Futures trading has become one of the most popular ways to participate in cryptocurrency markets, offering traders the opportunity to profit from both rising and falling prices while using leverage to amplify their positions.

However, futures trading also comes with higher risk. Leverage can amplify gains, but it can just as easily magnify losses. For beginners, understanding how futures work before placing a single trade is essential.

This guide breaks down futures trading step by step, explaining key concepts, risks, tools, and best practices so complete beginners can get started with clarity and confidence.

What is Futures Trading?

Futures trading involves buying or selling contracts that represent an agreement to trade an asset at a predetermined price on a specific future date.

In cryptocurrency futures, you're not actually buying the underlying cryptocurrency. Instead, you're speculating on whether the price will go up or down.

The key difference between spot trading and futures trading is that futures allow you to open positions with leverage, meaning you can control a larger position with a smaller amount of capital.

For example, with 10x leverage, you can control $10,000 worth of Bitcoin with just $1,000 of your own money.

Instead of owning Bitcoin, Ethereum, or another cryptocurrency, you trade a contract that tracks the price of that asset. Your profit or loss depends on how the price moves relative to your entry point.

There are two basic positions in futures trading:

- Long: You profit if the price goes up

- Short: You profit if the price goes down

This ability to hedge is one of the main reasons traders use futures, especially during bearish market conditions.

Spot Trading vs Futures Trading

Understanding the difference between spot and futures trading is critical before you begin.

In spot trading, you buy an asset outright. If you buy Bitcoin at $40,000 and the price rises to $45,000, your profit is the difference. If the price falls, you hold the asset until it recovers or sell at a loss.

In futures trading, you are trading price movements using contracts. You can use leverage to control a larger position with less capital, but this increases risk.

Key differences include:

- Futures allow leverage; spot does not

- Futures allow short selling; spot generally does not

- Futures have liquidation risk; spot does not

For beginners, futures trading requires stricter risk management than spot trading.

Understanding Key Futures Trading Concepts

Before diving into futures trading, you need to understand several fundamental concepts that will form the foundation of your trading knowledge.

Leverage is the ability to control a larger position than your actual capital would normally allow. While leverage can amplify your profits, it also magnifies your losses. Most platforms offer leverage ranging from 2x to 125x, though beginners should start with much lower leverage levels.

Margin is the amount of capital you need to open and maintain a leveraged position. There are two types: initial margin, which is the amount required to open a position, and maintenance margin, which is the minimum amount needed to keep the position open.

Long and Short Positions represent the two directions you can trade. Going long means you're betting the price will increase, while going short means you're betting the price will decrease. This flexibility to profit from falling markets is one of the major advantages of futures trading.

Liquidation occurs when your position is automatically closed because your losses have depleted your margin to the maintenance level. This is one of the biggest risks in futures trading, and why proper risk management is essential.

Funding Rates are periodic payments exchanged between long and short position holders. When the funding rate is positive, long positions pay short positions, and vice versa. These rates help keep futures prices aligned with spot market prices.

Understanding Leverage

Leverage is one of the most misunderstood aspects of futures trading. It allows you to open a position larger than your actual capital.

For example:

- With 10x leverage, $100 controls a $1,000 position

- With 20x leverage, $100 controls a $2,000 position

While leverage increases potential profits, it also reduces the margin for error. A small price movement against your position can result in liquidation, the automatic closure of your trade to prevent further losses.

Beginners are strongly advised to start with low leverage, such as 2x or 3x, until they fully understand how price movements affect their positions.

Margin and Liquidation Explained

When you open a futures position, you provide margin, which acts as collateral for the trade.

There are two common margin types:

- Isolated margin: Risk is limited to the margin allocated to a single position

- Cross margin: Your entire account balance supports open positions

For beginners, an isolated margin is safer because it prevents a losing trade from wiping out your entire account.

Liquidation occurs when your margin can no longer support your position due to adverse price movement. Once liquidated, the position is closed automatically, and you lose the margin used. Understanding the liquidation price before entering a trade is essential.

Perpetual Contracts and Funding Rates

Most crypto futures are perpetual contracts. Since they do not expire, exchanges use a mechanism called the funding rate to keep contract prices aligned with the spot market.

Funding rates are periodic payments exchanged between traders:

- If the funding rate is positive, long traders pay short traders

- If negative, short traders pay long traders

Funding rates vary depending on market conditions and can affect long-term positions, especially for traders holding trades over extended periods.

How to Start Futures Trading Step by Step

1. Learn the Basics Thoroughly

Before trading real funds, understand how leverage, margin, liquidation, and funding rates work. Futures trading is not suitable for guesswork.

2. Choose a Reputable Exchange

Select a platform that offers strong liquidity, clear fee structures, and robust risk controls. Security, transparency, and educational resources should be priorities.

3. Start With a Small Amount

Only trade with capital you can afford to lose. Many beginners make the mistake of overfunding their first trades.

4. Use Low Leverage

High leverage is not necessary to be profitable. Low leverage allows room for price fluctuations without immediate liquidation.

5. Trade Liquid Markets

Stick to high-volume pairs such as BTC/USDT or ETH/USDT. These markets have tighter spreads and more predictable behaviour.

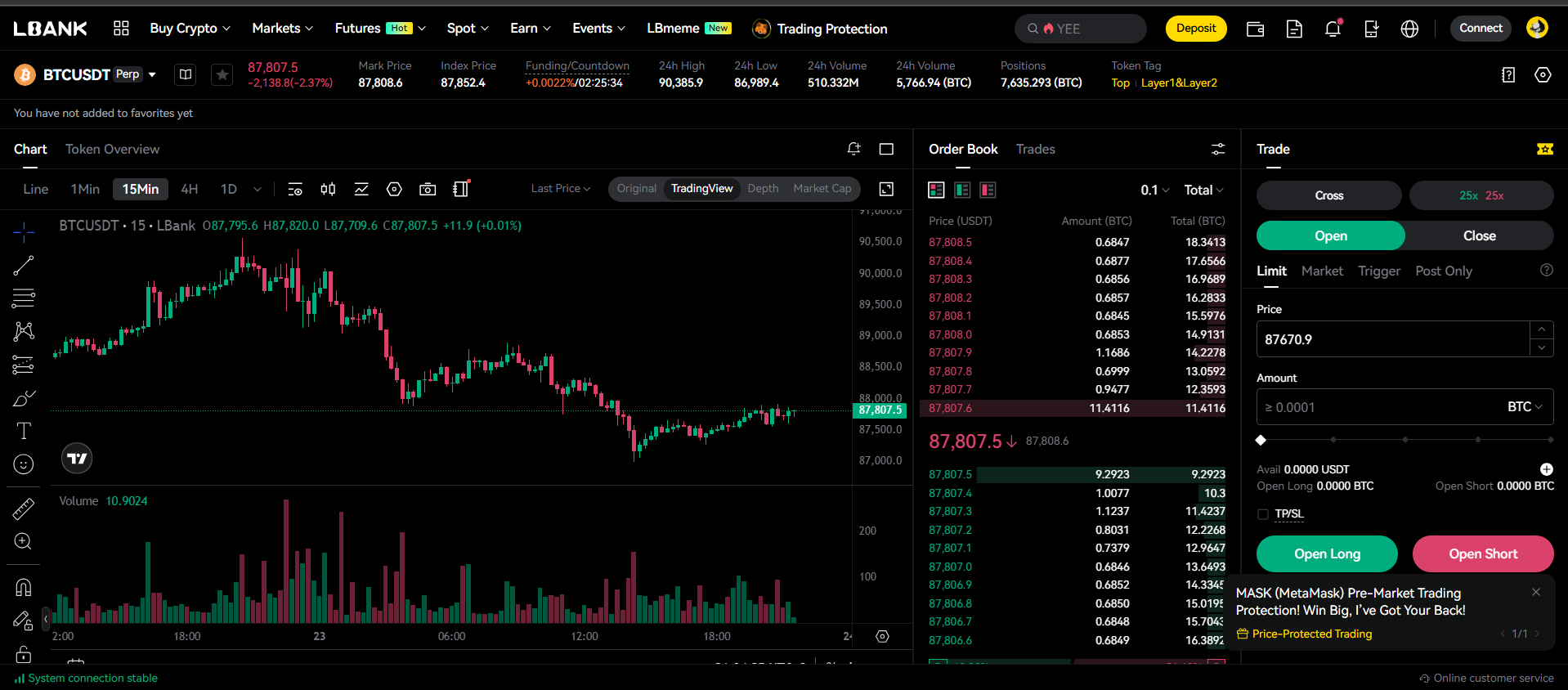

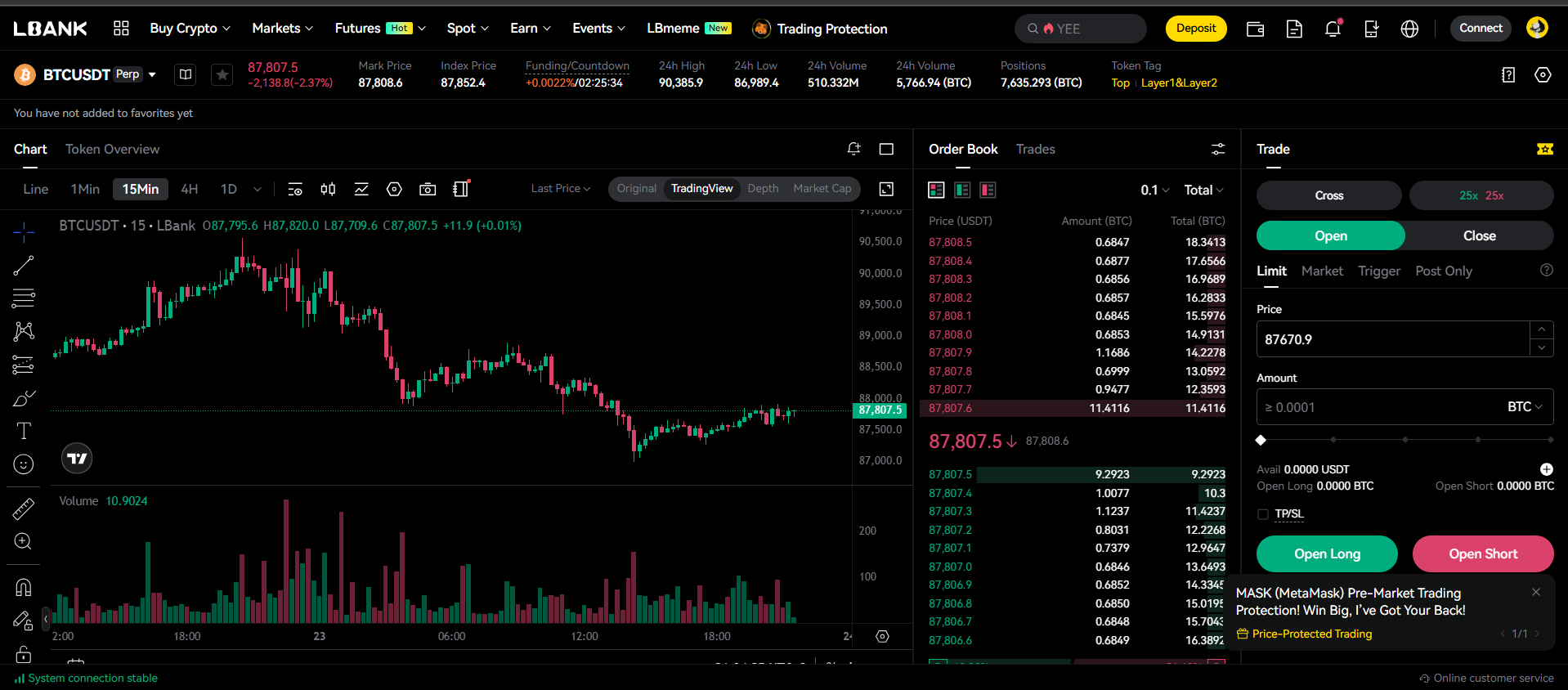

Setting Up Your Futures Trading Account

Getting started with futures trading on LBank is straightforward. First, you'll need to create an account if you haven't already. Complete the registration process and verify your identity according to the platform's requirements. This verification process is important for security and compliance purposes.

Once your account is set up, navigate to the Futures section of the platform. You'll need to transfer funds from your spot wallet to your futures wallet. This separation helps you manage risk by keeping your trading capital separate from your long-term holdings.

Before making your first trade, take time to familiarise yourself with the trading interface. Understand where to find the order book, price charts, your open positions, and your account balance.

Most platforms, including LBank, offer a demo or testnet mode where you can practice trading with virtual funds. This is an invaluable tool for beginners to learn without risking real money.

Developing Your Trading Strategy

Successful futures trading requires more than just knowing how to place orders. You need a solid strategy that guides your decision-making process. There are several approaches you can consider as a beginner.

Trend Following is one of the most straightforward strategies for beginners. This involves identifying the direction of the market trend and trading in that direction. You go long in uptrends and short in downtrends. The key is learning to identify trends using technical indicators like moving averages and trend lines.

Range Trading works well in sideways markets where prices bounce between support and resistance levels. Traders buy near support and sell near resistance, or vice versa for short positions.

Support and Resistance help you identify price levels where the market historically reacts. These zones help define entries, exits, and stop placements.

Breakout Trading focuses on entering positions when prices break through significant support or resistance levels, often accompanied by increased volume. These breakouts can lead to strong directional moves.

Regardless of which strategy you choose, it's essential to backtest your approach using historical data and practice it thoroughly before committing real capital.

Essential Risk Management Techniques

Risk management is perhaps the most critical aspect of futures trading, especially for beginners. More traders fail due to poor risk management than poor market analysis.

The first rule is to never risk more than you can afford to lose. A common guideline is to risk no more than 1-2% of your trading capital on any single trade. This means if you have $10,000 in your futures account, you should risk no more than $100-$200 per trade.

Always use stop-loss orders. A stop-loss automatically closes your position if the price moves against you by a specified amount. This prevents small losses from becoming catastrophic ones. Your stop-loss placement should be based on your analysis, not arbitrary percentages.

Start with low leverage. While platforms may offer up to 125x leverage, beginners should start with 2x-5x leverage at most. Higher leverage might seem attractive because of the potential for larger profits, but it also means you can be liquidated much faster when the market moves against you.

Position sizing is equally important. Don't put all your capital into a single trade, no matter how confident you feel. Diversifying across multiple positions or keeping reserve capital helps you weather losing streaks and take advantage of new opportunities.

Technical Analysis for Futures Trading

Technical analysis is the study of price charts and patterns to predict future price movements. While it's not foolproof, it provides traders with a framework for making informed decisions.

Start by learning to read candlestick charts, which display opening, closing, high, and low prices for specific time periods. Understanding candlestick patterns like doji, hammer, and engulfing patterns can provide insights into market sentiment.

Key technical indicators to learn include Moving Averages, which smooth out price data to identify trends; the Relative Strength Index (RSI), which measures momentum and identifies overbought or oversold conditions; and MACD (Moving Average Convergence Divergence), which shows the relationship between two moving averages.

Support and resistance levels are price points where the market has historically had difficulty moving above or below. These levels often act as turning points and are crucial for setting entry and exit points.

Common Mistakes to Avoid

Many beginners make similar mistakes when starting futures trading. Being aware of these pitfalls can help you avoid them.

Overleveraging is the number one killer of trading accounts. The temptation to use maximum leverage to make quick profits is strong, but it usually leads to rapid losses and liquidation.

Trading without a plan leads to emotional decision-making. Every trade you enter should have a clear rationale, including entry price, target profit, and stop-loss level determined before you place the order.

Revenge trading happens when you try to immediately recover losses by taking larger, riskier positions. This emotional response typically leads to even bigger losses.

Ignoring funding rates can eat into your profits, especially if you hold positions for extended periods. Always be aware of the funding rates for your positions.

Failing to keep a trading journal prevents you from learning from your mistakes and successes. Record every trade with your reasoning, outcome, and lessons learned.

Starting Your Futures Trading Journey

Now that you understand the fundamentals, you're ready to take your first steps into futures trading. Begin by opening small positions with low leverage. Focus on learning and gaining experience rather than making large profits immediately.

Set realistic expectations. Most professional traders consider themselves successful if they're profitable 50-60% of the time. Your goal initially should be to preserve capital and develop your skills, not to get rich quickly.

Continue educating yourself by reading trading books, following market analysis, and staying updated on cryptocurrency news that might affect prices. The markets are constantly evolving, and successful traders are lifelong learners.

Consider joining trading communities where you can discuss strategies and learn from more experienced traders, but always do your own analysis before taking any trade.

Conclusion

Futures trading offers exciting opportunities for cryptocurrency traders willing to put in the time to learn and develop their skills. While the profit potential is significant, so are the risks.

By starting with a solid understanding of the fundamentals, practising proper risk management, developing a clear trading strategy, and learning from both successes and failures, you can work toward becoming a successful futures trader.

Remember that consistency and discipline are more important than trying to hit home runs on every trade. Start small, stay patient, and let your skills and confidence grow organically. The journey to becoming a proficient futures trader takes time, but with dedication and the right approach, you can navigate the markets successfully on LBank's futures platform.