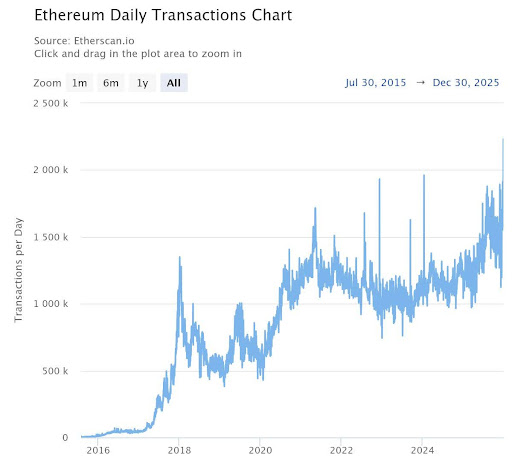

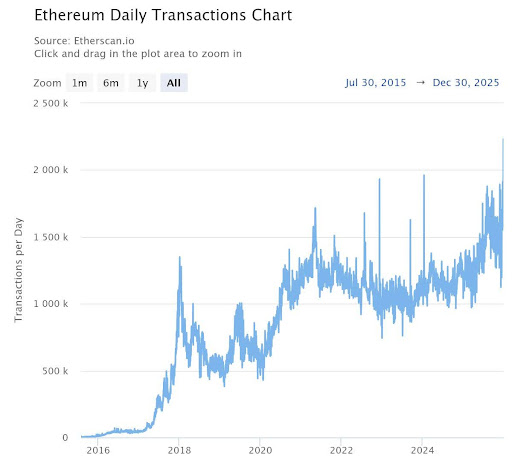

Ethereum wrapped up December 2025 with some unusual activity that has the crypto community talking. While ETH price stayed stuck around $3,000, the network saw transaction volumes hit levels not seen in years.

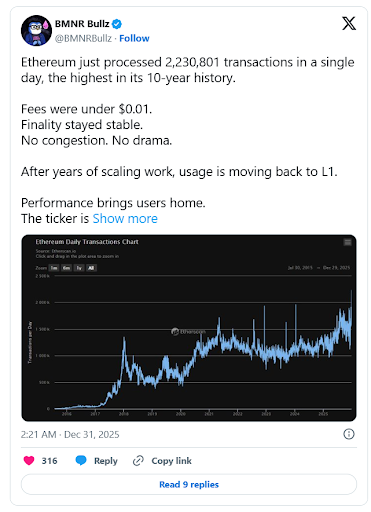

On December 31, 2025, Ethereum processed over 2.2 million transactions in a single day—the highest number in the network's entire history.

Image via Etherscan

This massive spike happened even as ETH corrected from above $4,500 a few months ago down to around $2,900, creating an interesting disconnect between price and actual network usage.

What makes this even more notable is that fees stayed incredibly low, under $0.01 per transaction, while the network maintained stable finality with no congestion issues.

Image via X

This suggests the years of scaling work are finally paying off, bringing users back to the main layer-1 network.

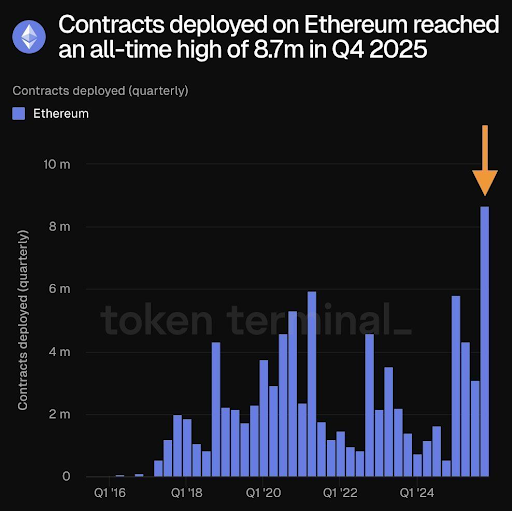

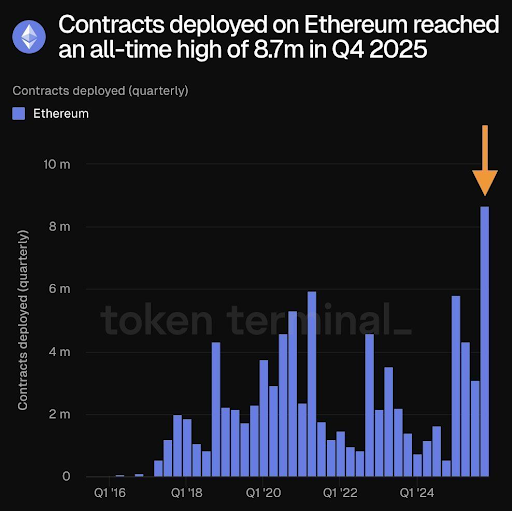

Smart Contract Deployments Reach All-Time Highs

Q4 2025 saw another record broken: over 8.7 million new smart contracts deployed on Ethereum. This number significantly exceeded previous quarters and helps explain why so many ETH transfers were happening during this period.

Image via Token Terminal

The growth comes from several sources. Real-world asset tokenization continues expanding, stablecoin usage remains strong, and developers increasingly use Ethereum as their settlement layer of choice.

The network is becoming core infrastructure for financial applications that need security and reliability.

Staking Queue on Ethereum Grows Substantially

By the end of December, roughly 890,000 ETH sat in the validator entry queue waiting to be staked. This sharp increase may have been driven by large-scale staking operations.

The timing of this staking surge coincided with the unusual spike in network transfers, suggesting institutional players were repositioning their holdings and preparing for longer-term strategies.

What This Means for ETH Holders

The situation presents a puzzle. Strong fundamentals—record transactions, massive smart contract deployments, growing staking participation—typically signal positive momentum. Yet the price remains range-bound near $3,000.

Some analysts point to selling pressure from U.S.-based investors as one explanation. Others note that ETH may be forming a bearish technical pattern that could play out in early 2026.

For traders and investors, this creates both risk and opportunity. The network clearly has genuine usage driving activity, not just speculation.

Applications built on Ethereum keep growing, which supports long-term value. But short-term price action suggests caution is warranted.

Looking Ahead to 2026

Ethereum faces an important year ahead. The network has proven it can handle significant transaction volume with low fees. Developer activity remains extremely healthy. Major financial institutions continue building on the platform.

The question becomes whether this strong foundation can translate into price appreciation, or if other factors will keep ETH suppressed. With weak ETF flows and low fee revenue compared to historical levels, the path forward isn't entirely clear.

What’s certain is that Ethereum's actual usage metrics paint a picture of a network that's very much alive and growing.

Whether the market recognizes and rewards this activity in 2026 remains to be seen, but the fundamentals suggest Ethereum isn't going anywhere.

ETH Statistics Data

ETH Current Price: $2,978

ETH Market Cap: $359.3B

ETH Circulating Supply: 120.69M

ETH Total Supply: ∞

ETH Market Ranking: #2