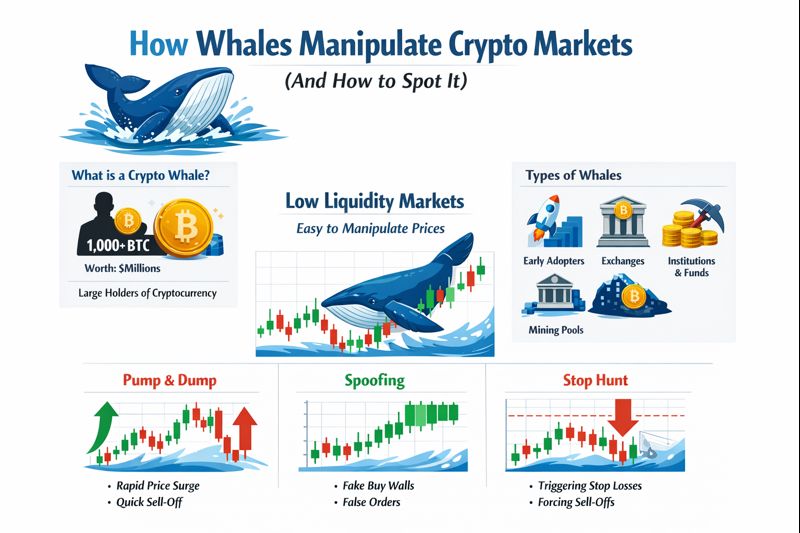

Crypto whales are individuals, institutions, or entities that hold huge amounts of cryptocurrency. The term "whale" comes from their ability to make waves in the market with their trading activity, just as a whale creates waves in the ocean.

The threshold for being considered a whale varies by cryptocurrency. For Bitcoin, holding 1,000 BTC or more (worth tens of millions of dollars) typically qualifies someone as a whale. For smaller market cap altcoins, holding even a few percentage points of the total supply can give you whale status.

Whales come in various forms, including early cryptocurrency adopters who accumulated large positions when prices were low, cryptocurrency exchanges holding customer funds, institutional investors and hedge funds, cryptocurrency project founders and development teams, and mining pools with substantial accumulated holdings.

What makes whales particularly powerful in cryptocurrency markets is the relatively low liquidity compared to traditional financial markets. A whale executing a large trade can significantly impact the price, and sophisticated whales know exactly how to exploit this dynamic to their advantage.

Image source: by Author

Why Crypto Whales Manipulate Market Prices

Understanding the motivations behind whale manipulation helps you anticipate their behaviour and protect yourself from their tactics.

The primary motivation is profit through accumulation and distribution. Whales want to accumulate large positions at the lowest possible prices and distribute them at the highest possible prices. To achieve this, they need to manipulate retail traders into selling low and buying high—the opposite of what leads to profitable trading.

Whales also manipulate markets to trigger stop losses and liquidations. By pushing prices to specific levels where they know many stop losses are clustered, they can trigger a cascade of forced selling that drives prices even lower, allowing them to buy at better prices.

Some whales manipulate to defend their existing positions. If a whale holds a large long position, they may engage in tactics that push prices higher to prevent liquidation or to exit profitably. Conversely, whales with short positions benefit from driving prices downward.

Market makers and trading firms manipulate to profit from the bid-ask spread and from retail traders' predictable emotional reactions to price movements. They create volatility that allows them to buy low and sell high repeatedly throughout the day.

Common Crypto Whale Manipulation Tactics Explained

Recognising these manipulation patterns is your first line of defence against falling victim to whale tactics.

Spoofing and Layering

Spoofing involves placing large buy or sell orders with no intention of executing them. The whale places a massive buy order far below the current market price or a massive sell order far above it. This creates the illusion of strong support or resistance at that level.

Retail traders view this large order as a sign of genuine market sentiment. They adjust their trading accordingly, buying because they think there's strong support below or selling because they see heavy resistance above. Once enough traders have reacted, the whale cancels the fake order and trades in the opposite direction.

Layering is a more sophisticated version where whales place multiple large orders at different price levels to create the appearance of market depth that doesn't actually exist. You can spot spoofing by watching the order book carefully. Spoofed orders often appear suddenly, are unusually large compared to typical market activity, remain at the same price level without adjustment as the market moves, and disappear quickly without being filled when the price approaches them.

Wash Trading

Wash trading involves a whale simultaneously buying and selling the same asset, often using multiple accounts, to create artificial trading volume and the illusion of market activity.

High volume attracts retail traders who assume increased volume indicates genuine interest and an impending price move. Traders enter positions based on this false signal, while the whale has already positioned themselves to profit from the subsequent real volume that retail traders provide.

Identifying wash trading requires looking for unusually high volume without corresponding price movement, repetitive trading patterns at specific times or price levels, volume spikes that don't align with news or market events, and trades that occur at prices slightly worse than the best available, which real traders would avoid.

Pump and Dump Schemes

This is perhaps the most notorious form of market manipulation, particularly common in low market cap altcoins. The whale accumulates a large position in a thinly traded cryptocurrency at low prices. They then artificially inflate the price through coordinated buying, often while simultaneously promoting the asset through social media, influencers, or even fake news.

As the price rises and retail traders notice the movement, FOMO kicks in, and they buy at elevated prices. Once the price has been sufficiently pumped and retail participation is high, the whale dumps their entire position, causing the price to crash and leaving retail traders with heavy losses.

Warning signs of pump and dump schemes include sudden, unexplained price spikes in low-volume coins, aggressive promotional campaigns on social media and forums, promises of guaranteed returns or "insider information," pressure to buy quickly before missing out, and a lack of fundamental news or developments justifying the price increase.

Stop Loss Hunting

Whales know that retail traders cluster their stop losses at predictable levels like round numbers, recent support or resistance levels, and just below key technical indicators. Whales intentionally push the price to these levels to trigger the stop losses, creating a cascade of selling that drives prices even lower.

Once the stops are triggered and retail traders are forced out of their positions, often at a loss, the whale buys at these artificially depressed prices. The price then often recovers quickly, leaving the stopped-out traders watching in frustration.

You can recognise stop loss hunting through sudden, sharp price movements that spike through support levels, immediate price recovery after the spike, often within minutes, high volume during the spike but lower volume during recovery, and price wicks on candlestick charts showing brief excursions followed by quick reversals.

Bear Raids and Bull Traps

A bear raid occurs when whales aggressively short an asset or sell large quantities to drive the price down rapidly, creating panic among retail holders. As fear spreads and retail traders sell in panic, the whale buys back at lower prices, sometimes even taking profits on their short positions.

A bull trap is the opposite—whales push prices higher to attract buyers, creating the illusion of a breakout. Retail traders pile in, expecting continued upside, but the whale then sells into this buying pressure, causing the price to reverse and trap the late buyers at high prices.

These traps are characterised by sudden, strong directional moves that reverse quickly, social media sentiment that becomes extremely bullish or bearish right before the reversal, and breakouts that fail to sustain above resistance or breakdowns that quickly recover above support.

Painting the Tape

Painting the tape involves executing a series of trades designed to create a specific appearance on the price chart. Whales might create bullish candlestick patterns at support levels to encourage buying, paint the chart to look like a continuation pattern is forming, or create the appearance of strong buying or selling pressure where none genuinely exists.

This manipulation targets traders who rely heavily on technical analysis, causing them to make decisions based on what appears to be legitimate price action but is actually manufactured.

Image source: by Author

How to Spot Crypto Whale Activity in Real Time

Developing the ability to recognise whale manipulation as it happens can save you from losses and potentially allow you to profit alongside the whales.

Monitoring Order Book Anomalies

The order book shows all pending buy and sell orders. Watch for walls, which are unusually large orders that appear suddenly, orders that move dynamically, being placed and cancelled repeatedly to create an illusion, imbalanced order books where one side suddenly becomes much heavier than normal, and the sudden disappearance of large orders as the price approaches them.

Legitimate large orders typically remain in place and get filled, while spoofed orders vanish before execution.

Analyzing Volume Patterns

Volume tells you how much trading activity is occurring. Suspicious volume patterns include volume spikes without corresponding price movement, suggesting wash trading, decreasing volume during price rallies, indicating a lack of genuine buying interest, increasing volume during sell-offs, suggesting forced liquidations or capitulation, and unusual volume at odd hours when most retail traders aren't active.

Compare current volume to historical averages for the same time of day and day of week. Significant deviations warrant scrutiny.

Watching Price Action Characteristics

Certain price movements are hallmarks of manipulation. Be alert for sudden vertical price movements up or down with little consolidation, V-shaped recoveries where price drops sharply then immediately recovers, failed breakouts that reverse quickly after triggering stops, and coordinated movements across multiple related assets suggesting organised manipulation.

Natural price discovery tends to be messier and more gradual, with consolidation periods and multiple tests of key levels.

Social Media and Sentiment Analysis

Whales often coordinate with or influence social media to support their manipulation. Red flags include sudden surges in coordinated positive or negative messaging, influencers simultaneously promoting the same narrative or asset, emotional language designed to trigger fear or greed, and claims of insider information or guaranteed profits.

When social media sentiment becomes extremely one-sided, especially if it happens suddenly, be sceptical and consider that manipulation may be underway.

Exchange Data and Whale Alerts

Several services track large transactions and whale movements. Follow whale alert services that track large transfers to and from exchanges. Large amounts moving to exchanges often precede selling, while large amounts moving to private wallets suggest accumulation for holding.

Monitor exchange inflow and outflow data, as unusual patterns can signal whale positioning. Check the distribution of holdings for the cryptocurrency you're trading, as high concentration in a few wallets indicates greater manipulation potential.

Image source: by Author

How to Protect Yourself From Crypto Whale Manipulation

Awareness alone isn't enough—you need practical strategies to protect your capital from manipulative tactics.

Avoid Predictable Stop Loss Placement

Don't place stop losses at obvious levels where whales hunt. Avoid round numbers like $50,000 for Bitcoin, obvious support and resistance levels visible on any chart, and just below recent lows or above recent highs.

Instead, place stops at less obvious levels based on your analysis, use mental stops instead of placing them in the order book where they're visible, or use time-based stops where you exit if your thesis doesn't play out within a specific timeframe.

Trade Higher Liquidity Assets

Manipulation is easier in thinly traded markets. Stick to major cryptocurrencies with high daily volume, as they're harder to manipulate. Avoid very low market cap altcoins unless you're specifically looking for high-risk, high-reward opportunities and understand the manipulation risks.

On LBank, focus on the most actively traded pairs where whale influence is diluted by overall market volume.

Use Limit Orders Strategically

Market orders are visible and vulnerable to manipulation. Limit orders give you control over your execution price and make you less susceptible to sudden price spikes or drops designed to trigger market orders at unfavourable prices.

Place limit orders at prices where you genuinely want to enter or exit, not where you feel pressured by FOMO or fear.

Verify Volume Legitimacy

Before trading based on volume signals, verify that the volume is legitimate. Check if volume is consistent across multiple exchanges, as wash trading is usually isolated. Look for corresponding social media activity and news that would justify the volume. Analyse whether the volume profile matches historical patterns for the asset.

Legitimate volume surges typically have clear catalysts and occur across multiple platforms simultaneously.

Maintain Emotional Discipline

Manipulation works by triggering emotional responses. Develop and stick to a trading plan regardless of dramatic price movements. Avoid FOMO—if you missed a move, there will be others. Don't panic sell during sudden drops if your fundamental thesis remains intact.

Take breaks from watching charts during high volatility to maintain perspective. Whales profit from your emotional decisions. Staying calm and rational is your greatest defence.

Diversify Your Holdings

Don't concentrate all your capital in assets susceptible to manipulation. Spread risk across multiple cryptocurrencies and asset classes. Keep a portion in stablecoins for opportunities and capital preservation. Consider holding positions on multiple exchanges to reduce counterparty risk.

Diversification limits the damage any single manipulation event can cause to your portfolio.

How Traders Can Profit From Whale Behavior

Once you can identify whale behaviour, you might be able to position yourself to profit alongside them rather than being their victim.

Following Smart Money

When you identify an accumulation by whales, consider joining them. Look for large wallet addresses accumulating during market fear and panic. Monitor exchange outflows, indicating whales are removing assets to hold long-term. Watch for whales buying during stop loss hunts when retail traders are forced out.

The key is distinguishing between whales positioning for profit versus whales distributing to exit positions.

Fading Extreme Moves

When you identify clear manipulation like a stop loss hunt or bear raid, consider taking the opposite position once the manipulation completes. If price spikes down to hunt stops, then quickly recovers, buy the recovery. If the price pumps to create a bull trap, then fails, short the breakdown.

This strategy requires quick identification and execution, as well as tight risk management.

Avoiding the Trap

Sometimes the best profit is the loss you avoid. If you identify a pump and dump beginning, resist the temptation to participate. If you recognise a bull or bear trap forming, stay out even if the move looks compelling. When manipulation is evident but you can't determine the whale's ultimate goal, preserve capital by staying in cash.

Not losing money is often more valuable than making money, as it preserves your capital for better opportunities.

Ethical Considerations and the Health of Crypto Markets

While this guide teaches you to recognise and potentially profit from manipulation, it's worth considering the broader implications.

Market manipulation harms the cryptocurrency ecosystem by eroding trust, discouraging new participants, reducing market efficiency, and potentially inviting regulatory crackdowns that harm everyone.

As a trader, you can contribute to healthier markets by not participating in obvious manipulation schemes, sharing knowledge about manipulation tactics with other traders, supporting exchanges that actively combat manipulation, and advocating for better market surveillance and enforcement.

The long-term success of cryptocurrency markets depends on fairness and transparency. While protecting yourself from manipulation is necessary, actively participating in it is ultimately self-defeating for the entire ecosystem.

Final Takeaways on Crypto Whale Manipulation

Whale manipulation is an unfortunate reality in cryptocurrency markets, particularly in smaller-cap assets and during periods of low liquidity. These powerful market participants use sophisticated tactics like spoofing, wash trading, pump and dumps, stop loss hunting, and various other schemes to extract profits from retail traders.

However, manipulation is not invisible. By understanding the tactics whales use, monitoring order books and volume patterns, recognising suspicious price action, and maintaining emotional discipline, you can protect yourself from becoming whale food. Even better, you can potentially position yourself to profit alongside these market movers rather than being victimised by them.

The key is developing a critical eye for market movements on LBank and other platforms. Not every price spike is a genuine breakout, not every volume surge indicates real interest, and not every sell-off reflects fundamental problems. Many of these movements are manufactured by whales for their own profit.

Stay informed, stay sceptical, and most importantly, stay disciplined. The whales may be powerful, but an educated, patient trader who refuses to be manipulated can navigate these waters successfully and emerge profitable over the long term.