A clear, research backed look at the new high performance EVM chain, its token, and what it means for devs and investors.A clear, research-backed look at the new high-performance EVM chain, its token, and what it means for devs and investors.

Can Monad (MON) Compet with Ethereum?

In the constantly evolving blockchain landscape, thousands of projects launch daily, but few dare to challenge the king directly. Enter Monad (MON) a project that isn't just another competitor, but a fundamental rethinking of how the Ethereum Virtual Machine (EVM) should work.

Monad (MON) arrived at this moment with big performance claims, a public mainnet launch and a large token allocation. That combination makes the question obvious and urgent: is Monad a true technical leap that can win developer mindshare and economic activity from Ethereum, or is it a high performance newcomer that will coexist with rather than replace the long-standing market leader?

Monad is technically ambitious and strategically positioned, but competing with Ethereum is as much about network effects, security history and liquidity as it is about raw speed. Below I explain why, with sources and practical takeaways.

What is Monad (MON)? The "Parallel EVM" Pioneer

Monad is an Ethereum Compatible Layer-1 blockchain designed for extreme performance and true decentralization.

The core problem Monad solves is the bottleneck of sequential processing. Most EVM chains (Ethereum, BSC, Avalanche) process transactions one by one like a single-lane road where every car must wait for the one in front. Monad changes the physics of this road by introducing Optimistic Parallel Execution.

- How it Works: Monad starts executing multiple transactions simultaneously before earlier ones in the block have completed. It then checks the results linearly to ensure they are correct.

- The Result: The outcome is identical to Ethereum, ensuring full compatibility, but the speed is exponentially faster.

The MON Tokenomics: Supply, Valuation & Airdrop

As of November 2025, the financial structure of the MON token has been fully revealed.

- Total Supply: 100 Billion MON.

- Public Sale Valuation: 7.5% of the supply was sold at a valuation of $2.5 Billion FDV ($0.025 per token).

- Market Valuation: Pre-market trading has seen MON prices around $0.13–$0.15, implying a much higher Fully Diluted Valuation (FDV) of $13–15 Billion.

- Airdrop: Monad allocated roughly 3.3 Billion MON (3.3% of supply) to the community.

The Airdrop Event:

The airdrop targeted over 230,000 eligible wallets, including 5,500 active community members and users from the wider crypto ecosystem. The claim portal faced heavy traffic and outages upon launch due to massive demand.

The Incumbent: Ethereum (ETH)

To understand the challenger, we must respect the King. Launched in 2015, Ethereum is the original smart contract platform.

- The Moat: Ethereum has the largest developer community, the deepest liquidity, and a TVL (Total Value Locked) in the hundreds of billions.

- Evolution: Ethereum is scaling via Layer-2 solutions (like Arbitrum and Base) rather than changing its base layer execution like Monad.

- The Trade-off: While secure, Ethereum's base layer remains slow (15-30 TPS) and expensive during congestion.

How Monad keeps EVM compatibility (so devs can reuse code)

Monad emphasizes full EVM compatibility: developers can reuse Solidity code, tools, and libraries. That’s a huge tactical advantage: it lowers friction for teams to port contracts, wallets and infra. Monad claims it can produce identical outcomes to Ethereum despite different internal execution mechanics by preserving a linear block structure while parallelizing internal execution. This design choice is meant to balance performance with developer familiarity.

Critical Comparison: Similarities & Differences

Where They Are the Same:

- EVM Compatibility: Both use Solidity. If you can code on Ethereum, you can code on Monad without learning a new language.

- Decentralization: Both rely on a decentralized network of validators to secure the chain.

Where They Diverge:

- Architecture: Ethereum is single-threaded (sequential); Monad is multi-threaded (parallel).

- Ecosystem Maturity: Ethereum has thousands of active dApps. Monad is just starting, with early projects like Magma (liquid staking) and Mynt (stablecoin) going live at launch.

- Hardware Requirements: Monad requires higher specs (32GB RAM) compared to Ethereum, which some critics argue could lead to centralization over time.

The "Solana Killer" Narrative

This section provides critical context on why Monad matters right now.

Monad is often called an "Ethereum Killer," but it is equally a threat to Solana. In the previous cycle, developers had to choose:

- Build on Ethereum for users/liquidity (but suffer slow speeds).

- Build on Solana for high speed (but lose EVM tools).

Monad attempts to merge these worlds. It brings Solana level speed (10,000 TPS) to the Ethereum standard (EVM).

If successful, it captures the best of both worlds: Solana's performance with Ethereum's developer experience.

This places it in a unique position to siphon liquidity from both chains.

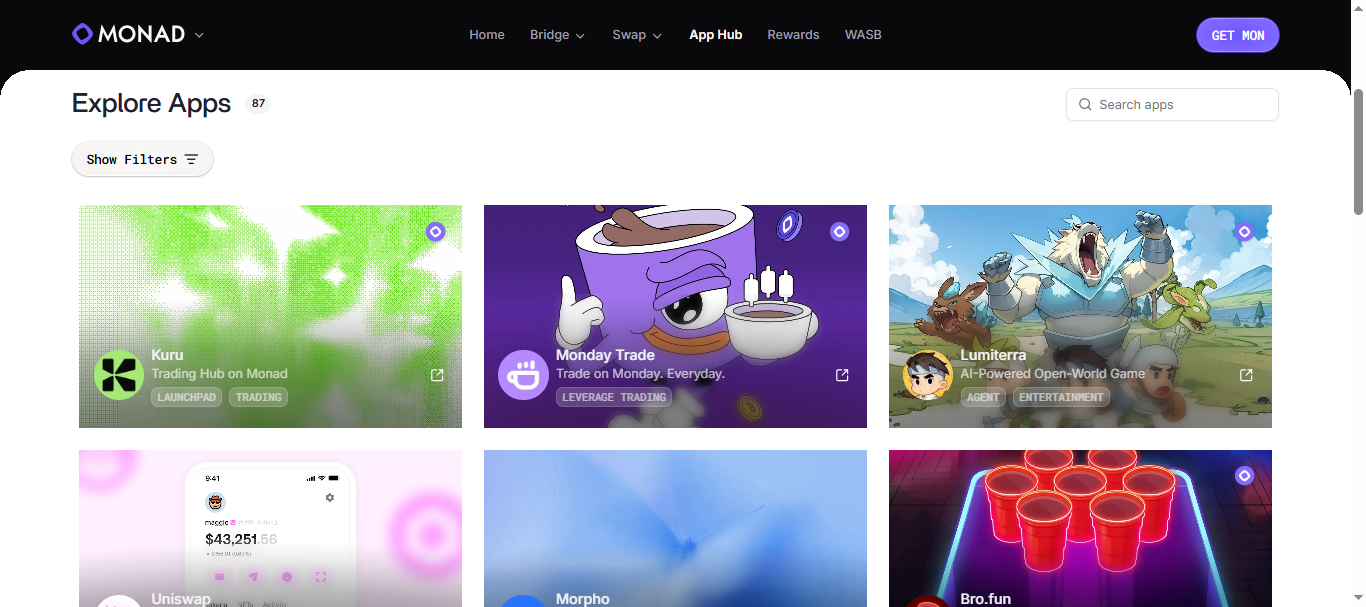

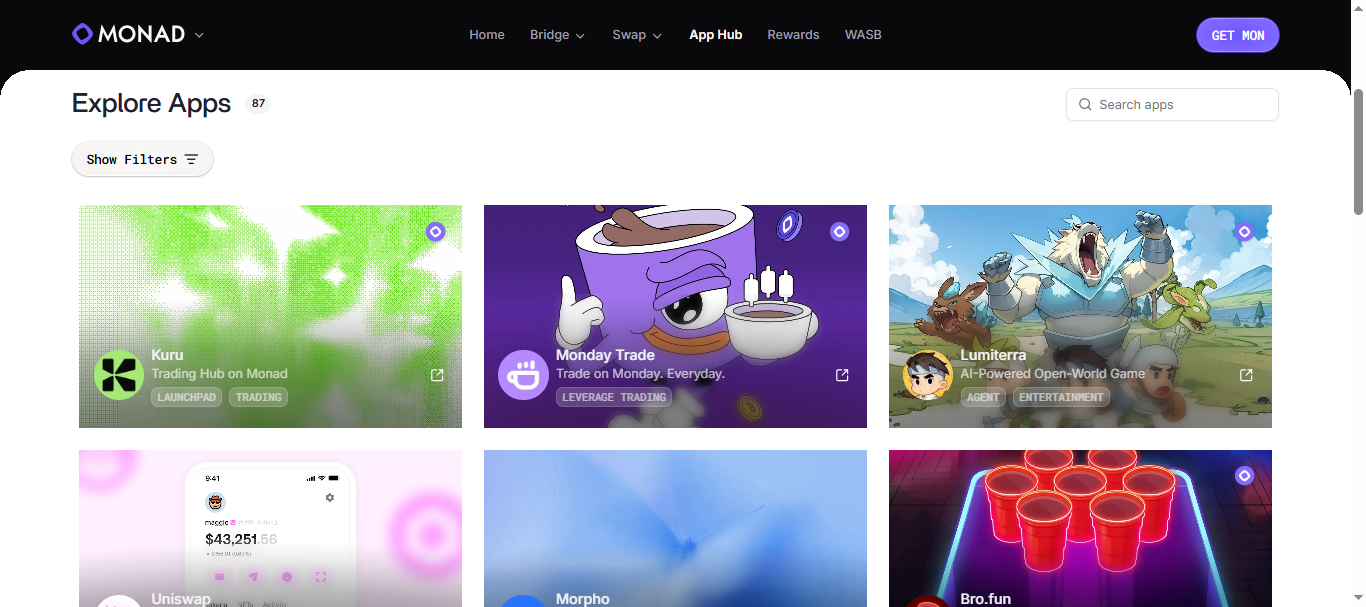

Ecosystem Deep Dive: Who is Building?

MONAD :

Curretnly Monad ecosystem market cap is 1.96Billion with 98 projects.

A blockchain is only as good as its apps. Monad launched with a suite of DeFi protocols already live:

- Kintsu: A liquid staking protocol allowing users to stake MON and receive sMON.

- Kuru: A CLOB (Central Limit Order Book) DEX that leverages Monad’s speed to offer a CEX-like trading experience on-chain.

- Mynt: A stablecoin protocol allowing users to mint USDm using MON as collateral.

ETH :

Curretnly Eth ecosystem market cap is 560+ Billion with 1400+ projects. Some of known projects are :

- Ondo : Ondo Finance is an open and decentralized investment bank.

- ChainGPT : ChainGPT is an advanced Ai model that assits individual and bussiness.

- Omina Protocol : Omina protocol is an RPC provider that priotizes dePIN and aggregation.

Monad, image by: Monad

What Success Looks Like for Monad

Monad doesn’t need to “kill” Ethereum to be successful. There are several sustainable outcomes:

- Coexistence with specialization: Monad becomes the go-to L1 for throughput-heavy on-chain experiences (e.g., on-chain gaming, high-frequency DeFi), while Ethereum remains

- the settlement & composability layer.

- Migration and consolidation: A meaningful share of dApps and liquidity migrates to Monad, creating a multi-L1 environment where both chains hold significant, overlapping ecosystems.

- Failure to gain traction: If developer incentives, liquidity, or decentralization concerns aren’t resolved, Monad could remain a technical curiosity with limited economic activity.

How to Prepare: Trading on LBank

While the market waits for Monad's ecosystem to stabilize, you can prepare using LBank.

- Sign Up: Create a secure account on LBank to ensure you are ready for spot listings.

- Practice with ETH: Trade ETH/USDT to get comfortable with liquidity and volatility.

- Watch the Unlock: Be aware that team and investor tokens have a 1-year lock-up, meaning the selling pressure from insiders will be delayed until late 2026.

- Earn Yield: Don't let your assets sit idle. Use LBank Earn to generate yield on your ETH capital while you wait for the right entry into the Monad ecosystem.

Conclusion: Which One Should You Choose?

Ethereum remains the undisputed king for safety and long-term security. However, Monad has kicked down the door of what is possible with the EVM. It solves the scalability problem without abandoning the developer standards that built the industry.

If you are a conservative investor, stick to ETH. If you are an aggressive investor looking for the infrastructure play of the 2026 cycle, MON represents the most credible challenge to the status quo we have seen in years.

Disclaimer: Always Do Your Own Research (DYOR). Investment in crypto assets involves significant risk.