Ethereum is at a crossroads right now. The second-largest cryptocurrency by market cap closed Monday at around $3,100, holding above a key trendline that's been supporting the price for weeks.

But there's a problem—ETH keeps running into a wall at around $3,150, and whether it breaks through or bounces back could determine where the price goes next.

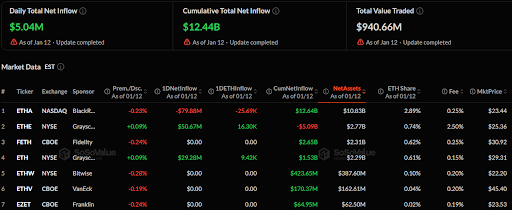

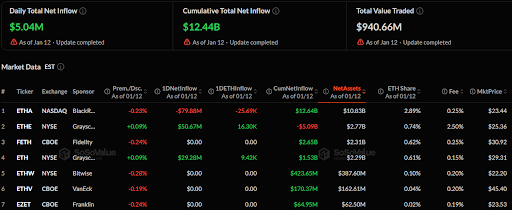

ETF Flows Turn Positive After Three-Day Drought

Spot Ethereum ETFs saw $5.04 million in net inflows on Monday, ending a three-day streak of money flowing out.

Image via SoSoValue

This might not sound like much compared to Bitcoin's $117 million in inflows the same day, but the direction matters more than the size.

BlackRock's ETHA fund actually lost $79.9 million, which was a surprise given that it's usually one of the steadier performers. But other players stepped up. Grayscale's two products brought in a combined $80 million, while 21Shares added $5 million.

The rest of the major funds—Fidelity, Bitwise, VanEck, and a few others—saw zero movement.

The total net assets across all Ethereum ETFs now sit at $18.88 billion, representing over 5% of ETH's entire market cap.

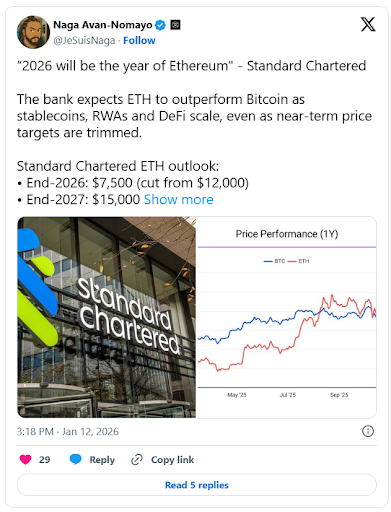

Looking Beyond 2026 With Bold Long-Term Forecast

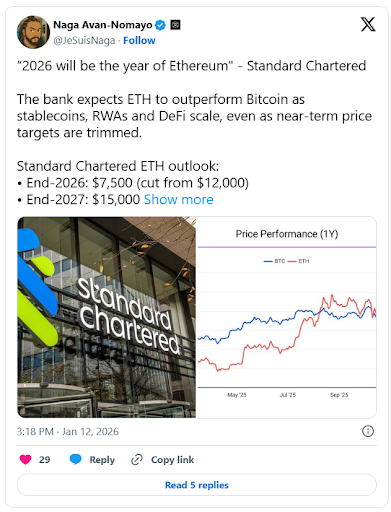

Standard Chartered recently updated their Ethereum price targets, and the numbers are eye-catching. The bank now sees ETH hitting $7,500 by the end of 2026—down from their previous $12,000 estimate—but they've added a new long-range target of $40,000 by 2030.

Image via X

Their reasoning focuses on Ethereum's role in the broader crypto ecosystem. The network processes the majority of stablecoin transactions, hosts most tokenized real-world assets, and remains the foundation for decentralized finance.

They're betting on planned upgrades that should boost transaction capacity by about 10 times over the next few years.

Popular market analyst Geoff Kendrick specifically called 2026 "the year of Ethereum, much like 2021 was." This suggests the network's relative performance against Bitcoin could improve as these technical improvements roll out.

Between corporate treasuries and ETF holdings, more Ethereum is getting locked up in long-term storage, which naturally limits the supply available for trading.

Regulatory developments could also play a role in Ethereum's performance this year. Kendrick mentioned the US CLARITY Act as potentially supportive for DeFi activity, with the Senate scheduled to review the bill on January 15 and possible passage coming in the first quarter.

Network Fundamentals and Future Challenges

Beyond price action and ETF flows, Ethereum co-founder Vitalik Buterin recently outlined what he sees as critical requirements for the network's long-term survival.

He emphasized that Ethereum needs to reach a point where its core value proposition remains intact even if active development were to stop tomorrow. Think of it like a hammer—once you buy one, it works forever without needing constant updates from the manufacturer.

Image via X

Buterin laid out seven key areas that need work, including:

- Full quantum resistance to protect against future cryptographic threats

- Scalable architecture through technologies like zero-knowledge proofs

- Block-building model that resists centralization pressures

His goal is for Ethereum to reach a state where the protocol is "cryptographically safe for a hundred years" and most future innovation happens through optimization rather than fundamental changes.

This technical roadmap matters because it addresses the blockchain trilemma that has long forced projects to sacrifice either decentralization, security, or scalability.

If Ethereum can deliver on these upgrades over the next few years, it would strengthen the case for those ambitious long-term price targets.

The Takeaway

The immediate trading environment remains somewhat uncertain. ETH is holding above support but facing resistance. ETF flows just turned positive after a rough stretch, and the broader crypto market is dealing with concerns about Federal Reserve policy.

The next week or two should provide more clarity about whether Ethereum is ready to make another push higher or needs more time to build momentum.

ETH Statistics Data

ETH Price: $3143

ETH Market Cap: $379B

ETH Circulating Supply: 120.69M

ETH Total Supply: ∞

ETH Market Ranking: #2