Prediction markets are not new. What’s new is that they are finally being taken seriously.

In a world where information travels faster than verification, prediction markets sit at a unique intersection of finance, data, and human behavior. Instead of asking what people say will happen, these markets ask what people are willing to risk capital on. That distinction matters. Capital-backed opinions tend to be sharper, more honest, and more informed.

As crypto matures beyond speculation, prediction markets are emerging as one of Web3’s most practical use cases. By 2026, they are no longer fringe experiments. They are becoming real-time probability engines used by traders, analysts, institutions, and even regulators.

A Brief History of Prediction Markets Before Crypto

The idea of prediction markets predates crypto by decades. In the late 1980s and 1990s, academic institutions like the Iowa Electronic Markets (IEM) experimented with small-scale markets to forecast elections. These markets consistently outperformed traditional polls, despite strict capital limits. The reason was simple: participants had skin in the game.

In the early 2000s, centralized platforms such as Intrade attempted to commercialize the concept but were ultimately shut down due to regulatory pressure. The core idea survived, but the infrastructure was fragile. Crypto changed that. Blockchain removed the need for a centralized bookmaker, enabling open participation, transparent settlement, and global access. What prediction markets lacked before wasn’t demand. It was trust-minimized infrastructure.

The Mechanics Behind Prediction Markets

At their core, prediction markets are probability markets.

Each market represents a binary or multi-outcome event:

- Will Bitcoin reach $100,000 by June?

- Will the Federal Reserve cut rates this quarter?

- Will a specific candidate win an election?

Each outcome is tokenized into shares, typically priced between 0 and 1. A price of 0.72 implies a 72% probability according to the market.

Participants buy shares they believe are undervalued and sell those they believe are overpriced. As information flows in, prices adjust. The market becomes a continuously updating probability signal.

Settlement and Oracles

The most critical component is resolution. This is handled via:

- Trusted data sources (official statistics, government releases)

- Decentralized or optimistic oracles

- Dispute resolution mechanisms

Well-designed markets assume adversarial behavior and build incentives to challenge incorrect outcomes. This is where modern Web3 prediction markets have evolved significantly compared to earlier versions.

Why Prediction Markets Are Seeing a Surge in Adoption

The recent explosion in the prediction market sector is the result of several powerful forces converging simultaneously. At the forefront is a climate of intense macro uncertainty, where constant shifts in interest rates, elections, and geopolitical events drive a sustained demand for hedging tools. This demand is further amplified by the repeated failure of traditional forecasting such as polls and media analysts to accurately capture real-world probabilities, whereas liquid markets have proven to be more resilient to manipulation and quicker to adapt to new information.

This growth is facilitated by a robust crypto-native infrastructure, where the use of stablecoins and Layer 2 solutions has removed technical friction, making the trading of probabilities as seamless as swapping tokens. Furthermore, a supportive shift in the regulatory environment throughout 2025 has invited institutional curiosity, allowing hedge funds and professional traders to participate through regulated frameworks. The cultural perception of these platforms is also shifting, with many now viewing them as essential "information markets" rather than mere gambling outlets. These combined factors are clearly reflected in the market data: between January and October 2025, prediction platforms generated over $27.9 billion in trading volume. With the sector projected to reach a valuation of $95.5 billion by 2035, prediction markets are cementing their status as a vital new asset class for both retail and institutional investors.

The Leading Crypto Prediction Market Platforms Today

Polymarket

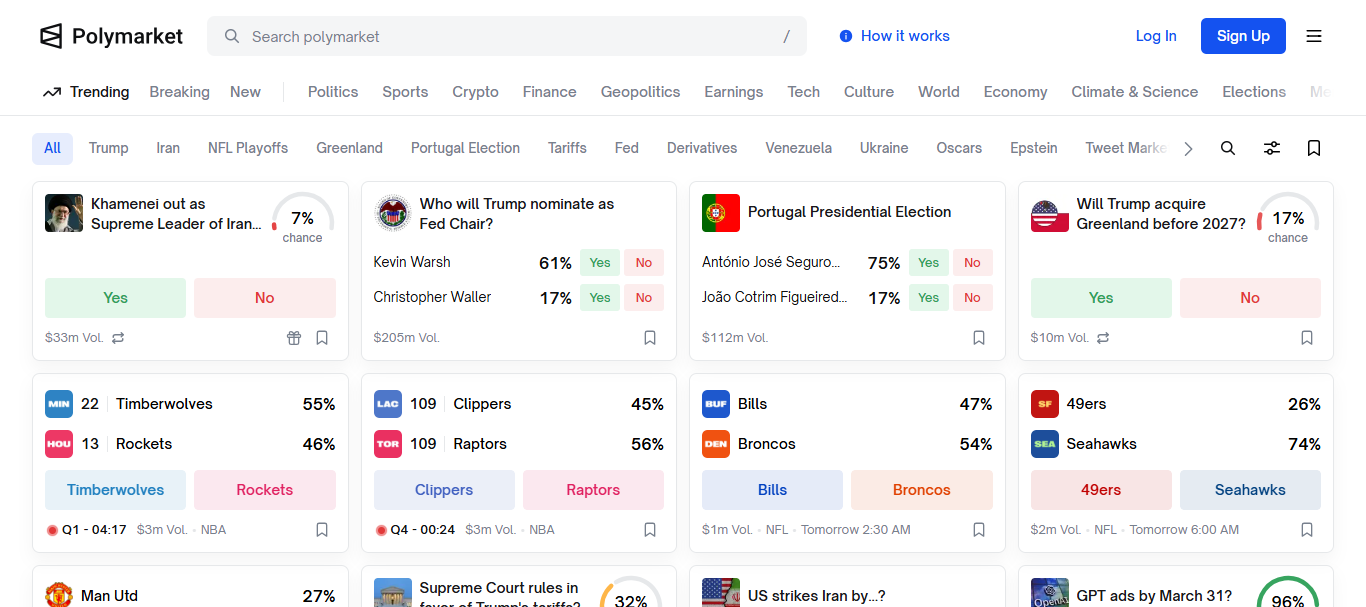

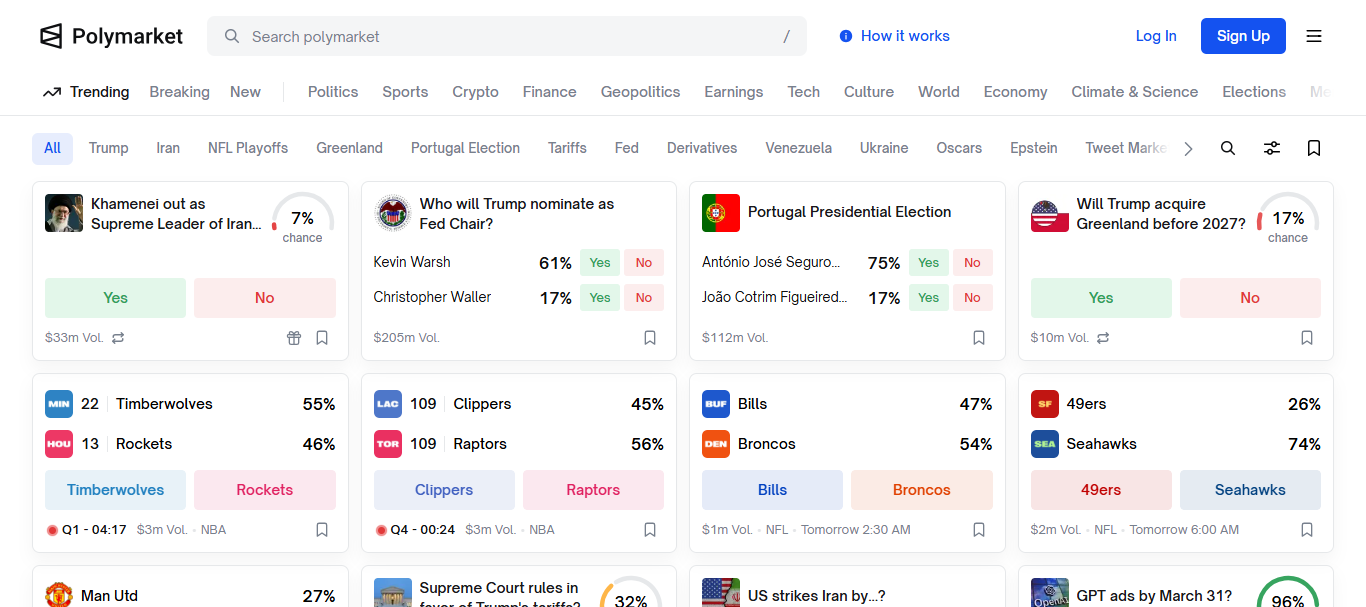

Polymarket is the dominant decentralized platform and the face of crypto-native prediction markets.

Built on Polygon and settled in USDC, Polymarket offers deep liquidity, simple UX, and fast settlement. It has become a go-to reference point for election odds, macro events, and crypto milestones.

Its biggest strength is cultural relevance. Media outlets, traders, and even policymakers frequently cite Polymarket prices as real-time forecasts.

Kalshi

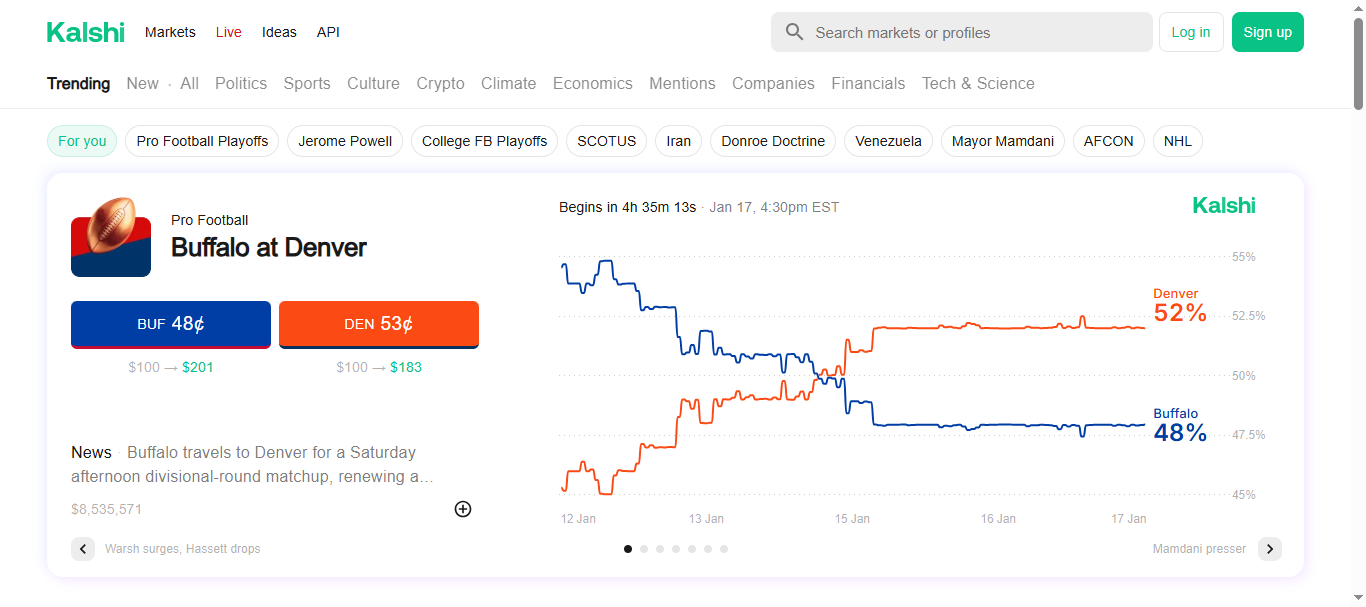

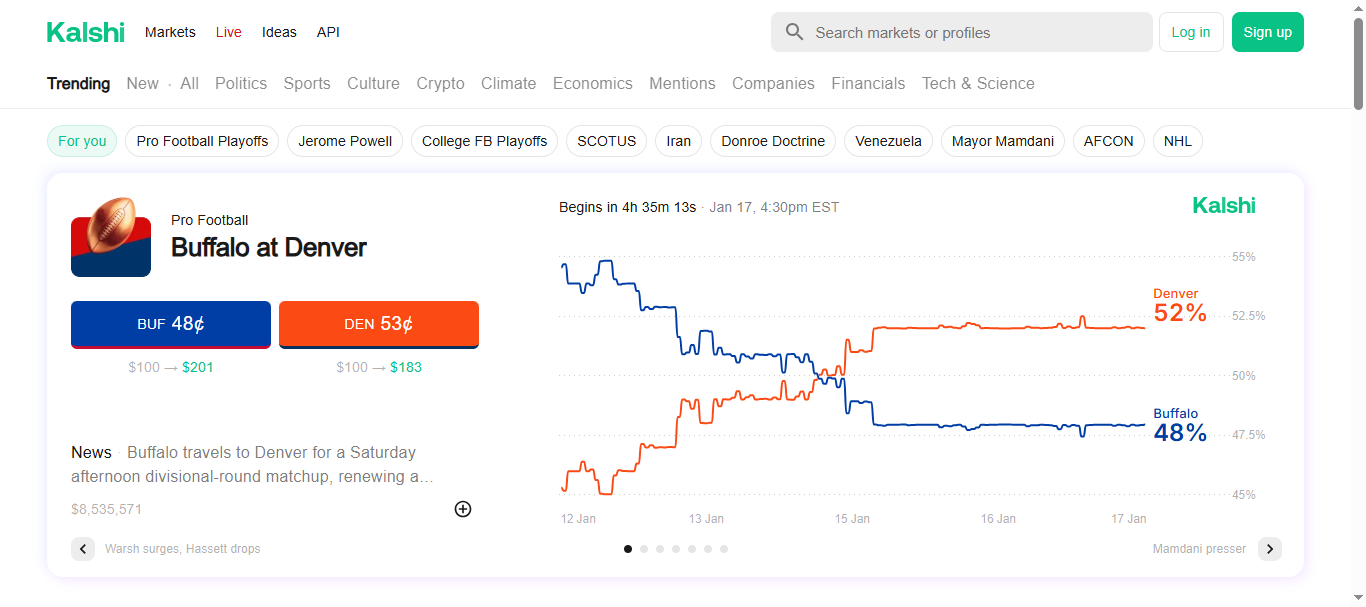

Kalshi represents the regulated future of prediction markets.

As a CFTC-approved exchange, Kalshi operates within U.S. regulatory frameworks. This makes it attractive to institutions, compliance-driven traders, and traditional finance participants.

Kalshi’s volumes spike around macroeconomic data releases, interest rate decisions, and legally approved political markets. Its existence signals that prediction markets are no longer purely experimental.

Opinion Labs

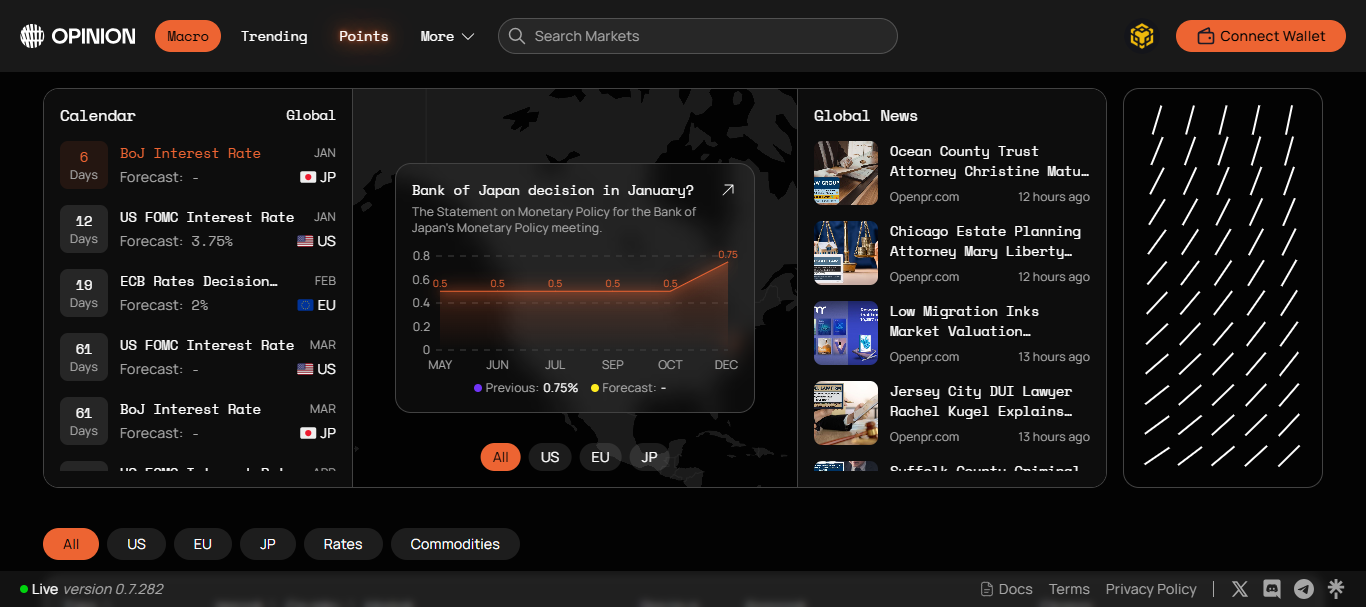

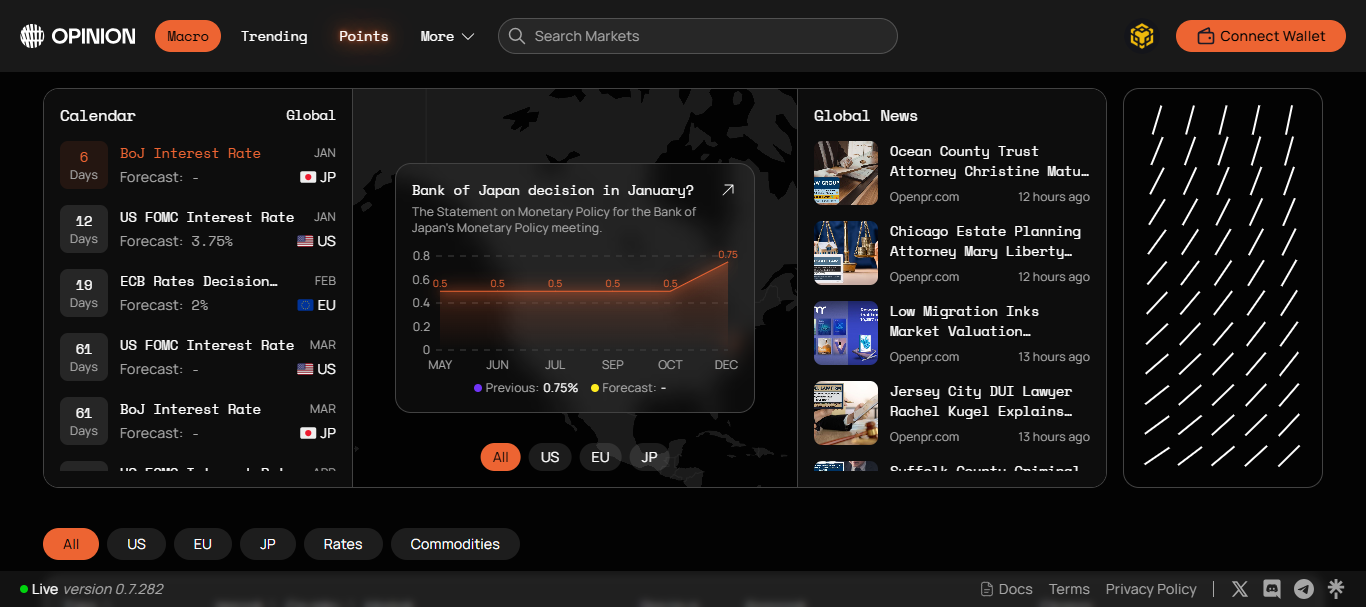

Opinion Labs focuses on aggregation and UX innovation.

Rather than competing purely on liquidity, Opinion Labs aims to unify fragmented markets and provide cleaner probability signals. Its design philosophy treats prediction markets as analytical tools rather than speculative games.

This approach reflects where the sector is heading: fewer gimmicks, more signal.

How Prediction Market Tokens Are Designed and Used

Unlike many DeFi narratives, prediction market tokens tend to have clearer roles:

- Governance over market creation and parameters

- Incentives for liquidity providers

- Dispute resolution participation

- Fee rebates and protocol revenue sharing

Examples include governance tokens tied to decentralized platforms or oracle-related tokens used in resolution mechanisms.

Importantly, many successful platforms intentionally delay token launches. This reflects a shift away from speculative token-first launches toward product-first adoption.

Key Risks and Structural Challenges in Prediction Markets

Prediction markets are not without flaws.

Liquidity fragmentation can distort probabilities. Thin markets are vulnerable to manipulation. Oracle design remains a constant trade-off between decentralization and reliability.

Regulation is the largest unknown. Some jurisdictions classify prediction markets as derivatives, others as gambling, and others as something entirely new. This inconsistency shapes where platforms can operate. However, these challenges are signs of growth, not weakness. Every financial primitive goes through a regulatory and structural refinement phase.

The Future of Prediction Markets as Core Web3 Infrastructure

Looking ahead, prediction markets are poised to evolve beyond standalone platforms, transforming into foundational infrastructure for the broader Web3 ecosystem. By functioning as a decentralized "nervous system," these markets will likely translate global uncertainty into measurable, actionable signals for various protocols. We expect to see deep integration into DAO governance systems and treasury risk management, where market-based forecasting can guide strategic decision-making. Furthermore, prediction markets will likely underpin new insurance and reinsurance models, provide critical data for on-chain analytics dashboards, and serve as direct inputs for DeFi protocols that require real-time probability as a financial primitive.

Why Prediction Markets Matter in the Next Phase of Web3

Prediction markets are no longer about guessing outcomes. They are about pricing uncertainty.

As Web3 matures, applications that combine incentives, transparency, and real-world relevance will survive. Prediction markets check all three boxes.

For traders, they offer new hedging tools. For analysts, real-time probabilities. For builders, a foundation for decision-making systems.

And for platforms like LBank, understanding and tracking this evolution is essential. As these markets grow, so does their influence on how crypto-native and traditional participants interpret the future. This isn’t a trend. It’s a primitive finally finding its moment.

Disclaimer: This content is for educational and informational purposes only and does not constitute financial advice. Cryptocurrency and prediction market trading involve significant risk and volatility. Please conduct your own thorough research (DYOR) and ensure you are in compliance with your local laws and regulations before participating in any event-based trading or decentralized finance protocols.