Crypto regulations took on real weight in 2025. What had long existed as draft laws, policy statements, and regulatory warnings began to show up in day-to-day market activity.

Exchanges adjusted listings, stablecoins disappeared from certain regions, and licensing requirements moved from “coming soon” to mandatory.

According to the latest regulatory roundup from Chainalysis, this year marked the shift from regulatory intent to regulatory execution.

This change did not happen evenly. Some jurisdictions moved quickly; others struggled with interpretation and capacity. Still, the direction was consistent across regions.

Crypto is now regulated as part of the financial system, not as a side experiment. That distinction matters because it changes how rules are enforced, how penalties are applied, and how closely regulators coordinate with banks and law enforcement.

Stablecoins Take Center Stage

No area drew more regulatory attention in 2025 than stablecoins. Policymakers increasingly treated them as payment instruments rather than trading tools, especially given their role in cross-border transfers and settlement.

This led to new rules around reserves, audits, and redemption rights in several major markets.

In regions where stablecoin frameworks were enforced, exchanges were required to limit or remove access to tokens that did not meet local standards. This triggered a visible rotation toward approved stablecoins and reduced the global reach of others.

In the United States, a federal framework for stablecoin issuers introduced uniform expectations around backing and transparency. In Europe, compliance requirements shaped which stablecoins could legally be offered to users.

The effect on markets was subtle but meaningful. Liquidity became more regional, and the assumption that all stablecoins function the same way no longer held.

Over time, these rules are expected to influence which stablecoins dominate global payments and which remain niche or offshore.

Tokenization and Banks Move Closer to Crypto

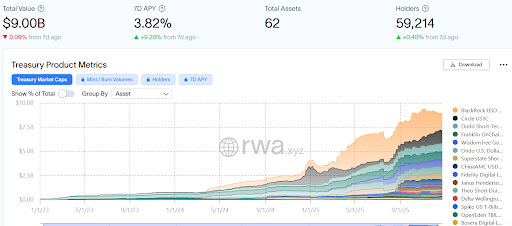

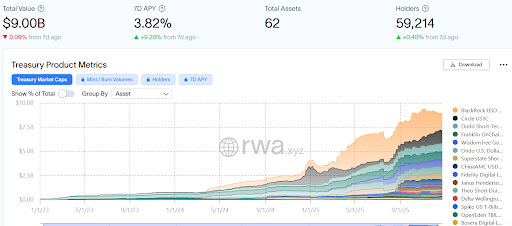

While enforcement tightened, regulators also made room for controlled innovation. Tokenization gained traction in 2025, particularly for financial instruments like U.S. Treasuries and commodities.

By the end of the year, tokenized money-market products crossed $8 billion in assets, while tokenized commodities exceeded $3.5 billion.

Image via RWA.xyz

These figures remain small compared to traditional markets, but growth was steady and deliberate.

Regulators generally supported this trend through pilot programs and limited approvals. Rather than rewriting financial law, authorities focused on how existing rules apply when assets move on-chain.

This approach encouraged participation from traditional financial institutions, many of which began offering custody, settlement, or tokenized products under clearer guidance.

At the same time, banking regulators softened earlier restrictions on crypto activity. In several jurisdictions, banks were allowed greater involvement in custody and digital-asset services, provided risk controls were in place.

This reduced friction between crypto platforms and the banking system and helped normalize on-chain activity within regulated finance.

Enforcement, Financial Crime, and What Comes Next

As crypto adoption expanded, regulators placed heavier emphasis on financial crime and asset recovery. In 2025 alone, more than $3.4 billion in cryptocurrency was stolen, much of it tied to organized fraud and state-linked actors.

These losses accelerated regulatory focus on monitoring, sanctions compliance, and seizure capabilities.

Authorities responded by tightening expectations around transaction surveillance and cooperation between exchanges and law enforcement.

Several countries also strengthened consumer-protection rules, especially around scams and fraud reimbursement. The goal was not just punishment but deterrence and faster recovery of stolen funds.

Looking ahead to 2026, the policy trajectory is clear. Crypto regulations are expected to deepen rather than reverse.

Stablecoin rules will mature, AML scrutiny will intensify, and differences between national frameworks may increase compliance costs for global platforms.