Ripple continues to chart its own course in the crypto industry, maintaining a clear stance against going public despite raising significant capital and achieving a massive valuation.

The company's leadership has made it clear that an initial public offering isn't part of their near-term plans.

Why Ripple Isn’t Going Public

Monica Long, Ripple's president, addressed speculation about a potential IPO during a recent Bloomberg interview.

Image via Bloomberg

Her reasoning was that the company doesn't need to tap public markets when it already has strong finances. "We're in a really healthy position to continue to fund and invest in our company's growth without going public," Long explained.

This position comes on the heels of Ripple's November 2025 funding round, where the company secured $500 million from major institutional investors. The round valued Ripple at $40 billion, attracting heavyweights like Fortress Investment Group and Citadel Securities.

While Long acknowledged the deal terms were "very positive, very favorable for Ripple," she didn't elaborate on specific investor protections that reportedly included guarantees on share buybacks and preferential treatment in various scenarios.

Building an Enterprise Ecosystem

Rather than pursuing an IPO, Ripple has focused on aggressive expansion through strategic acquisitions. Throughout 2025, the company completed four major deals totaling nearly $4 billion.

These purchases weren't random—each one strengthened Ripple's position in different segments of the digital asset infrastructure space.

The acquisitions included:

- Hidden Road, a global multi-asset prime broker

- Rail, which handles stablecoin payments

- GTreasury, a treasury management platform

- Palisade, specializing in digital asset custody and wallets

Together, these companies give Ripple a comprehensive suite of tools that traditional finance firms need to work with blockchain technology.

Importantly, the strategy appears to be working. Ripple Payments has processed more than $95 billion in total volume.

Ripple Prime, built using the Hidden Road acquisition, recently added collateralized lending services and institutional XRP products to its offerings.

At the center of both platforms sits RLUSD, Ripple's dollar-backed stablecoin.

Long framed the approach as product-focused: "The connective tissue that traditional finance needs to make blockchain and cryptocurrencies and stablecoins, all these tokenized assets, to make them actually useful and applicable in the real world."

XRP Price Performance

While Ripple builds behind the scenes, XRP price has captured attention with strong action. The token jumped over 30% in January's first week, outpacing most cryptocurrencies in the top 20 rankings except for Dogecoin and Sui.

This rally pushed XRP past BNB to claim fourth place in market capitalization rankings. CNBC's Brian Sullivan noted that "the hottest crypto trade of the year is not Bitcoin, it is not Ether, it is XRP."

Why XRP is the new cryptocurrency darling, image source: CNBC

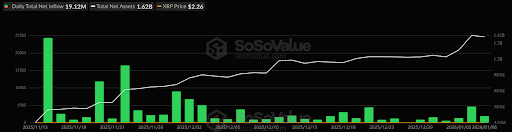

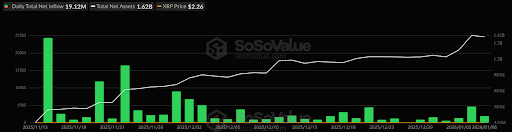

Part of XRP's strength comes from ETF inflows. Unlike Bitcoin and Ethereum ETFs, where investors typically chase price momentum, XRP ETFs saw buying during the fourth quarter's market weakness.

That contrarian bet paid off as cumulative inflows reached $1.25 billion, with $19.12 million entering on January 6 alone.

Image via SoSoValue

Some analysts project that sustained ETF buying could absorb 4.8 billion XRP throughout 2026 if current trends continue. That level of accumulation would significantly reduce available supply, potentially supporting higher prices.

However, not everyone agrees on what's driving XRP's gains. Some market observers argue that thin liquidity on the sell side, rather than genuine buying pressure, explains the rapid price increases.

This debate will likely continue as traders watch whether demand can sustain current levels.

XRP Statistics Data

XRP Current Price: $2.17

XRP Market Cap: $131.9B

XRP Circulating Supply: 60.67B

XRP Total Supply: 100B

XRP Market Ranking: #4