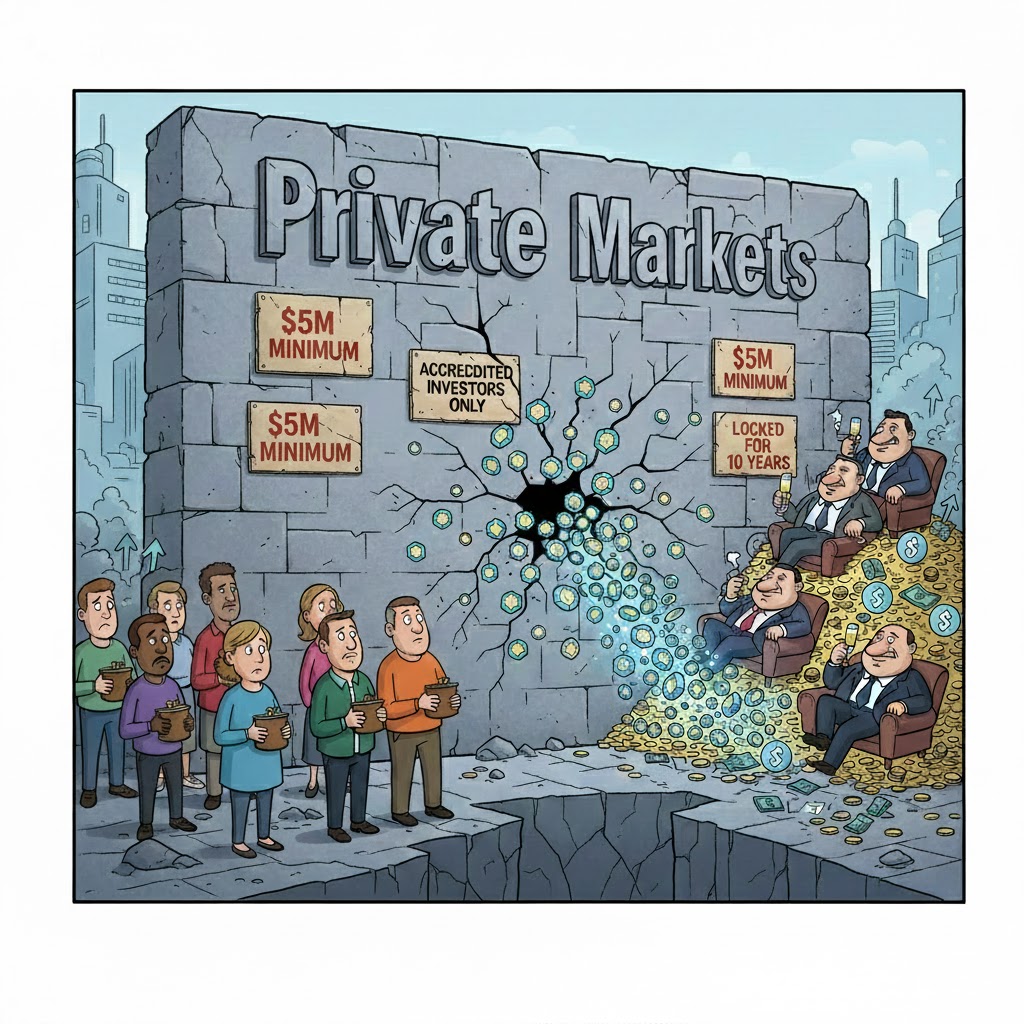

The investment opportunities in private markets have been historically limited for a select few, with venture capital firms often requiring $5M to invest, private equity firms looking for anywhere from $10–50 million from institutions, and real estate syndicates asking for $100,000–$500,000 to invest. Because of these barriers, most average investors have been excluded from the best performing asset class for decades.

Tokenisation changes this dynamic, as private equity funds can be tokenised into smaller fractions of ownership (e.g., 100 million tokens for a $100 million fund). Retail investors can now purchase an interest in private equity with an initial investment of only $1,000, rather than millions. In addition to democratizing access, tokenisation also provides increased liquidity. Investors can trade their tokens on secondary markets instead of having to wait 7–10 years for their investment to mature. Smart contracts will also automate compliance and significantly reduce legal fees associated with minor contractual agreements, therefore lowering the overall cost of a transaction.

That's the vision, at least. The reality will be much less straightforward.

What Tokenized Securities Really Are

Asset-backed tokens are issued on the blockchain and represent shares, bonds, land or funds. In contrast to a paper receipt, a token shows legal title (direct ownership).

The blockchain is used to track the product and a Smart Contract provides information on the transaction (transfer), or condition (limit).

Hamilton Lane's Secondary Fund VI, raised a traditional fund $55–60 million and a $20,000 tokenised fund through Marketplaces and used the Polygon blockchain. The investors have similar economic exposure to the fund but are structured differently. The Smart Contracts will automate the transfer of tokens, distribute dividends to investors and allow the investors the rights of an owner.

The BUIDL (the name of the fund) from BlackRock is a money market fund that invests in U.S. Treasuries and runs on the Ethereum blockchain. The tokens are issued to fund shareholders and they earn U.S. Treasury interest for owning the tokens and will be able to sell the tokens to any eligible investors. Blockchain instant settlement replaces T + 2 Clearings.

The Real Problems Tokenization Solves

The obstacles that small investors face in accessing the private markets are not due to the ideological elitism of fund managers, but rather because economic failures have created an environment where the cost of servicing a $100,000 investor is almost identical to that of servicing a $10 million investor. As a result, the administration costs of servicing smaller investors cannot be absorbed by companies that have limited capital resources.

Tokenization will drastically change this economic reality. Tokenizing a $100 million fund by issuing 100 million tokens creates a unique investment opportunity for thousands of individuals who are interested in investing only $1,000 each. The result is that these small investors can now take advantage of opportunities that have historically only been available to larger investors in the range of $5 million to $10 million.

Equally important is the potential for liquidity offered by tokenization. Venture Capitalists and Private Equity funds typically lock up their capital for long periods (12 years for VC, 7 to 10 years for PE). Secondary market sales of Limited Partner interests only allow for loss of 20% to 40% of the NAV if they wish to exit the investment before the end of the lockup term.

Tokenised securities can be traded on Digital Exchanges and/or Peer-to-Peer systems. For example, invest in a tokenised Venture Capital fund today and then you can sell your tokens on the open market in 3 years! You won't receive fund distributions or sell your tokens in a secondary market. Therefore, the lack of liquidity that traditional private investing creates has been eliminated; however, tokenised private assets are not as liquid as public stocks.

Fund managers can realise many operational advantages that have been neglected because of the growing trend of tokenising private investments. For instance, traditional fund managers spend significant amounts of time (hours) preparing quarterly reports for Limited Partners (LPs), issuing capital calls, issuing capital distribution insight to LPs, and preparing tax documents for hundreds or thousands of LPs. By contrast, many of the worker-intensive functions mentioned above can be automated with Smart Contracts. Therefore, when a fund receives fresh investments, it will automatically distribute tokens to each LP and monitor compliance with the issuance of tokens. Thus, because everything will be recorded on Chain Data, all reports will be quickly viewable and available to the fund manager.

Where Tokenization Works in Practice

The initial success of tokenization is seen with Money Market Funds. Franklin Templeton's BENJI Fund and Blackrock's BUIDL fund are examples of Treasury-backed Money Market Funds that were tokenized and launched by using Polygon. The proceeds from these assets are readily available to users, as the associated risks and returns are easily identifiable. Additionally, tokenised Money Market Funds have clear structure and rules, as well as established regulations.

Although Tokenisations of Private Equity are still in their infancy stage by progressing, it appears that Private Equity companies are gaining traction as Hamilton Lane has indicated that "feeder funds" can attract capital to tokenised Private Equity funds. KKR has indicated a desire to explore ways to Tokenise their flagship funds. However, most private equity companies do not launch tokenised products due to a lack of interest from many large institutional investors who would not be comfortable with minimum investments of $20,000. Furthermore, these LPs are looking for exposure to tens or hundreds of millions in value of the funds.

RealT and Lofty allow people to invest in fractional ownership of rental properties, but they don't provide a lot of liquidity; although it's easy to purchase tokenized rental properties, determining an accurate price for the tokens is much more difficult since most of these tokens trade infrequently and there aren't many active secondary markets for them. While venture capital tokenization is mostly a theoretical idea, the biggest players in the venture capital industry, such as Sequoia, Andreessen Horowitz, and Benchmark, don't currently use tokenization to represent their funds; however, there are some platforms that do. Many traditional LPs do not benefit from this project because they have no interest in dealing with the complexities of this type of regulation.

When the tokenization of any asset solves a genuine issue, it has been a success. In the case of programmable yield and 24/7 settlement capability, we can see the enhancements made to money market mutual funds as a result of tokenization, similar to the lowering of barriers to entry (through fractional ownership) into the real estate market. Of the two dominant segments of private equity, pension funds and endowments, neither require the use of tokens to participate.

Why Regulation Still Blocks Tokenized Securities

SEC treats tokenised securities as regular securities. A fund manager must register under the Securities Act, file reports under the Exchange Act, and comply with the Investment Company Act.

Most projects use Regulation D or S to evade registration. Accredited investors can fundraise without SEC registration under Reg D. Reg S permits foreign investors to buy tokens. These exclusions have selling, transfer, and holding term limits that undercut liquidity tokenisation promises.

In July 2025, the GENIUS Act clarified stablecoin restrictions but did not affect tokenised securities. Though ambiguous, the SEC proposed a new "innovation exemption" in 2025 to change tokenised securities issuance. Every project must fit into paper certificate regulatory frameworks because there is no "Reg T for tokenisation" to streamline blockchain-based securities.

The Technical Barriers Tokenization Has Not Solved

Smart contracts provide security vulnerabilities not seen in traditional securities. Code defects can steal funds, lock them, or violate regulations. Traditional securities have operational risks—wires go to improper accounts—but one defective line won't destroy an enterprise. In tokenised securities, maybe.

Institutional issues arise from custody. Crypto custodians understand blockchain security but can't keep stocks. Traditional securities custodians don't hold crypto. Institutional investors avoid tokenisation due to this gap.

Broken interoperability. Ethereum doesn't operate with Polygon or Solana without bridges. ERC-3643 compliance frameworks are not used by all projects. An investor with tokenised securities on several blockchains needs numerous wallets, increasing complexity.

Few investors want to manage crypto wallets. Passing private keys and seed phrases to pension fund administrators is ludicrous. Custodial techniques mask complexity but restore tokenization's centralisation.

What the Future of Tokenized Securities Looks Like

Regulatory clarity will encourage selective adoption rather than wholesale change. Expect few traditional securities to move to blockchain. Expect tokenisation to solve specific difficulties in money market funds, Treasury products, and speciality instruments.

Fractional ownership opens private credit and invoice financing markets. Private equity and venture capital will receive tokenised exposure from feeder funds and retail SPVs. These will supplement, not replace, buildings.

Institutional LPs oppose tokenising flagship funds. They're OK with current arrangements and don't need supplementary liquidity or lower minimums. In the future, tokenised securities will be issued alongside regular shares, providing separate marketplaces where investors can exchange tokens or traditional securities.

Why Tokenized Securities Are Still a Niche Today

Tokenised securities solve accessibility, liquidity, and efficiency challenges. Tokenised securities now attract billions, indicating the technology works.

Whether the benefits outweigh the regulatory hassles, technical challenges, and institutional inertia is unclear. Two billion tokenised securities are a rounding error compared to $100 trillion global securities markets.

Tokenised securities could flood the market within a decade if regulations clarify, custodial solutions mature, and large financial institutions determine blockchain settlement trumps traditional infrastructure. We're building new infrastructure. Technology exists. Beyond experimentation, a regulatory framework and market consensus are needed.

Tokenisation isn't failing—it's just not changing finance. That may change. It could remain a niche solution for specific market issues. Either way, current experiments will determine whether on-chain securities become mainstream or remain marginal.