Monthly Bitcoin Price Projections

Bitcoin price $150,000 - The Motley Fool, $170,000 - JPMorgan, $250,000 - Fundstrat, Standard Chartered - $150,000 by 2026 and then $500,000 by 2030. Ark Invest still has projections for Bitcoin between $300,000-$1.5 million by the end of this decade.

A comparison of high price targets to previous all-time highs of $126,000 and subsequent low points of under $90,000; therefore, overall the long-term projection has not changed – short-term returns on investment (ROI) of crypto's leading asset are still in the middle of a December range that looks more like a bear trap than a consolidation point.

The Institutional Math That Changed Bitcoin’s Market Structure

In 2024, Bitcoin underwent a tremendous transformation that is still being examined by analysts to assess what that might mean for the future. The market is no longer merely following the four-year Halving cycle that has always produced big returns for investors. With Bitcoin mining slumping below 1% of new Bitcoin created yearly, this growth rate falls well short of the 2% inflation rate of Gold, as well. Each consecutive Halving effectively has less and less impact on the current price, and as a result, many different buyers are now purchasing at this time.

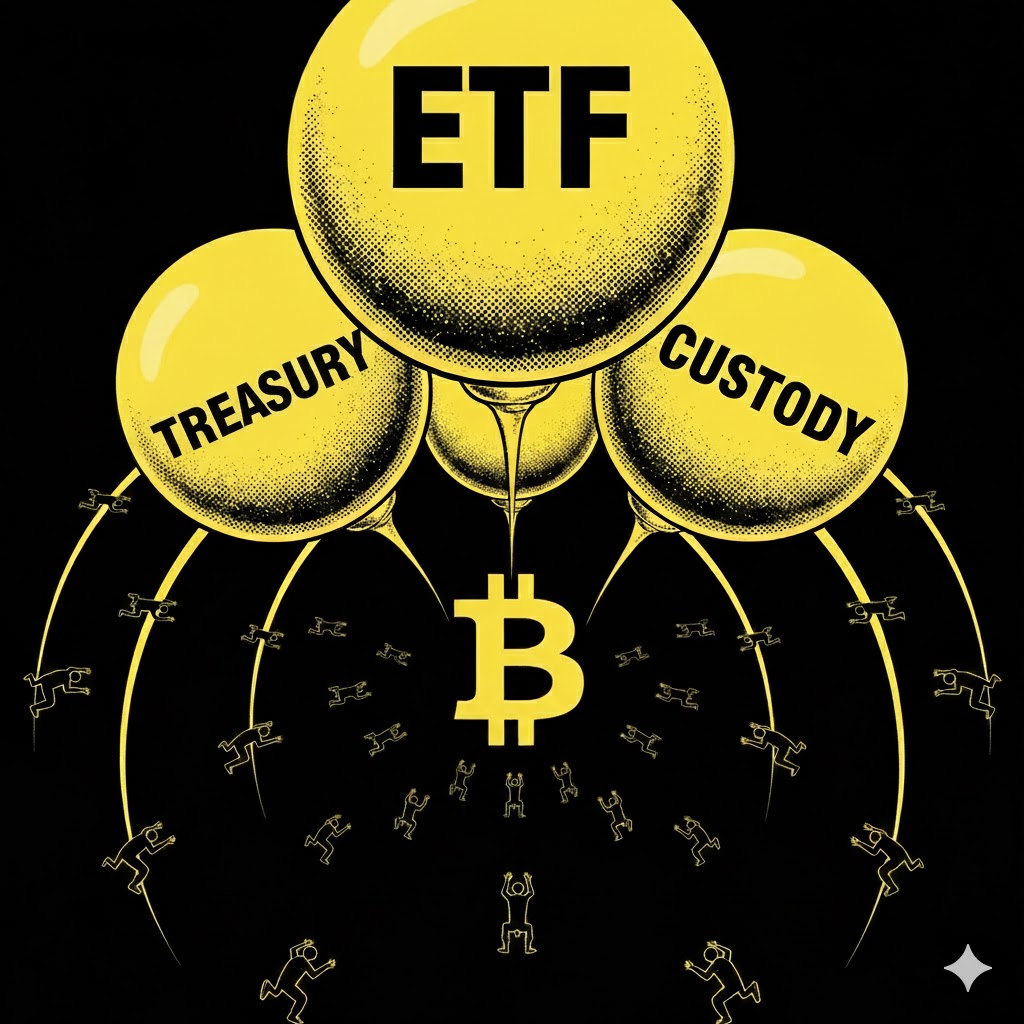

In 2025, Exchange Traded Funds (ETFs) received more Bitcoin than all miners could produce. For example, the BUIDL fund of BlackRock received $1.8 billion. Franklin Templeton manages $650 million on-chain. The STRATEGY fund owns approximately 671,268 Bitcoin, which is valued at nearly $59 billion. Beyond mere speculation, these numbers represent institutional integration with capital that is patient in nature with regard to portfolio obligations that view cryptocurrencies as an asset class.

Why $150,000 Became Bitcoin’s Institutional Floor

Analyst's Price Target consensus of approximately $150,000 in 2026 represents the Institutional cost base, ETF inflow's Technical structure. The Standard Charter issued a target price of $300,000 but due to fewer corporate treasury purchases, it lowered it to $150,000. Citigroup believes that ETF issuers will receive $15 billion in ETF inflows within 12 months.

The Motley Fool's $150,000 target price is due to the breakdown of Bitcoin's four-year cycle theory and advancements in Quantum Security. Bitcoin has never had two years down and thus, a 7% decrease in 2025 creates the potential for recovery similar to the 95% increase of 2019 in 2026.

The Quantum Resistant Improvements created by the Bitcoin Development Community, plus analysts' expectation that the market will discount existential risk as factored into Bitcoin's price targets, support their $170,000 and $250,000 price points as signs of Strong institutional adoption outside of ETFs.

Morgan Stanley's last request to issue Spot Bitcoin and Solana ETFs was accompanied by Bank of America's authorization for the use of cryptocurrency in Investment Portfolios. Cathie Wood mentioned that the U.S. Treasury may purchase Bitcoin to increase its Strategic Bitcoin Reserve in the event that markets fall prior to the mid-term elections in 2026.

Why Bitcoin’s Safe-Haven Rally May Be a Bull Trap

The price of Bitcoin rose 17% from its lows in mid-November and reached a temporary high of $94,792 in early January. This price rise caused a break in the downward trend that started in October, but it didn't break out of the monthly opening range for December. Technical analysts will see this as a bull trap if Bitcoin can't stay above the $94,263 price barrier. Bitcoin's price went up because investors were looking for a safe place to put their money because of uncertainties across the world. However, it couldn't break through resistance, so it couldn't set up a new range of price support or start an upward momentum trend. If Bitcoin's price drops below $83,712, it might be seen as entering into another downward spiral, with losses perhaps going as low as $78,000.

Because leverage is being taken out of the market instead of added to it, there is a good likelihood that the present surge is a bull trap. The open interest for bitcoin futures fell by over 40%, from $94.1 billion at the start of October to just $54.6 billion now. Also, people that have a lot of money in bitcoin (the smart money) are not putting in a lot of buy or sell orders on the market. The BTC cost basis heat map shows a lot of resistance at price levels between $88,000.00 and $88,459.00, according to the heat map. The heat map reveals that 200,000 BTC has been exchanged at current prices, which means there is a lot of overhead supply that could be stopping future rallies.

The Long-Term Bitcoin Targets Wall Street Refuses to Abandon

Many people have a lot of hope about Bitcoin's future through 2026, even though most long-term predictions seem to be very optimistic regarding its future. Standard Chartered Bank's prediction of Bitcoin reaching $500,000 by 2030 is indicative of that optimism, and Ark Invest predicts it could reach anywhere between $300,000 and $1,500,000, since this projection includes all bitcoin that has been actively traded on institutional markets. Lastly, Michael Saylor believes Bitcoin could be worth $13 Million by 2045. While some of these predictions may be considered "fringe" predictions, supporters have made them based on a large amount of institutional research regarding the possibility Bitcoin will fundamentally alter the economic landscape for years to come.

The top challenges of the future are surrounding the growth of our mutual fund (ETF) industry, continued growth in the number of governmental agencies accepting the use of Bitcoin, and increased use of Bitcoin as collateral by traditional financial institutions (mainly banks). As the new normal occurs between 2028 and 2030, institutional demand for Bitcoin is projected to exceed the amount of new coins created by cryptocurrency miners daily due to the 2028 Bitcoin halving causing a drop in mining activity. The subsequent increase in price of Bitcoin should result in creation of a scarcity-type "price discovery" period between institutional investors. Both traditional and institutional investors need to reach an agreement to create this scarcity by removing some or all of the coins from the supply to achieve their desired economic outcomes.

What Bitcoin’s $150,000 Consensus Means for 2026

The Bitcoin Market is currently sitting at a consensus of $150,000 for the year 2026. At this level, the Market is neither excited nor despairing but rather seems to be adapting to changes in the price of Bitcoin. Following the $100,000 price point in late 2021, investors were disappointed that the price of Bitcoin did not remain above 100K, they were expecting a post-halving price bump or coin drop that would happen at a rapid pace but as of today, we have not seen that happen, and additionally, nothing has changed fundamentally. The adoption of Bitcoin into institutions is continuing to push forward (i.e., GENIUS Act) where several policies have been introduced with simplified definitions of the rules around the Institutionalization of Bitcoin. If employment levels continue to fall, then the Federal Reserve may lower interest rates. Historically, reductions in interest rates during the depreciation of the dollar have been positive for Bitcoin.

As a result, in 2026, financing bitcoin could transition bitcoin into what is commonly referred to as a "breather" year with pricing fluctuating in a range from $65,000.00 to $125,000.00 while the market adjusts to new levels. The development of institutional investing (i.e., Exchange-traded funds and Custodial Services) may help to hydrate the market to the point of transforming Bitcoin from a highly volatile investment to a requirement for a diversified investment portfolio. Investors should understand that institutionalization will provide more incentive for investment in Bitcoin than speculative means. While investors may not make immediate wealth from their investments in Bitcoin in 2026, they will likely see Bitcoin as an essential investment to include in their portfolios by 2026.