When Crypto Meets Geopolitics

The crypto market entered 2026 riding a fragile sense of confidence. Bitcoin had been hovering near record highs, leverage was creeping back into the system, and traders were increasingly comfortable pricing risk as if geopolitics were background noise. That illusion broke quickly.

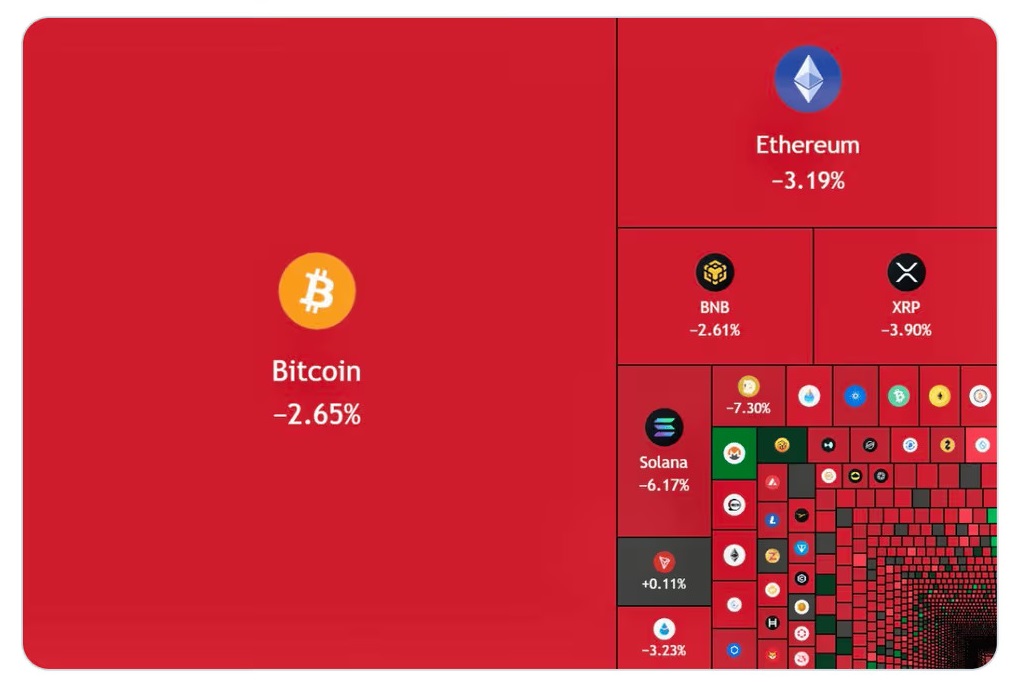

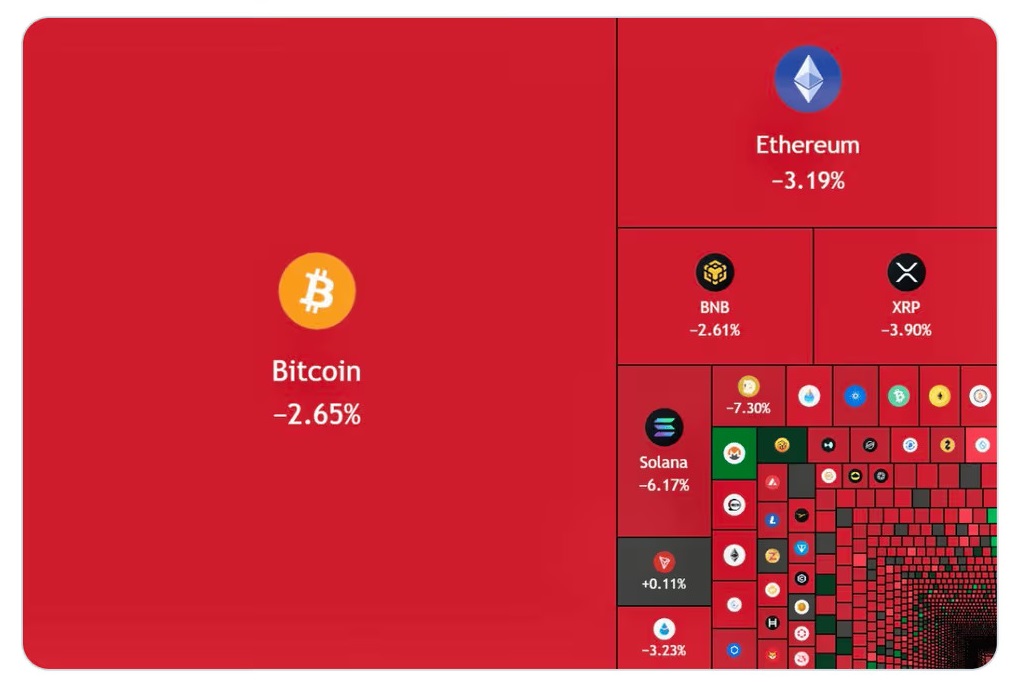

By mid-January 2026, over $875 million in crypto positions were liquidated in a single day. Bitcoin price slid from the $97,000 zone to nearly $92,000, dragging the broader market down with it. This was not a protocol failure, a hack, or a crypto-native collapse. It was a macro shock, driven by geopolitics, policy uncertainty, and a sudden global shift toward risk-off behavior.

To understand this crash, you cannot look at crypto in isolation. You have to follow the chain reaction that began far outside the blockchain world.

Tariffs Were the Trigger That Broke the Market

The catalyst was not subtle. It was political. President Donald Trump’s renewed tariff threats, first signaled in late 2025 and escalated in January 2026, reignited fears of a full-scale global trade war. What began as rhetoric quickly turned into policy risk when the administration announced a 10% tariff on imports from eight European nations, with the possibility of escalation to 25% by mid-year. Markets hate uncertainty, but they especially hate uncertainty tied to trade flows. These tariffs threatened nearly $1.5 trillion in global trade, and investors immediately began repositioning. Crypto, despite its decentralized ideals, remains a risk asset in the eyes of global capital. When institutions de-risk, crypto is one of the first assets to feel it.

The result was swift:

- Leveraged long positions unwound aggressively

- Perpetual funding rates flipped negative

- Liquidity thinned across altcoin markets

This was not panic selling by retail alone. It was systemic deleveraging.

Why This Crash Was Inevitable, Not an Accident

The January crash did not come out of nowhere. The groundwork was laid months earlier.

In October 2025, Trump floated the idea of 100% tariffs on Chinese imports, triggering one of the largest liquidation events in crypto history. Bitcoin fell nearly 30% from its peak near $126,000, and over $19 billion in leveraged positions were wiped out.

The primary driver of the current market jitters is a renewed fear of a global trade war.

- The Panic Signal: U.S. President Trump's escalation regarding the Greenland dispute, specifically the announcement of 10% tariffs on eight European nations starting February 1, has ignited a "risk-off" sentiment.

- The Contagion: This sentiment mirrored broader market slides in the S&P 500 and European indices as investors fled toward traditional safe-havens like gold and silver, which recently hit record highs.

- Historical Context: This follows a pattern established in late 2024, including "Liberation Day" in April 2025, where aggressive reciprocal tariffs on China (60%) and other nations led to a 30% drop in Bitcoin prices by October 2025.

That event taught markets a painful lesson:

Crypto does not hedge against trade wars. It amplifies them.

By January 2026, leverage had quietly rebuilt. When tariff threats returned, the system was once again vulnerable.

The Greenland-related escalation was simply the match. The fuel had been accumulating for months.

Source : @Watcher.Guru

The Macro Layer: How Global Markets Pulled Crypto Down

Once tariffs entered the picture, the sell-off expanded beyond crypto.

Equities slipped. European indices turned red. Bond markets showed stress as foreign holders reduced exposure to U.S. debt. At the same time, gold and silver surged to record highs, absorbing capital fleeing volatile assets.

This is classic macro behavior:

- When policy credibility weakens, capital seeks safety

- When trade routes are threatened, growth assets suffer

- When uncertainty spikes, leverage dies first

Crypto sat directly in the blast radius.

What Turned a Sell-Off Into a Crash

Three structural issues amplified the damage:

Leverage Saturation

A large portion of market activity was built on borrowed capital. When price moved against traders, forced liquidations accelerated the fall.

Policy Uncertainty

Delayed crypto legislation, including the stalled CLARITY Act, left institutions without clear regulatory signals. In uncertain environments, capital retreats.

False Hedge Narrative

Many traders treated Bitcoin as a geopolitical hedge. This event reinforced that, in the short term, crypto trades more like high-beta tech than digital gold.

Why the Timing Made Volatility Unavoidable

The timing could not have been worse.

The crash occurred just ahead of a packed macro calendar:

- U.S. GDP and Core PCE reports

- Labor market data (JOLTS, job openings)

- PMI readings across the U.S., EU, and China

- A critical Supreme Court ruling on tariff legality

Markets were facing policy risk and legal risk simultaneously.

Regardless of the ruling, volatility was unavoidable:

- A ruling against tariffs would undermine policy credibility

- A ruling in favor would force markets to price long-term trade damage

Either path pressured risk assets.

What Past Macro Crashes Tell Us About What Comes Next

Despite the severity, this was not a structural failure of crypto.

Historical patterns show that:

- Most tariff-driven crashes recover once policy clarity improves

- Bitcoin demand often rebounds once leverage resets

- Institutional interest remains intact during macro driven sell-offs

Analysts projecting Bitcoin back toward the $96,000–$100,000 range are not predicting euphoria. They are modeling normalization.

This was a reset, not a death spiral.

Key Lessons From the 2026 Crypto Market Crash

The 2026 crash reinforced hard truths:

- Leverage is not a strategy.

- Macro matters more than narratives.

- Crypto does not exist outside global politics.

- Risk management is survival, not weakness.

And perhaps most importantly:

Capital preservation is a win.

Why the 2026 Crash Was a Reset, Not the End of Crypto

The 2026 crypto crash was not caused by code, hacks, or speculation alone. It was the product of a global system under stress, where tariffs, politics, and leverage collided.

Crypto is maturing, but maturity comes with exposure to real-world forces. As the market grows more interconnected with global finance, these shocks will happen again.

Those who survive are not the loudest traders. They are the most disciplined ones.

Disclaimer

This article is for informational and educational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile and influenced by macroeconomic and geopolitical factors. Always conduct your own research and assess risk carefully before making financial decisions.