Consensus mechanisms represent, at the most basic level, the foundation of economic security for any blockchain ecosystem. As such, the choice of consensus mechanism has a significant impact on the long-term financial viability, level of decentralization, and vulnerability of blockchain systems to attacks. After transitioning to a PoS consensus mechanism, an event known as "the Merge".

In September 2022, the Ethereum blockchain placed a tremendous amount of reliance upon its PoS consensus mechanism. Ethereum significantly decreased its total energy usage (over 99.95%) by utilising PoS instead of the energy-intensive Proof of Work (PoW), while still maintaining the same level of security for the network.

In contrast, the Solana blockchain developed a groundbreaking approach to consensus based upon the PoH clock that allows for time to be synchronized amongst various nodes, thus resolving an issue that has plagued many other blockchain projects. Understanding the unique protocol functions of each blockchain is necessary to comprehend the potential uses and limitations of each blockchain.

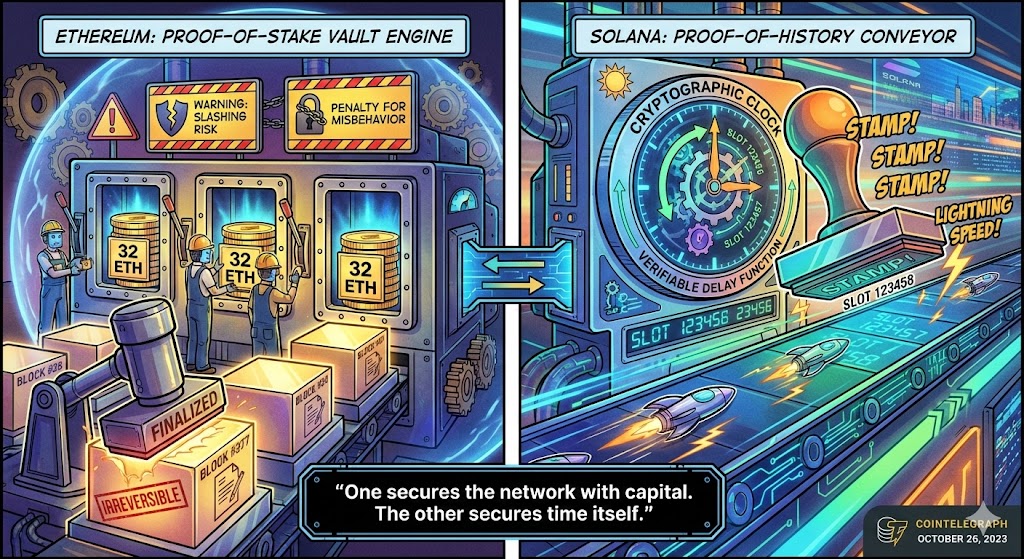

Ethereum’s Proof of Stake: Securing the Network Through Capital at Risk

To become a validator under the Proof of Stake system, validators are required to deposit 32 ETH into a deposit contract. Validators also need to run three separate software applications: the execution client, the consensus client, and the validator client.

The purpose of a stake is to encourage validators to act honestly by risking their own funds; therefore, if a validator tries to defraud the network by submitting multiple blocks where only one was required or submitting incorrect timestamps, the validator will forfeit some or all of their staked tokens.

To provide for "finalized" blocks within Ethereum, Casper-FFG is used. When a block is finalized, it is not possible to revert to a previous state unless the majority of validators also lose their staked tokens. For an attacker to revert an already finalized block, they would need to agree to lose at least one-third of the total staked tokens. This model creates an economic disincentive against the actions of an attacker, making them much more difficult and costly to execute.

Ethereum's Proof of Stake system will create fixed time intervals of 12 seconds for each epoch (sequence of time slots), providing the same fixed time intervals for all validators and thus eliminating the possibility of competing or fluctuating block times created under the Proof of Work mining model.

Why Proof of Stake Changed Ethereum’s Energy Economics

The Crypto Carbon Ratings Institute tested the Ethereum network for its carbon rating and has verified the increase in the efficiency of the Ethereum network since its inception. Due to the usage of the new version of the Ethereum network, the amount of energy consumed by the Ethereum network is equivalent to the amount of energy consumed by approximately 2,100 average size homes in the United States per year, when before it consumed enough power to run a large sized country. The amount of CO2e produced per year from the Ethereum network is estimated to be approximately 870 metric tonnes.

When there is the ability for a Bitcoin transaction to be processed at a maximum rate of 5 TPS, Bitcoin requires approximately 830 KWh of energy to process a transaction. In comparison, the Ethereum network has the capability to process anywhere between 15 TPS and 50 KWh of energy used to process each transaction.

Moreover, the validators of Ethereum can not only increase the efficiency of the Ethereum blockchain, but also help preserve the environment. Therefore, validators do not need to have expensive mining rigs, nor do they consume large amounts of energy to validate transactions.

Anyone with a minimum balance of 32 ETH, along with regular computers, can become a validator. This opens up the possibility of increasing the decentralization of the Ethereum network, while addressing many of the existing problems associated with current infrastructure.

Solana’s Proof of History: Solving Blockchain’s Time Synchronization Problem

The PoH protocol leverages a VDF to ensure that every block producer must complete a VDF before being assigned a time slot to produce a block. While the concept of consensus is not a novel one, creating a cryptographic clock for verifying the order in which events happen has never been done before. Solana uses PoH to append items to the series of events by including hashes from existing states.

Furthermore, everything related to the event, including state, input data, and indices are publicly available, and cannot be modified or changed in different ways after they have been published.

In addition, PoH timestamps each block, verifies the cryptographic timestamp with a VDF, and records all the timestamps to provide evidence of when the blocks were created and what time it took for the blocks to be created.

In contrast, traditional blockchains require massive resources to support the large computational requirements for consensus among nodes, to identify the order in which they received and processed transactions. Therefore, PoH eliminates this limitation by timestamping all blocks directly into the blockchain. As a result, Solana processes over 65,000 TPS with a block time of just 400 milliseconds when using PoH, compared to traditional blockchains.

How Proof of History Works Before Consensus Even Begins

Cryptographic Timestamping is what Event Streaming applies. Using a secure, sequential hashing algorithm that conforms to the "hash" standards set by IPAC as well as pre-image resistant hashing techniques and random-generation methods such as a random seed or nonce, Event Streaming combines these algorithms to produce a universally accepted timestamp in the form of a hash.

A hash is a fixed-length, irreversible output from the hashing algorithm and acts as a unique identifier for the current state of the blockchain. The hashes are created by combining the hashes of previous blocks using the hashing algorithm repeatedly. This creates a long chain of hashes, or the hash chain.

The combination of PoH and PoS allows Solana's network to stream data securely across multiple nodes while establishing an unchangeable history of every transaction that occurred and when it occurred. Each hash corresponds to a specific transaction on the blockchain and provides a mechanism for future validation of the original state of the blockchain.

By using both PoH to timestamp transactions and PoS to validate those transactions, Solana's network has eliminated the issue of having to synchronize everything. By combining these two techniques together, Solana has increased the speed of the network without sacrificing security.

PoS vs. PoH: The Trade-Off Between Security, Speed, and Resilience

The primary focus of Ethereum's PoS is to maintain the security and decentralization of the Ethereum blockchain and facilitate high throughput capabilities. This has resulted in longer 12-second slots, as well as longer 32-slot epochs to slow down the validator's global consensus process, meaning that Ethereum does not need to rely on high-bandwidth networks.

The framework for Ethereum requires its validators (also referred to as Ether miners) to use three different types of clients: an "execution client," a "consensus client," and a "validator client." Each type of client is designed to decentralize completely the node framework of Ethereum; however, this design will make it more challenging to scale Ethereum as compared to other blockchain platforms.

Solana's PoH has been developed using a VDV model that provides an advantage over Ethereum's PoS by allowing the Layer-1 to sync faster. However, due to the structure of PoH, Solana has some of the disadvantages associated with PoH, such as the centralization of validators and the instances of emergency shutdowns caused by network issues, which required many validators to perform coordinated restarts. In conclusion, both of the above examples present a conflict between maximizing throughput and maintaining distributed resilience.

The Centralization Problem Neither Ethereum Nor Solana Can Ignore

Critics of PoS cite the 'compounding' nature of PoS as an obstacle to achieving decentralization for both Ethereum and Solana due to the fact that people with higher wealth holdings can stake more coins and thus have more opportunity to become a validator which leads to further wealth accumulation. Critics do not limit this belief to a theory; they refer to their view as being based upon their own observation of the impact of PoS in real-time.

Ethereum has approached this issue from a variety of angles, most notably through the introduction of liquid staking and pooled validator options. Liquid staking provides a way for less wealthy holders to 'get in' without the need to run a full validation node. Stake weight distribution can also be used to evaluate how decentralized an investor's portfolio is much the same way that transaction metrics are used to assess an investor's level of decentralization.

Solana is experiencing the same problems that both Ethereum and PoS face; however, neither Ethereum nor Solana has yet to address the bigger problem of the way that capital-based consensus favours the accumulation of capital either through staking deposits or through the purchase of mining equipment.

How Ethereum and Solana Perform Under Real-World Network Stress

Solana’s time between blocks is only 400 milliseconds long and with the speed of its PoH, Solana can also split block information into multiple smaller groups of transactions that can be processed by validators on-the-fly instead of waiting for the entire network to reach a global consensus. When institutions like Western Union and JPMorgan Chase build a stablecoin infrastructure on Solana, they take advantage of this considerable theoretical throughput as it satisfies the needs of institutional settlement.

Meanwhile, Ethereum’s PoS was able to support The Merge, which was the largest consensus migration ever to take place in cryptocurrency history. Without experiencing any network downtimes or security risks, the Ethereum network currently has more than 87,000 validators located worldwide.

The distribution of validators throughout the globe makes it difficult for any one party to attack at high throughput, however Layer-2 solutions currently provide to process over 90% of Ethereum execution and resolve the scalability issue while still maintaining all of the security protections of the original foundation layer.

What Ethereum and Solana’s Consensus Choices Mean for Crypto’s Next Phase

When it comes to competition, it is crucial to understand that there is no such thing as a zero-sum game; competition between two unique groups of users generates trillions of dollars monthly across both networks. Both of these networks have enormous diversity of users, including large institutional users and small independent developers, so there are plenty of reasons to consider both options.

From an economic model standpoint, choosing between PoS and PoH is about more than just choosing the technical approach to validating transactions; it greatly impacts how validators earn revenue based on the services their respective economic models provide to users, as well as speed of application use.

In the future, only those networks that develop and implement an economic stability long-term model and align their consensus processes with users' needs will be successful.