Currently, this is one of the most common questions in crypto right now.

After periods of slow prices, uncertainty, and market pullbacks, it is normal for both new and experienced investors to look ahead and try to understand what comes next. Crypto markets move in cycles, and every cycle brings hope, excitement, and a lot of speculation.

However, a bull run does not start because of a date on the calendar. It starts when the right conditions come together. These conditions often include market confidence, global economic changes, technology growth, and how people react to previous market cycles.

In this article, we will look at what a crypto bull run really is, what usually triggers it, and whether 2026 could be the year the next major bull market begins.

What a Crypto Bull Run Actually Is

A crypto bull run is a long period where prices across the crypto market rise steadily and strongly.

During a bull run, most major cryptocurrencies increase in value, trading activity grows, and public interest returns at scale.

It is not just about prices going up for a few days or weeks. A real bull run usually lasts for months and is driven by growing confidence, increasing demand, and more people entering the market.

During a bull run, you often see:

- Higher trading volumes

- Increased media attention

- New users entering crypto

- Strong optimism across the market

At the same time, bull runs are emotional. Many people fear missing out, while others rush in without fully understanding the risks. This is why bull markets often feel exciting but can also become dangerous for unprepared investors.

Why 2026 Is the Year Everyone Is Watching

The crypto bull run, referring to a sustained period of strong upward price momentum across Bitcoin and major altcoins, doesn't have a single definitive "start date," as markets are influenced by cycles, macro factors, and sentiment.

Many people are paying close attention to 2026 because of how crypto markets have behaved in the past. Crypto tends to move in cycles, with long periods of slow or falling prices followed by strong growth phases.

After a major bull run, the market usually goes through a cooling period. Prices drop, interest fades, and weaker projects disappear. This phase can last years, not months. Once the market has fully reset and confidence slowly returns, a new growth cycle often begins.

In short, people are looking at 2026 because crypto cycles are slow, recovery takes time, and markets usually need patience before strong growth returns.

Where the Crypto Market Stands in Mid-January 2026

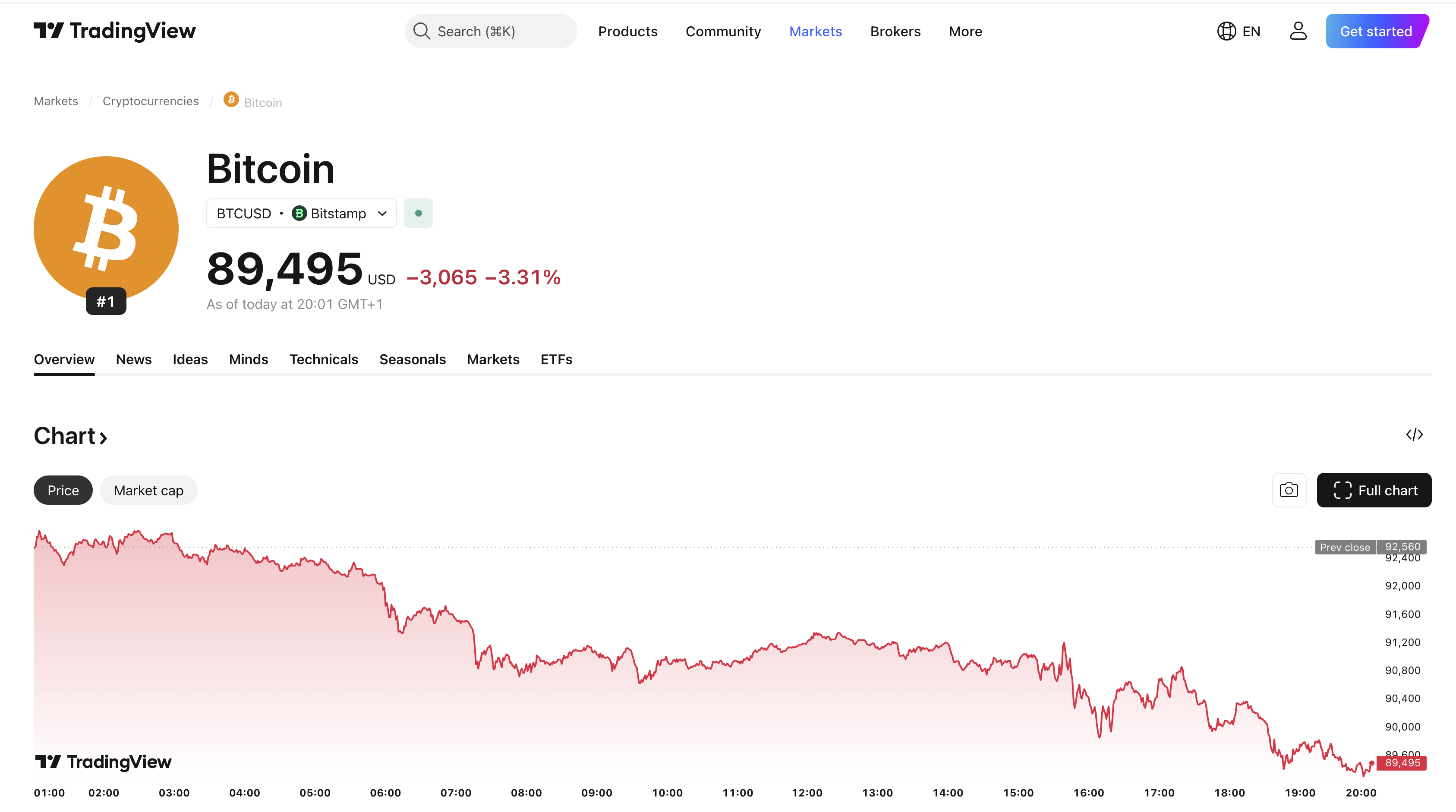

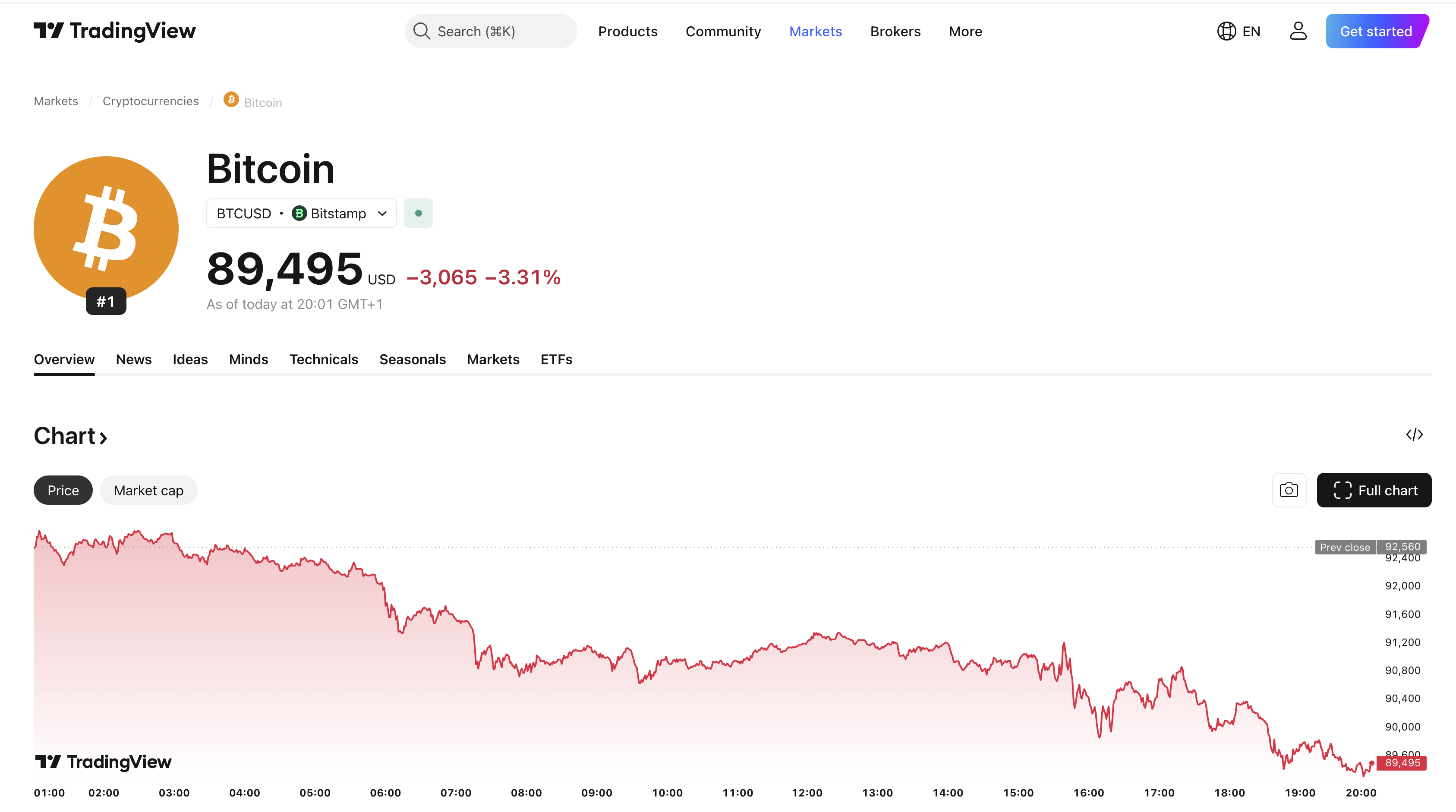

Bitcoin price is around $89,000–$95,000 (with recent dips below $90,000 amid global risk-off moves like bond market issues and tariff threats). This follows a strong 2025 run where BTC hit all-time highs above $125,000–$126,000 in late 2025 (likely October), but the market has since consolidated or corrected, erasing some early 2026 gains. Many view this as a healthy accumulation rather than the end of the cycle.

Image source: TradingView

The April 2024 Bitcoin halving typically drives the most explosive gains 12–18 months later (roughly mid-2025 to late 2026). Historical patterns place the peak phase in Q2–Q4 2026, meaning significant upward momentum could build or accelerate from here.

When Could the Next Major Leg (or "Bull Run") Start in 2026?

The period between January and June 2026 is one of the most commonly discussed windows for a renewed or intensified bull phase.

- Some experts, including Raoul Pal, have pointed to several factors that could come together during this time. These include rising global liquidity, governments refinancing debt, possible fiscal stimulus, clearer crypto regulations, and increased institutional interest. When these forces align, they can inject fresh money and confidence into the market.

- Some analysts (e.g., from Mudrex, CoinDCX, and others) see 2026 as the continuation/peak of the post-2024 halving bull market, with the strongest momentum in Q2–Q4 2026. If the cycle extends due to ETFs and institutional adoption, the explosive phase might not have fully started yet.

- Other analysts (Michael Saylor, Lady of Crypto, others) call 2026 potentially the "biggest bull run ever," driven by supply absorption, credit expansion, and macro tailwinds, with peaks possibly mid-year or later. They see 2026 not as a fresh start, but as a continuation or peak of the bull market that began after the 2024 halving.

Key Factors That Could Trigger a Crypto Bull Run in 2026

A crypto bull run does not start because people hope for it. It starts when several important factors come together and push the market forward. If a bull run happens in 2026, it is likely to be driven by a combination of the factors below.

Returning Market Confidence

Confidence plays a huge role in crypto. When people feel uncertain, they stay away. When confidence slowly returns, money starts flowing back in.

By 2026, many investors expect the market to be more stable than it was during previous crashes. Fewer panic sell-offs, clearer expectations, and a calmer market environment can help rebuild trust. Once confidence improves, both small and large investors are more willing to participate again.

Global Liquidity and Economic Recovery

Crypto does not exist in isolation. Global economic conditions affect how much money people are willing to invest.

If inflation eases, interest rates stabilise, and economies recover, investors may start taking more risks again. In such conditions, assets like crypto often benefit, as people look for growth opportunities beyond traditional markets.

Institutional Capital Re-Entering Crypto

Large institutions move slowly, but when they commit, they bring significant capital.

By 2026, more banks, investment firms, and financial platforms may offer crypto-related products. This kind of adoption increases market liquidity and often signals long-term confidence. Institutional involvement has historically played a role in pushing markets into stronger growth phases.

Real Use Cases and Better Technology

Bull runs are stronger when crypto is actually being used, not just traded.

Improved blockchain technology, faster networks, lower fees, and real-world applications can attract new users. When people use crypto for payments, savings, or business tools, demand grows naturally. This type of growth is more sustainable than hype alone.

Clearer Regulations

Unclear regulations create fear and slow down growth. When rules are confusing, investors hesitate.

If more countries provide clearer and fairer crypto regulations by 2026, it could remove a major barrier to adoption. Clear rules help businesses build confidently and make investors feel safer participating in the market.

Supply Constraints and Demand Pressure

Crypto prices are strongly affected by supply and demand. When demand increases while supply remains limited, prices rise.

Over time, reduced selling pressure, long-term holding, and growing demand can create the conditions for a bull run. If more people want to buy than sell, prices naturally move upward.

Why No One Can Predict the Exact Date

Many people want a clear answer to when a crypto bull run will start. The truth is, no one can predict the exact date, and there are good reasons for that.

Crypto Markets React to Too Many Variables

Crypto markets are influenced by many factors at the same time. These include global economic news, government decisions, investor emotions, technology updates, and even unexpected world events.

Because these factors change constantly and often without warning, it is impossible to point to a specific day or month and say, “this is when the bull run starts.”

Bull Runs Build Slowly, Not Instantly

A common mistake is thinking that a bull run begins suddenly. In reality, bull runs usually build over time.

Prices may move slowly at first. Confidence returns gradually. More people start buying. Only later does it feel like a bull run is clearly happening. By the time most people notice it, the market has often already moved.

This slow build makes it hard to identify a clear starting point.

Human Behaviour Is Unpredictable

Crypto markets are heavily driven by human behaviour. Fear, greed, excitement, and panic all play a role.

People do not react the same way to news or price movements. Some buy early, some wait, and others sell too soon. Because emotions are unpredictable, market reactions are also unpredictable.

External Events Can Change Everything

Unexpected events can delay, speed up, or completely disrupt market cycles. These include:

- Sudden regulation changes

- Economic crises

- Major exchange failures

- Breakthroughs in technology

Any of these can shift market direction overnight, making long-term predictions unreliable.

Dates Create False Confidence

Fixating on a specific date can be dangerous. It creates false confidence and can lead people to make rushed or emotional decisions.

Instead of asking “what exact date will the bull run start?”, it is often more useful to watch market conditions, trends, and long-term signals.

What Matters More Than Timing the Bull Run

Trying to perfectly time a bull run often leads to stress, rushed decisions, and mistakes. Instead of waiting for the “right date,” it is more useful to focus on things you can actually control.

Build Knowledge and Understanding

The best time to learn is when the market is quiet. Understanding how crypto works, how different projects create value, and how market cycles behave puts you in a stronger position when prices start moving.

People who prepare early usually make calmer and better decisions than those who rush in during hype.

Focus on Risk Management

No matter how confident you feel, crypto is still risky. Always think about how much you can afford to lose, rather than how much you hope to gain.

Good risk management means avoiding over-investing, spreading your exposure, and not relying on one single outcome.

Pay Attention to Market Conditions

Instead of watching the calendar, watch what is happening in the market.

Look for signs like improving sentiment, increasing activity, stronger projects surviving long downturns, and steady growth rather than sudden spikes. These signals matter more than dates.

Have a Clear Personal Strategy

Everyone’s situation is different. Some people prefer long-term holding, others trade short-term moves. What matters is having a plan that fits your goals, income, and risk tolerance.

A clear strategy helps you avoid emotional decisions when the market becomes noisy.

Be Patient and Consistent

Bull runs reward patience more than speed. Markets often move more slowly than people expect, then faster than they can react.

Consistency, learning, and discipline usually matter more than catching the exact bottom or top.

What to Expect From Crypto in 2026

Predictions vary wildly. BTC could reach $150,000–$300,000 (or higher in super-bullish scenarios) by end-2026, with altcoins potentially outperforming in later stages. However, some foresee corrections (50%+ drops in certain assets) or a "boring" range-bound year if momentum stalls.

No one can say for sure when the crypto bull run will start in 2026. What we can say is that bull runs usually come after long periods of patience, not excitement.

If 2026 becomes a strong year for crypto, it will likely happen gradually, driven by confidence, adoption, and real use, not sudden overnight pumps.

The smartest move is not trying to catch the exact bottom or top, but understanding the market and staying prepared when momentum slowly returns.