The crypto market entered 2026 on a positive note after a relatively quiet December that saw Bitcoin trading in a narrow range.

Recent data shows renewed investor interest, with significant inflows into exchange-traded products and improved market conditions across major blockchains.

Strong ETF Inflows Signal Renewed Confidence

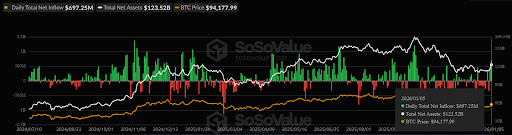

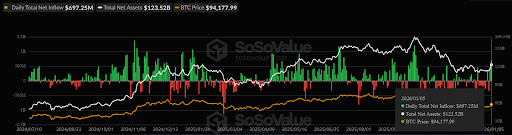

U.S. spot Bitcoin ETFs recorded $697 million in net inflows on the first trading day of 2026, marking the largest single-day total since October.

Image via SoSoValue

This surge pushed two-day inflows to nearly $1.2 billion, with BlackRock's IBIT leading the way at $660 million, followed by Fidelity's FBTC at $279 million.

The strong start contrasts sharply with December's performance, when Bitcoin ETPs saw approximately $1 billion in outflows.

Market analysts attribute December's weakness to tax-loss harvesting, where investors sold holdings to realize capital losses before year-end.

The quick reversal in January suggests these flows were temporary rather than reflecting a fundamental shift in demand.

Bitcoin prices held steady between $85,000 and $95,000 throughout December, with volatility dropping to 20-25% in the second half of the month. Trading activity picked up notably in early January, with prices climbing above $90,000 as volume returned to the market.

Altcoin Markets Show Mixed Performance

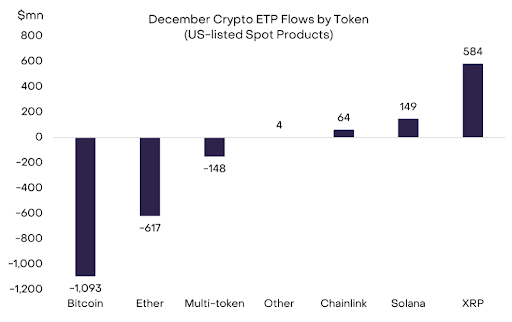

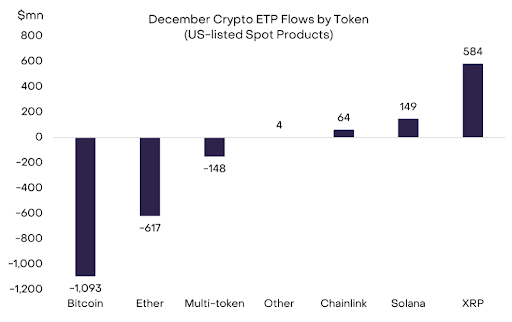

While Bitcoin and Ethereum ETPs experienced outflows in December, alternative cryptocurrency products saw different patterns.

XRP ETPs recorded substantial net inflows of $584 million, though the token's price underperformed, suggesting some inflows came from in-kind creations rather than new fiat purchases.

Image via Grayscale

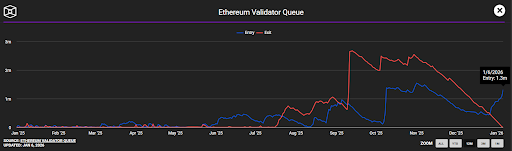

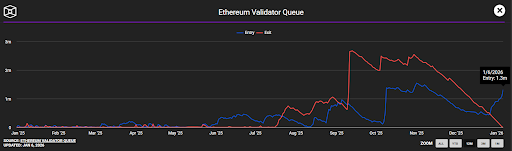

Ethereum's market showed signs of institutional re-engagement. The validator exit queue dropped to zero in early January, down from a September peak of 2.67 million ETH.

Meanwhile, the entry queue grew to approximately 1.3 million ETH, indicating renewed willingness from large holders to stake their tokens. The network currently supports nearly 1 million active validators securing 35.67 million ETH.

Image via The Block

Derivatives Markets Stabilize

Crypto derivative markets remained relatively stable in December after significant disruption in October.

Open interest across major perpetual futures exchanges held steady around $50 billion and increased slightly during the month. This stability suggests the deleveraging that followed October's liquidation event has largely run its course.

Options open interest declined sharply due to concentrated expirations on December 26, though this was expected and part of normal quarterly cycles.

Institutional Developments Accelerate

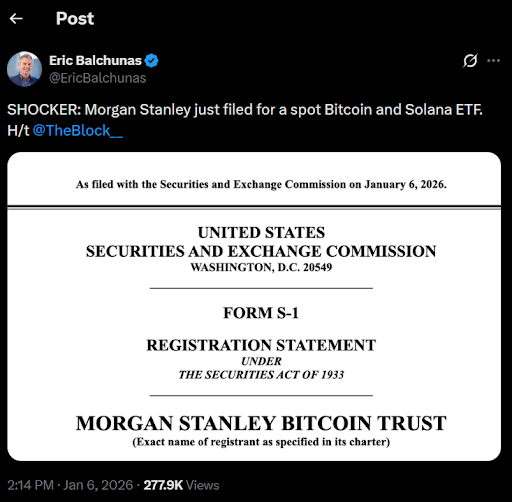

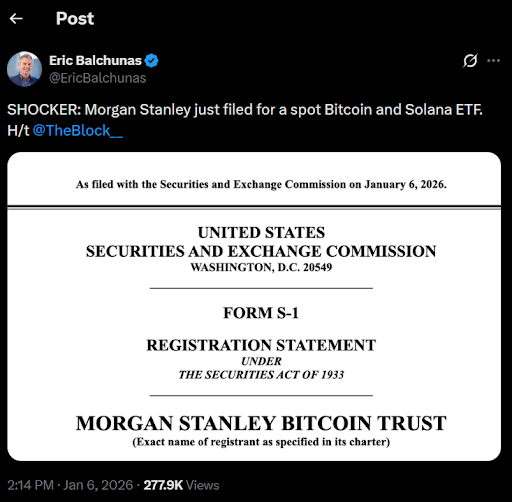

December saw major progress in institutional adoption despite quiet price action. Morgan Stanley filed registration statements with the SEC for spot Bitcoin and Solana ETFs, signaling deeper institutional commitment to crypto products.

Image via X

If approved, Morgan Stanley would join BlackRock and Fidelity as major ETF issuers.

The Depository Trust & Clearing Corporation (DTCC), which processes roughly $3.7 quadrillion in annual securities transactions, received SEC approval to launch a tokenization service.

JP Morgan Asset Management announced a tokenized money market fund on Ethereum. These developments represent a significant shift toward integrating blockchain technology directly into institutional financial infrastructure.

Crypto Regulatory Outlook Improves

The regulatory environment appears increasingly favorable for crypto assets. The Senate Banking Committee scheduled January 15 for markup of the Responsible Financial Innovation Act, a comprehensive crypto market structure bill.

If passed, the legislation could provide clearer rules for digital asset issuers and enable regulated firms to report crypto holdings on balance sheets.

Market observers expect continued momentum throughout 2026, driven by improving regulatory clarity and growing institutional participation.

The combination of strong ETF flows, stabilizing derivative markets, and major institutional initiatives suggests the crypto market's quiet December may have been a brief pause rather than a trend reversal.