The Bitcoin market is seeing major shifts in investor behavior as institutional money continues to flow into exchange-traded funds. Total assets in US spot Bitcoin ETFs have now reached $123 billion, marking a significant milestone for the cryptocurrency's mainstream adoption.

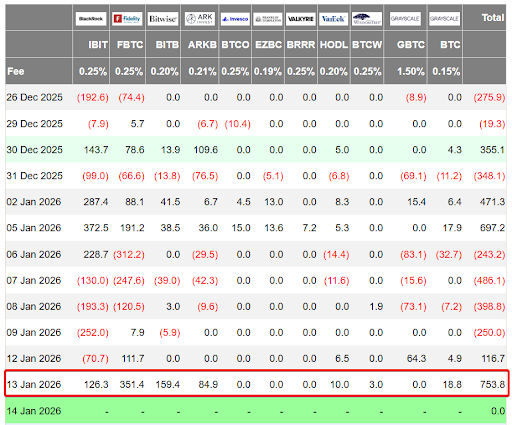

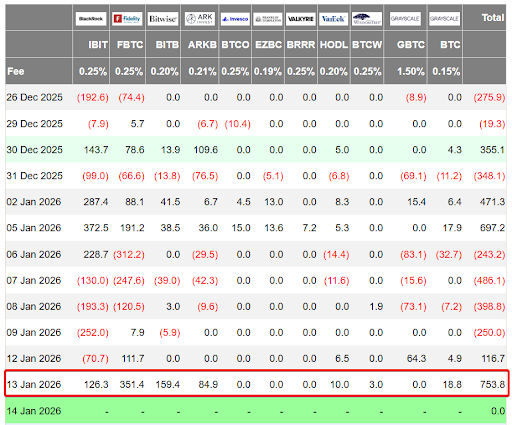

On Tuesday, these investment products pulled in $753 million in a single day. This represents the highest daily inflow since early October 2025, signaling renewed interest from large investors.

Image via Farside Investors

Who's Actually Buying Bitcoin?

Bloomberg analyst Eric Balchunas points out something interesting about these ETF buyers.

They're not day traders or speculators looking to make quick profits. Many are older investors with serious money who plan to hold their positions for years, similar to how they approach gold investments.

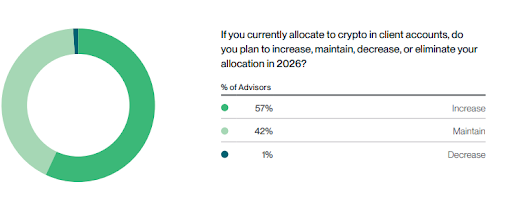

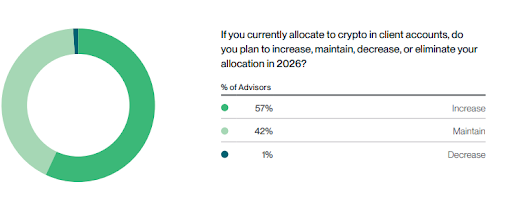

Recent survey data backs this up. A study from VettaFi found that 99% of financial advisors who bought crypto in 2025 plan to either maintain or increase their holdings in 2026.

Image via Bitwise

This kind of commitment suggests Bitcoin is becoming a standard part of investment portfolios rather than a speculative gamble.

When investors lock up Bitcoin for years instead of trading it actively, less supply hits the market. Since January 2024, ETFs have purchased more Bitcoin than miners have produced. Yet prices haven't shot up the way you might expect.

Why Hasn't Bitcoin Price Exploded Higher?

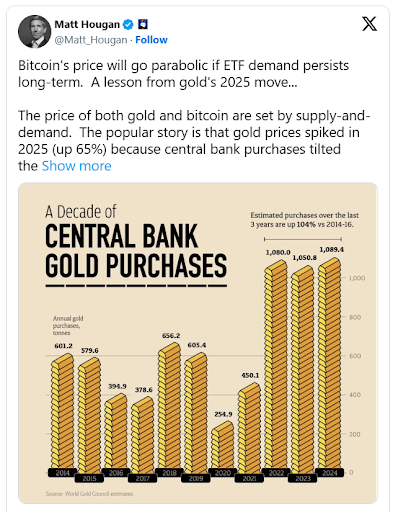

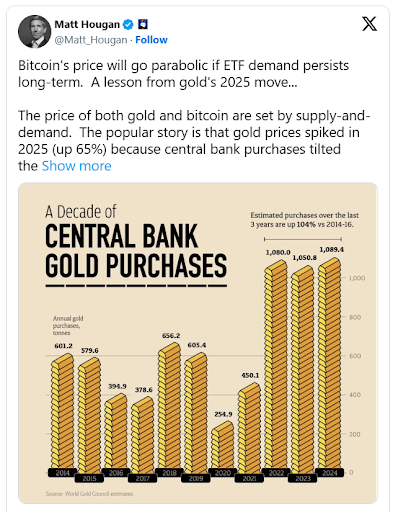

Crypto analyst Matt Hougan explains this puzzle by comparing Bitcoin to gold's recent price history.

Image via X

When central banks doubled their gold purchases after 2022, prices barely moved at first. Gold rose just 2% in 2022, then 13% in 2023, before jumping 27% in 2024 and finally surging 65% in 2025.

The reason is that early buyers got absorbed by existing holders who were willing to sell. Eventually though, those sellers ran out of coins to offload. When persistent demand met shrinking supply, prices took off.

Bitcoin appears to be following a similar path. Long-term holders and early adopters have been gradually selling into ETF demand, keeping price growth relatively steady despite massive institutional buying.

But if these sellers exhaust their supply while ETF purchases continue, the resulting supply squeeze could drive prices significantly higher.

Other Crypto Funds Gaining Ground

While Bitcoin ETFs dominate headlines, other crypto investment products are also seeing strong inflows.

Ethereum ETFs attracted $130 million on Tuesday, bringing their 2026 total to $240 million. Solana ETFs have pulled in $67 million without a single day of outflows since launching.

Meanwhile, traditional ETFs are seeing even more dramatic inflows—$46 billion in just the first six days of 2026. This shows investors are actively deploying capital across markets, though they're currently favoring established assets over crypto.

Image via X

Looking at On-Chain Data

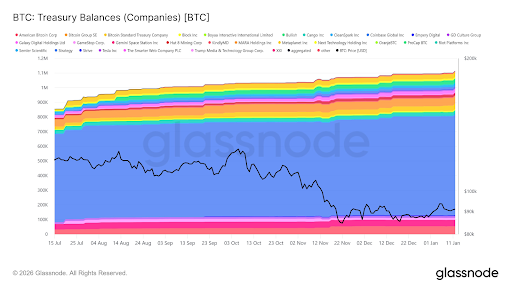

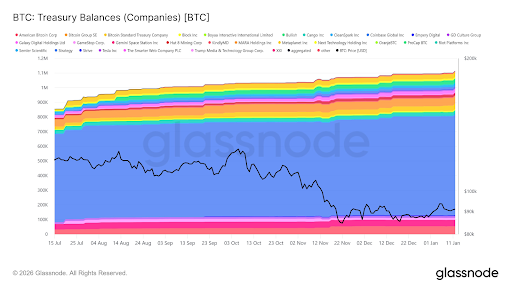

Corporate Bitcoin treasuries tell another story. Companies have added 260,000 Bitcoin to their balance sheets over the past six months, far exceeding the 82,000 coins mined during that period. This works out to roughly $25 billion in monthly corporate buying.

Image via X

These purchases represent a different type of demand than ETFs. Companies are making strategic long-term bets on Bitcoin as a treasury asset, not offering products for retail investors.

What This Means for Traders

For anyone following Bitcoin markets, the key takeaway is patience. The infrastructure for institutional adoption is clearly in place and growing. But price appreciation may take time to materialize as existing holders continue distributing coins into new demand.

The comparison to gold suggests Bitcoin could be setting up for a major move once selling pressure exhausts itself.

Traders should watch for signs that long-term holder distribution is slowing while ETF inflows remain strong. That combination could mark the beginning of a significant rally.

Bitcoin recently pushed past $97,000 despite higher-than-expected inflation data, showing the market is increasingly able to ignore traditional risk-off signals.

BTC Statistics Data

BTC Price: $97,336

BTC Market Cap: $1.94T

BTC Circulating Supply: 19.97M

BTC Total Supply: 21M

BTC Market Ranking: #1