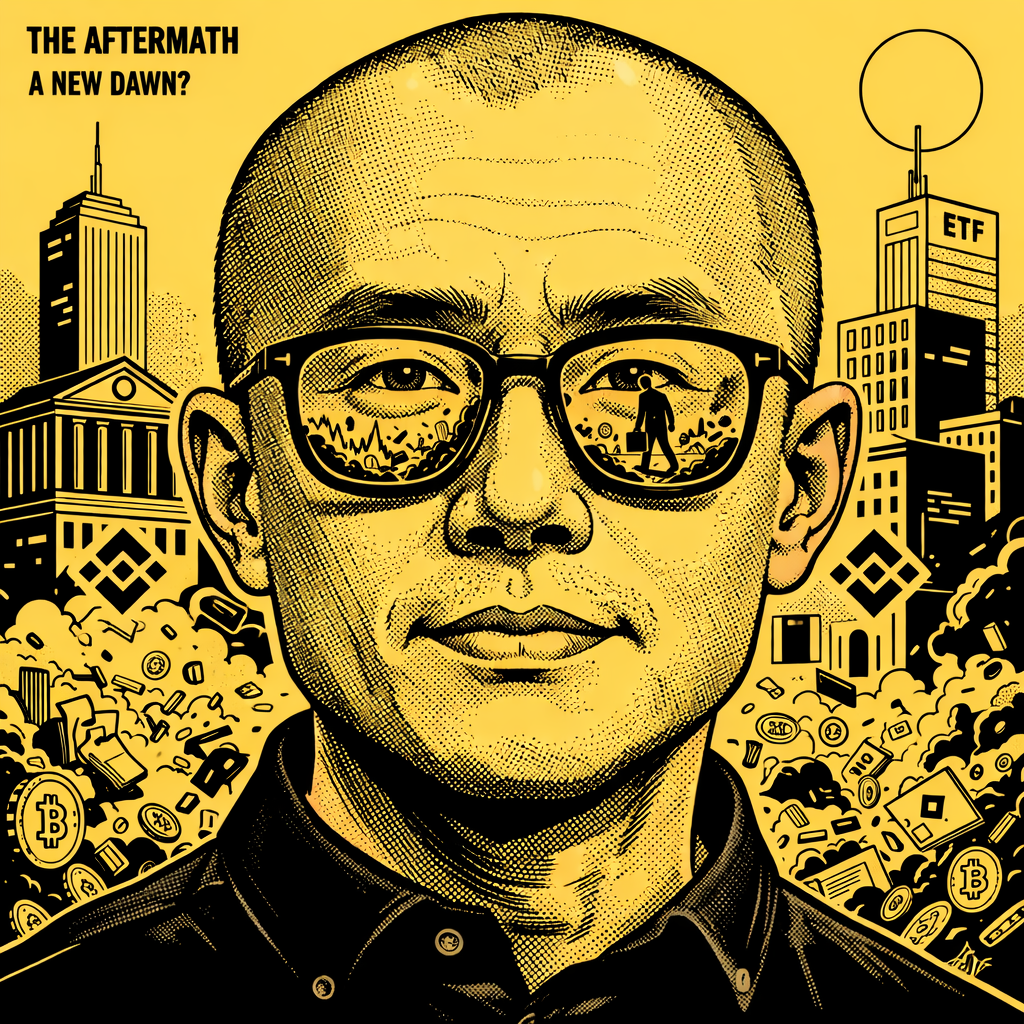

Changpeng Zhao's (CZ) X post from January 11 suggests that "a supercycle is coming" but the cautionary wording of CZ's statement is well considered, given the context in which he made the claim. The date of CZ's supercycle thesis coincided with the SEC taking cryptocurrencies off of its list of high risk items for 2026. For an industry that has been under heavy scrutiny for many years, this signals a significant shift, indicating that crypto is becoming accepted as a segment of the traditional financial system.

CZ's position on the existence of a supercycle can be attributed to three converging factors; institutional capital being allocated to alternative investments, regulatory clarity replacing enforcement actions regarding crypto, and macroeconomic conditions that are supporting alternative investments. While the stock market was experiencing a downturn, Wells Fargo made an investment of $383 million into a Bitcoin ETF; with regard to JPMorgan, contrary to Jamie Dimon's previous statements, they are now allowing clients to utilize Bitcoin; and Morgan Stanley has filed for their own Bitcoin & Solana ETF. None of the aforementioned examples can be classified as speculative investments, but instead represent institutions laying the groundwork for continued growth in the crypto space in a meticulous and methodical manner.

In his X post, CZ stated "I could be wrong, but Super Cycle incoming," responding directly to news that the SEC removed crypto from its 2026 examination priorities list. The SEC's failure to make it to the priority list is more than just a PR stunt; rather, it signifies a shift in enforcement resources from cryptocurrency towards Artificial Intelligence, Cyber Security and Third Party Vendor Risks (TPVR). In essence, the SEC has indicated that crypto has matured enough to no longer require primary focus when it comes to regulation. Regulatory enforcement ushered in uncertainty as to how an individual or business would operate and was restrictive to innovation.

What Supercycle Actually Means

A phenomenon commonly called a supercycle refers to the long-term rise in an asset's value due to significant underlying shifts in the way people use the asset, rather than an increase driven by speculation or through excessive leverage. By contrast, a standard bull cycle typically lasts a few months, based on retail trader FOMO, excessive leverage and hype, which ultimately die out as liquidity in the marketplace dries up. Supercycles last multiple years, based primarily on the entrance of institutions into the asset class, macroeconomic tailwinds and the amount of infrastructure being built out to create long-term demand for the asset.

The increase in Bitcoin price to over $20,000 in December 2017 was primarily due to speculative investment through retail traders. This market manipulation through the futures market created an environment of excessive short pressure and led to a significant decline of the value of Bitcoin. By contrast, the period from early 2020 through April 2021 has all the characteristics of a supercycle; many institutional treasuries have purchased Bitcoin (MicroStrategy, Tesla), Payment Processors (Square, PayPal) have begun utilizing the Blockchain for payment processing, and the development of ETFs has expanded access to Bitcoin to a broader audience. Unfortunately, the uncertainty surrounding regulation and the macroeconomic environment (higher interest rates) have reduced the momentum and slowed the growth of supercycle activity.

CZ's 2026 Supercycle thesis states that these barriers are being broken down. Since the introduction of Spot Bitcoin ETFs, they have accumulated $56 billion in inflows, which makes Spot BTC ETFs the largest source of revenue for BlackRock. From 2025 to 2030, Stablecoin usage has grown by 525%. The federal stablecoin regulation was enacted through the GENIUS Act. Policies that were enforced during the Trump administration are now enabling stablecoin usage through various forms of regulation; thus, the anti-institutional attitude has now turned into a pro-institutional attitude due to shifting from barriers preventing the deployment of large amounts of institutional capital to a belief that it is necessary to have the support of institutional investors using Stablecoins.

The base case forecast for Bitcoin from VanEck is based on supercycle math; this indicates that Bitcoin will only reach a base value of $2.9 million by 2050 if it captures 20% of the total International Trade volume and 10% of the total Domestic GDP. If gold serves as the primary global Reserve Asset, the bull case would have a total value of $53.4 million. Even in a worst-case scenario of $130,000 Bitcoin value, Bitcoin will continue to appreciate rather than decrease dramatically at the conclusion of a supercycle; therefore, the overall long-term outlook is extremely bright.

The Institutional Confirmation

The $383 million Bitcoin investment made by Wells Fargo amidst a retail panic is indicative of how the behaviour of institutions differs from that of retail. Retail investors tend to react to price fluctuations by selling during periods of decline and buying during periods of growth, while institutions operate by making long-term strategic allocations when market dislocations occur when there is a divergence between the price of an asset and its fundamental value. A large, established bank (a $2 trillion institution) making an investment of hundreds of millions of dollars indicates that the institution views Bitcoin as an important component of a diversified portfolio rather than a short-term speculative asset.

JPMorgan's decision to allow its clients to use Bitcoin despite the skepticism expressed by Jamie Dimon, the bank's CEO, reflects the bank's practicality; it values client demand and its competitive positioning above the personal opinions of its CEO. A fluid market for cryptocurrency services has developed as a result of companies such as Morgan Stanley, Bank of America and Charles Schwab offering crypto-related products, creating a competition among such companies; companies not offering crypto services will likely suffer diminished customer base regardless of the opinions expressed by their senior leadership.

The launch of VanEck and Grayscale's BNB ETF indicates the legitimacy of crypto's top-layer providers. Conservative institutions were expecting that Bitcoin ETF listings would eventually happen, and that they would include listing of alternative layer 1 assets along with Bitcoin. This suggests that the expectations of various institutional investors regarding the value of cryptocurrencies are now being fulfilled. Institutions have begun to see the potential value of blockchain networks other than Bitcoin itself.

The Macro Setup

In reference to macroeconomic factors, CZ (a well-known Bitcoin exchange operator) spoke about the potential for interest rate cuts, continued quantitative easing and fiscal expansion, which all reduce liquidity for buyers and sellers of alternative assets. The increase in printing money from central banks has negatively affected fiat currency values, while fears surrounding sovereign debt have increased. Therefore, as a result of these factors, Bitcoin may eventually fill the role as a safe haven for investors who previously relied upon gold.

As a result of continued and accelerated debasement, the Federal Government debt has exceeded $37 trillion. The uncertainty created by government shutdowns and the debt ceiling makes it apparent that an economy cannot continue indefinitely, whereas Bitcoin provides a level of comfort for an investor due to the fact that Central Banks' monetary policies provide unlimited growth potential for fiat currency, while Bitcoin is constrained to a maximum supply of 21 million units.

As a result of this debasement, gold has recently reached new highs in 2025; thus validating the theory of debasement and providing an opportunity for Bitcoin investors to potentially capitalize on this situation. According to Van Eck's research, the first quarter of 2025 has demonstrated that Bitcoin has underperformed the Nasdaq 100 by approximately 50%. This means that if the previously identified issues surrounding cryptocurrencies are resolved and macro economic conditions remain favourable, there is no reason why Bitcoin cannot return to its historical average.

The Regulatory Pivot That Changes Everything

The SEC has been removed from priority lists due to major changes in its policies such as; halting enforcement actions against certain tokens in the case against a large exchange; creating generic listing standards for spot crypto ETFs; and focusing its resources towards developing (rather than established) technologies (i.e. crypto). Furthermore, this dramatic shift by the SEC and the crypto industry represents a significant transition away from the idea that crypto is a decentralized, unregulated shadow banking system requiring strict regulation towards crypto being a newly forming category of assets integrated into traditional banking systems under existing regulation.

For example, with the GENIUS Act establishing stablecoin regulation through statutory law, it now provides the industry with defined guidelines for compliance and allows traditional financial institutions to enter the cryptocurrency space. With clear compliance guidelines, Financial Institutions can engage in crypto service offerings with certainty regarding compliance, and investors can invest without fear of potential punitive actions down the line and businesses seeking funding can pursue financings without fear of violating existing laws.

The Skeptical Case

According to analysts, "Don't expect there like this tweet that you're going to see some supercycle." Pro-crypto laws will not ensure the stability of crypto at the same time they will create positive or big markets over time. The slow rate of institutional adoption may create larger price increases over the years as opposed to large price increases coming. The macro environment can change rapidly creating disruptions to crypto in a short period. CZ said it very clearly, "I could be wrong." Getting that message out is important because the "supercycle" can definitely be right about the fundamentals but wrong about the timing or magnitude. The end of liquidity and macro situations will continue to weigh heavily into how Bitcoin's market cycles are determined, and as a result Bitcoin's four-year halving market cycles will end up breaking apart over time. Also with the discovery of some new patterns, it is always likely that we will need to find new methodologies and new techniques to determine how to interpret them. Predictions based on historical cycles may not reflect the future markets with any validity.

The Crypto Implication

The regulatory pivot is a turning point for CZ, whether or not the supercycle happens. Crypto was under existential regulatory threat from 2021 to 2024 because of enforcement actions, uncertainty about how to classify it, and pressures to debank. That time came to an end when the SEC moved resources around and Congress passed laws that set up legal frameworks.

The infrastructure that was built during that time makes it possible for crypto to be used for a long time, no matter what happens to the price in the short term. Institutions don't make ETF products, custody solutions, and payment rails with the idea that they will only be useful for a short time. They build infrastructure with the idea that crypto will be a standard payment option and part of everyone's portfolio for the next ten years.

It is possible that the supercycle will not happen in 2026. But the infrastructure that will make sure crypto stays in global finance is being built right now, when there is more clarity about regulations than there was before. That's the structural change that CZ is betting on, and institutions are backing it up by putting money into it.