The Deepfake Romance Scam Every Crypto Investor Should Fear

Hong Kong authorities recently took down a pretend romance scam using fake people... with a Twist! With the help of deepfake technology to manipulate the emotions of others, the crooks behind this enterprise were able to amass a whopping $46 million!

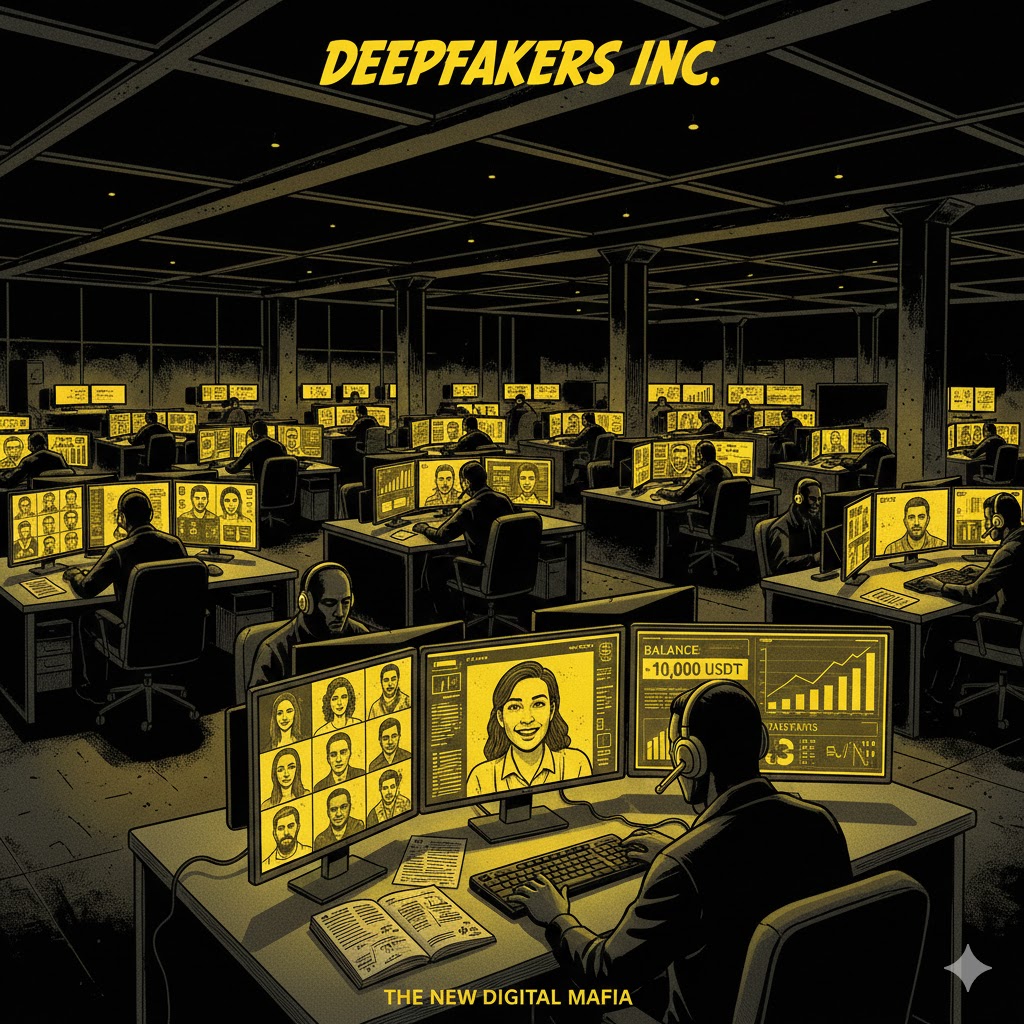

In October 2024, police raided an operation that was running out of a 4,000 square foot building in Hung Hom and operating with 27 members. They found training manuals, non-existent trading platforms, and a sophisticated real-time AI face-swapping application that was capable of fooling the victims on video calls!

This was not a test-run! The group of crooks employed recently graduated students to create fake cryptocurrency trading sites, developed complicated training scripts specific to various victim types, and utilized deepfakes so believable that the victims genuinely believed they had developed romantic relationships with attractive women.

Additionally, the police confiscated expensive watches, over 100 cell phones and irrefutable evidence showing the syndicate expanding its operations from Hong Kong to neighbouring Taiwan, Singapore, Malaysia and mainland China. The scammers did everything in their power to make their schemes convincing. Upon dupe-ing their victims, they then vanished when the duped would attempt to withdraw money!

Crypto’s AI Scam Problem Is Accelerating, Not Slowing Down

The terrible news is that the 2017 deepfake bust of January 2025 should be alarming to everyone, in less than three months of that event there were another 31 people arrested and another $4,370,000 in proceeds from the sale of deepfake products and services. This is not an isolated issue; the United Nations Office on Drugs and Crime found more than 100 deepfake software providers that were making their services available via Telegram to organized crime groups throughout Southeast Asia. Criminal gang activity focused on (and continues to target) people who engage in cryptocurrency transactions because cryptocurrency transactions are not reversible, so they represent an ideal "crime" to perpetrate upon the unsuspecting.

All digital asset holders should be concerned about how sophisticated this technology has become. Not only did these operations utilize "still" AI-generated images of individuals; they utilized real-time deepfake technologies to create a real-time "person" during video chats, including voice manipulation, as well as the use of personality scripts tied to topics such as wine tasting or investing in cryptocurrencies, and to market their luxurious lifestyles. The idea was to create a false sense of trust with the victim before directing them to a counterfeit exchange where they could observe fictitious profits growing on screen but yet were unable to receive them.

Altcoins Keep Rewarding Speculation Over Fundamentals

Because of the weakness of cryptocurrencies, many scammers prey on investors. However, these fluctuations in price, as seen by some cryptocurrencies experiencing large increases recently, have created opportunities for traders to capitalize on these changes. For example, HIVE and other mid-cap cryptos have been identified as having large price moves due to the movement of capital during sudden bouts of momentum and also the price changes are very short-lived.

The percentage of the market represented by Bitcoin is still around 59% with an Altcoin Season Index currently below 40%, therefore there are still many altcoins that are failing. According to technical analysts, there will be "mini altseasons" in 2026 but they will only be small rallies rather than the larger market rip trends seen in 2017. There are only a few well-known names making large amounts of money, whereas there are thousands of tokens that are struggling for a small portion of those prices. If you believe that there will be an altcoin craze similar to what occurred in 2017, I would encourage you to evaluate your assumption as there is a significant differentiation in this market cycle as institutional capital is flowing to Bitcoin and regulated ETF products, rather than speculative mid-cap names.

The Restaking Revolution: Ethereum’s Real Economic Innovation

Staking demand and the restaking ecosystem will drive builders (who are building infrastructure) & bad actors (who are launching romance scams). The standardized Ethereum staking usually has an annualized percentage yield (APY) of 4–5%, whereas the restaked ETHs via EigenLayer and Ether.fi may be used to secure additional protocols, giving multiple payouts to the stakers without the need for new money.

EigenLayer allows validators to stake Ether (ETH) or other forms of Liquid Staking Derivatives and opt them into validation of Actively Validated Services (AVS) and receive Ethereum's native staking rewards, as well as AVS protocol incentive rewards. Users can stake their ETH with Ether.fi, Renzo and Puffer Finance, which will restake to EigenLayer and return Liquid Restaking Tokens to the stakers to maintain liquidity. Composability will increase the returns to stakers, and DeFi capital will be utilized productively.

Currently, EigenLayer has $19.5 billion of locked value, supporting nine AVS's and over 50 more in development, which demonstrates this technology extends Ethereum's security layer to new applications without the need for each protocol to bootstrap its own validator set (ex: 'the Ethereum ecosystem'). As the ecosystem evolves, the blended returns between AVS's and regular staking will likely produce at least 1 or more percent higher than traditional staking methods based on the overall level of AVS adoption and Tokenomic designs.

The Hidden Risks Most Investors Ignore When Restaking ETH

Restaking on its own doesn't represent a windfall of free money. When ETH is restaked, it increases the risk of suffering from slashing events because it is securing more than one protocol. The inherent structure of the validator ecosystem is such that validators are held to higher standards than stakers. An example of this higher standard is that if a validator were to act poorly, he would incur much harsher penalties than a staker and this would also be true in a slashing event where stakers would lose all their staked ETH.

Leaving EigenLayer after a staking event requires waiting at least an additional 7 days to have your funds returned. This is in addition to the regular unbonding period required by Ethereum. Smart contracts, as well as technology concentration, and unforeseen technical complications, pose significant risks.

However, the larger picture is that while you are seeking 65% returns via speculative altcoins, there are currently builders creating systems that will continue to grow their payouts without needing to deposit additional funds. Restaking is one example of how the structural changes that are happening below the surface of the infrastructure of crypto are changing what constitutes the "casino layer." The question is not whether HIVE will be worth 20% more in 6 months, but whether you can identify which assets have true value in the future growth of this industry?

What Actually Matters for Crypto Investors in 2026

To be aware of what you're holding and why is the idea behind crypto investing, not "avoid crypto. The risks associated with staking and investing in new coins or cryptocurrencies far exceed those associated with staking and investing in Ethereum; developing a comprehensive understanding of what you own and plan to do with it is far more beneficial than participating in speculative projects without an understanding of their underlying characteristics.

Retail investors, although they may be reticent, do not possess sufficient size and leverage to offer true stability and security like that of institutional investors. For the time being, cryptocurrency, like all assets, will become more sophisticated; as technology continues to advance and become more entrenched, it is imperative that we learn about the underlying fundamentals to determine whether we are profiting through speculation or through the development of value-driving assets. At this point, it becomes clear what separates the retail investor from the institutional investor; where does institutional money go when investing into cryptocurrency?